E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Trio of Deals Boost Concho’s Position in Permian Basin

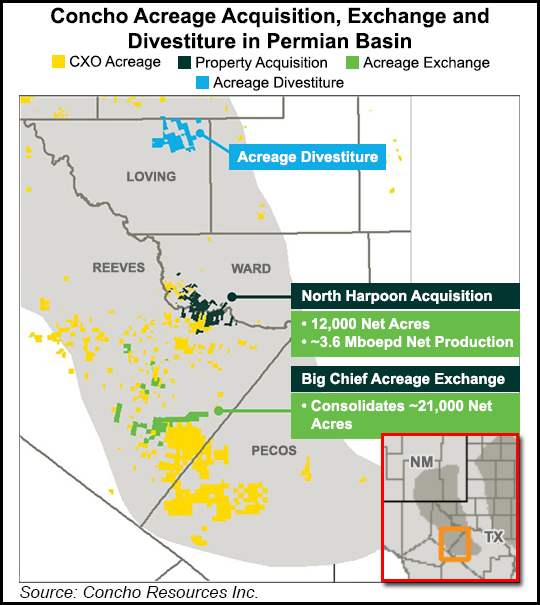

Concho Resources Inc. said a trio of separate deals — a purchase, a swap and a sale — will help bolster its position in the southern Delaware Basin and reduce its net debt, all without impacting its capital budget or production outlook for 2016.

In a statement Monday, the Midland, TX-based independent said it had agreed to acquire approximately 12,000 net acres adjacent to its North Harpoon prospect in Reeves and Ward counties in Texas from an undisclosed private operator for total consideration of approximately $360 million, which includes 2.2 million shares of common stock in Concho, $150 million in cash and $40 million to carry a portion of the seller’s future drilling costs.

Concho said the acquisition, expected to close in 1Q2016, would increase its “exposure to core acreage in the southern Delaware Basin,” and enable it to use longer laterals to develop its existing North Harpoon acreage. The company said the acquired acreage had net production of approximately 3,600 boe/d and estimated proved reserves of 18.5 million boe at the end of 2015. As part of the deal, the seller will retain a 20% non-operated working interest in the assets.

In the second transaction, Concho agreed to an acreage exchange with another Midland-based rival in the Permian Basin, Clayton Williams Energy Inc. (CWEI). Under terms of the deal, 21,000 net non-operated acres would be consolidated into an operated position adjacent to the company’s Big Chief prospect in Reeves County.

“Consolidating operated positions benefits both parties and allows [us] to optimize drilling activity with more efficient long-lateral wells and provides for greater control of field development,” Concho said, adding that the acreage exchange with CWEI would have “no impact” on its daily production.

Concho and CWEI, which also has operations in East Texas, are rumored to be considering a merger (see Shale Daily, Nov. 16, 2015; Oct. 15, 2015). Concho added that the acquisition, coupled with the CWEI swap, would add more than 350 horizontal drilling locations to its inventory in the southern Delaware Basin, including more than 200 for longer laterals.

Under the third transaction, Concho agreed to sell 14,000 net acres in Loving County, TX, to Silver Hill Energy Partners II LLC for $290 million in cash. The company said production from the assets to be sold totaled 2,500 boe/d in 3Q2015, and held 5 million boe of estimated proved reserves at the end of 2014. Concho said the divestiture, expected to close in 1Q2016, would eliminate approximately $100 million in lower rate-of-return obligation drilling in 2016.

“These transactions highlight our focus on actively managing and improving our portfolio of high-quality assets in the Permian Basin,” said CEO Tim Leach. “The combined effect of these transactions not only strengthens our portfolio, but also frees up capital to develop higher returning properties while improving our leverage metrics.”

In a separate presentation on Monday, Concho said its unaudited pro forma balance sheet as of Sept. 30, 2015 would now reflect $487.6 million in cash — $290 million from the Loving County divestiture, plus $347.6 million from an equity offering last October, minus $150 million for the North Harpoon acquisition. The pro forma balance sheet also shows net debt for the company fell from $3.82 billion to $2.89 billion.

Last November, Concho attributed enhanced completions and longer laterals to its posting of record production in 3Q2015, and said it planned to spend $1.4 billion on capital expenditures in 2016, including $1.2 billion on drilling and completions, and $200 million for opportunities in leasehold, the midstream and other facilities.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |