Regulatory | Infrastructure | NGI All News Access

NatGas Harder to Compete for California Alternative Fuel Grants

Natural gas used in transportation is facing an uphill battle competing for funds in California’s $100 million annual alternative/renewable vehicle grant program, according to a revised staff report at the California Energy Commission (CEC), which administers the six-year-old program.

With the state’s aggressive climate change goals, zero and near-zero emission — the latter including renewable natural gas (RNG) — have a leg up on traditional natural gas vehicles (NGV) and their compressed natural gas (CNG) and liquefied natural gas (LNG) infrastructure. For traditional fueling, the 2016-2017 draft report is recommending cutting grant money in half; vehicle incentives would stay flat.

“The energy commission continues to support low-carbon RNG through our biofuel production category in addition to our low-nitrogen oxide [NOx] natural gas engine development activities,” a spokesperson told NGI. “NGV fueling infrastructure funding has been reduced to a level that reflects the demand currently expressed by the public sector.”

The draft staff report, “2016-17 Investment Plan Update for Alternative and Renewable Fuel and Vehicle Technology Program,” leads off with the state goals of getting greenhouse gas (GHG) emissions to 1990 levels in 2020, 40% below that 10 years later, and 80% below that by 2050.

It goes on to point out that since the transportation sector accounts for more than one-third of GHG emissions in the state (37%), “significant technological and market changes” will be required. State lawmakers adopted the grant program in 2007 and recently extended its funding through 2023.

In the current draft, NGV fueling infrastructure would be reduced to $2.5 million in 2016-2017, after being set at $5 million in the current fiscal year (2015-2016), a big jump from $1.5 million in the 2014-2015 fiscal year. Incentives for NGVs would stay at $10 million, where they have been for the past two fiscal years. Biofuel production/supply, which includes RNG developments, would stay at $20 million.

CEC staff note that the $5 million in the current fiscal year was meant as a one-time bump to encourage more school districts and municipal governments to upgrade outdated infrastructure.

The report states that NGVs are expected to “continue to play a role in reducing emissions and petroleum use,” but CEC staff sees natural gas as a transportation fuel “maturing” and CEC alternative fuel grant incentives “have less of an impact as other financing options become available.”

An emerging issue touched on in the report is state air regulators’ imposed higher carbon intensity values on conventional natural gas — as opposed to RNG — because of higher pipeline energy intensity, methane leakage estimates, and tailpipe emissions.

“Though the revised carbon intensity value for CNG is less beneficial than previously assumed, it still provides GHG emission reductions compared to gasoline and diesel fuel,” the report noted. Medium- and heavy-duty trucks are another area where NGVs provide advantages and the CEC grants have supported natural gas in these sectors.

The alternative fuel and renewables vehicle program is broken into four categories — alternative fuel production, fuel infrastructure and fuel, as well as advanced technology vehicles, and “related needs and opportunities.” NGVs have a share in each, and collectively the program has doled out $606 million over six years, nearly $100 million of that to NGVs, if funds for RNG are included.

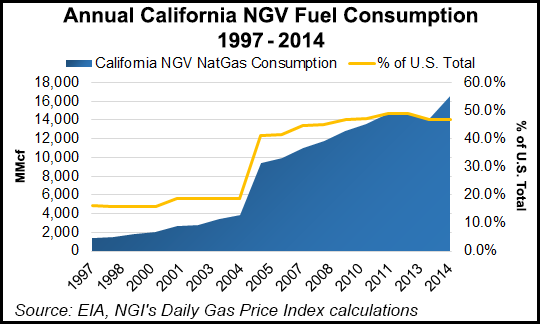

Traditional NGVs have included $21 million for 65 fueling stations and $56.6 million for 2,809 vehicles. California leads the nation in the number of CNG and LNG fueling stations in place with more than 500 public or private CNG facilities and roughly 45 public or private LNG-dispensing places.

“Relative to most other alternative fuels, natural gas fueling is commercially mature and relies on an existing natural gas pipeline infrastructure throughout the state,” according to the report.

“Emerging technologies are also expected to transform the needs and opportunities for [CEC funding] in coming years. Natural gas engines and emission control technologies that achieve the [state air board] optional low nitrogen oxide emission standard are expected to be commercially available in 2016.”

Separately last Thursday, the California Public Utilities Commission authorized Southern California Edison Co. (SCE) to spend up to $22 million to implement the first phase of a pilot program to spur the deployment of about 1,500 electric vehicle (EV) charging stations and conduct a marketing/outreach campaign supporting electric transportation.

Called “Charge Ready,” the SCE program would site EV charging stations at areas where people park cars — workplaces, campuses, recreational areas, and apartment/condominium complexes. Utility officials and regulators contend a common barrier to spreading more use of EVs is the lack of a robust charging infrastructure in the state.

In Nebraska, a similar program is underway, applying to CNG, LNG and propane vehicles and rebates for residential CNG fueling equipment. Vehicle conversions will be eligible for rebates covering up to half the cost or a maximum of $4,500; dispensing equipment up to half the cost or a maximum of $2,500.

The program was created by the Nebraska legislature (Bill 581) last May.

Nationally, the NGV sector scored some wins last year in Congress, but it faces challenges in the low global energy commodity price environment, according to Matt Godlewski, who heads the Washington, DC-based trade group NGVAmerica. After stepping up the natural gas transportation sector’s presence in states and the nation’s capital, the sector has “much work to do” this year in areas such as safety and technology, Godlewski noted in the group’s 2015 annual report.

“In 2016, our state advocacy committee will lead initiatives in more than 15 states aimed at new legislation to incentivize additional fleets and consumers to purchase NGVs,” Godlewski said. “The industry’s best days are ahead.”

In the NGVAmerica annual report, Chairman Gordon Exel of Westport Innovations said the group’s mission was more important than ever. “We face external threats from those who have an agenda against fossil fuels, and [we can lead by] clearly stating the environmental benefits of NGVs and use credible data to make our case.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |