E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Rig Count Continues to Tumble; Canada Again Resurgent

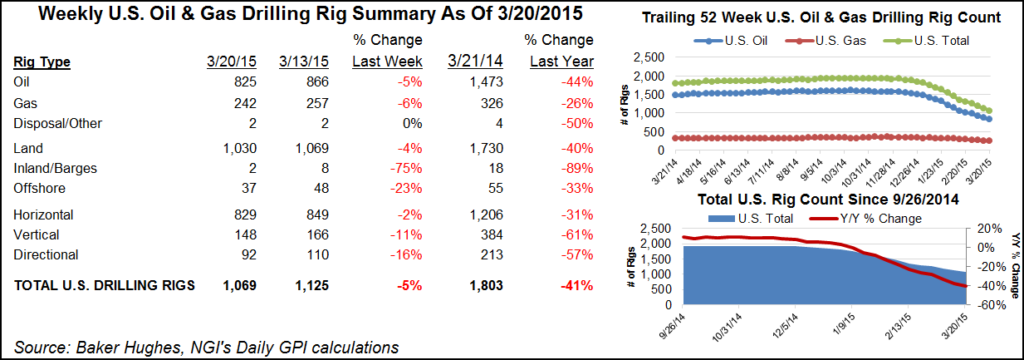

The U.S. rig count dropped by a net of 14 units in the week ending Jan. 15 compared with the previous week, falling 61% from a year ago. At the same time, the number of rigs in Canada jumped to 227, up 37% from 166 in the first week of the year, but still down 48% from 440 last year.

The latest Baker Hughes Inc. count has the total number of active U.S. rigs at 650, with 515 directed at oil — only one less than a week ago — and 135 focused on natural gas. The vast majority, 623, are on land. Eight horizontal units fell, along with four vertical rigs and two directional units. In the first Baker tally of the year last week there were 664 rigs in the United States and 166 in Canada (see Daily GPI, Jan. 8).

The upsurge in Canada was enjoyed in all regions, but it was strongest in Alberta, which jumped from 97 rigs a week ago to 147 rigs Jan. 15. In the previous week’s count Canada showed adramatic return of 83 rigs, which one observer said was typical. “This is the normal increase after the holidays,” Alondra Oteyza, investor relations director, said in an email. “If you look at prior years, you will see a similar increase in early January.”

Natural gas prices remain stubbornly low, and oil prices have also fallen precipitously. Oil traded below $30/bbl Friday. The reverberations have been felt across the industry (see Shale Daily, Jan. 14; Daily GPI, Jan. 5).

With the oil futures curve not forecasting a price rebound above $50/bbl until 2019, it may be a better play to pay down debt than invest in upstream development or acquisitions, Raymond James & Associates Inc. analysts said this week (see Shale Daily, Jan. 15). And the global oil and natural gas industry’s plight isn’t expected to improve in 2016 as the strain of low commodity prices is expected to continue dragging down budgets and limiting financial flexibility, according to Moody’s Investors Services (see Shale Daily, Jan. 4).

There were 12 fewer rigs operating in U.S. unconventional production basins, according to the latest Baker tally, with the Permian Basin losing seven units, the biggest loser among plays. However, the Permian rig count is still by far the largest of the plays at 202; the next largest rig count, in the Eagle Ford Shale, is just 68 rigs, followed by the Williston Basin (47), Marcellus Shale (38), Cana-Woodford Shale (37), Haynesville Shale (23), Denver-Julesburg/Niobrara formation (19), Granite Wash formation (14), Utica (13) and Mississippian Lime (12).

Rig numbers continue to decline across the United States. Texas was again the biggest loser among states, giving up seven more rigs. There were only 49 rigs operating in North Dakota this week, a nearly 25% decline since the end of the year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |