NGI Archives | NGI All News Access

Power Sector’s Natural Gas Burn at Record High 26 Bcf/d, EIA Says

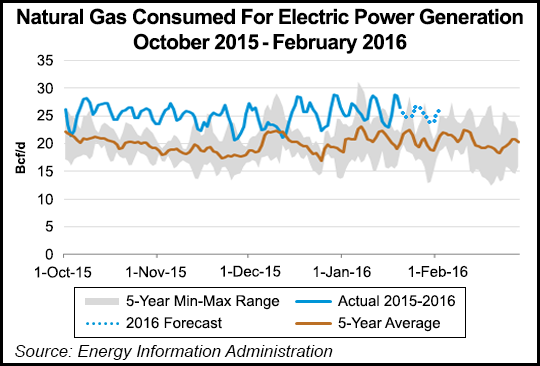

Consumption of natural gas for power generation since the beginning of the year has averaged 26 Bcf/d, 24% more than the five-year average and 3% more than the five-year maximum, despite electricity-weighted heating degree days that were close-to-average nationally, according to the Energy Information Administration (EIA).

“Low natural gas prices and growth in natural gas power generation infrastructure are the main drivers in the consumption growth,” EIA said in its latest Natural Gas Weekly Update. “This is a continuation of a trend, with 2015 being a record-high year for power burn, according to preliminary Bentek data. Bentek estimated that power burn averaged 26.4 Bcf/d in 2015, 6.8% greater than the next-highest annual average, in 2012.”

EIA recently reported that wholesale power prices for on-peak hours declined year/year at major trading hubs across the United States in 2015, thanks to cheaper natural gas (see Daily GPI, Jan. 11). Monthly average on-peak electricity prices were 27-37% lower in 2015 compared to 2014, EIA said.

And natural gas became much more competitive with coal for electric generation last year, EIA said.

“Through October 2015, around 11 GW of coal-fired generation was retired, although this generation was likely already running at a reduced capacity factor, meaning that those plants were active for fewer hours a day than before,” EIA said Friday.

For the first time ever, natural gas surpassed coal for the largest share of domestic power generation in April of last year, according to EIA’s monthly generation data. Gas subsequently surpassed coal in July, August, September and October, with November and December data not yet available (see Daily GPI, Dec. 28, 2015; Dec. 2, 2015; Oct. 28, 2015).

Continuing low gas prices, new gas-fired generation and more coal plant retirements have natural gas well situated for another year of strong power burn, Barclays analyst Nicholas Potter said in a note Friday.

“Although final numbers are not yet in, our estimates point to total U.S. power burn averaging around 26.4 Bcf/d in 2015, enough to beat the previous record of 24.8 Bcf/d set in 2012,” Potter said. “Assuming normal summer weather, our current forecasts point to a 2016 power burn coming in at 26.2 Bcf/d. If temperatures were to match those of summer 2015, which was 8% warmer than normal, we think power burn could be boosted by another 400-500 MMcf/d in April-October, potentially setting a new power burn record.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |