NGI Archives | NGI All News Access

How Low Can They Go? NE NatGas Forward Prices Tank Again

The slide that natural gas forwards started on Jan. 8 continued in full swing through Jan. 14 as February fixed prices shed anywhere from 25 cents to $1.70 on unconvincing weather forecasts and a surprise storage report, NGI’s Forward Look data shows.

The Nymex February contract tumbled some 33.3 cents between Jan. 8 and 14 as weather forecasters remained skeptical of significantly cold weather beyond next week.

In its midday weather update on Friday, NatGasWeather said that while a fairly impressive Polar blast will play out this weekend into next week, what comes after isn’t quite intimidating enough between Jan. 23 and 27.

“It will be up to colder temperatures returning at the end of January if any support in prices is going to occur, which there is potential for, but not convincingly,” NatGasWeather said.

Meanwhile, this week’s storage report offered another sharp blow to futures. The U.S. Energy Information Administration reported a 168 Bcf withdrawal from storage inventories for the week ending Jan. 8.

Despite last week’s draw being the largest so far this winter, it came well below market expectations and far below last year’s 220 Bcf draw and the five-year average draw of 178 Bcf.

With overall demand so far this winter remaining below average, U.S. storage inventories remain high at around 3.5 Tcf, which is 22% above year-ago levels and 19% above the five-year average.

But while the Nymex set the stage for this week’s dramatic sell-off, Northeast markets once again stole the spotlight amid declining demand in the weeks ahead and increased supply in the form of liquefied natural gas (LNG) imports.

Forward Look data shows Algonquin Gas Transmission city-gates February fixed prices plunging $1.70 from Jan. 8 to 14 to reach $5.29 as New England demand is expected to spike early next week but then fall steadily after that.

Genscape shows demand reaching 3.74 Bcf/d on Jan. 18, up from the recent seven-day average of 3.22 Bcf/d, but then sliding to 3.59 Bcf/d by Jan. 22 and to 3.42 Bcf/d by Jan. 29.

Genscape, based in Louisville, KY, is a real-time data and intelligence provider for energy and commodity markets.

Further out the forward curve, AGT March tumbled 98 cents to $4.27, while the summer 2016 strip fell 27 cents to $2.91. The winter 2016-2017 package dropped 43 cents to $5.65.

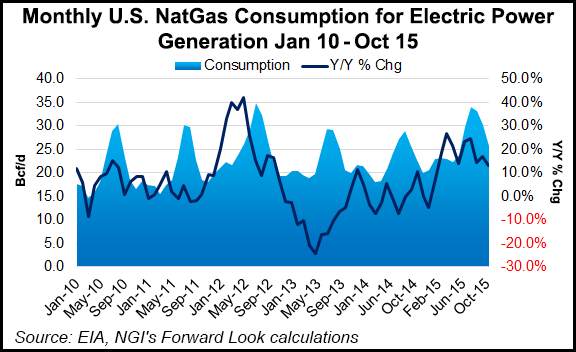

The weakness at Algonquin come as LNG imports in the region have tracked higher this winter compared to last year as higher year-over-year power burn has trumped the decline in overall demand.

Indeed, power burn appears to be on the rise not just in New England, but other eastern markets as well.

In a note to clients on Thursday, equity research company Jefferies said they see base-load power demand growth to be the largest factor in overall natural gas demand growth in the near to intermediate term.

“The move to gas is being driven by environmental mandates, but also prudence given persistently falling supply and distress in the coal sector,” Jefferies said.

“Key markets to focus on are the mid-Atlantic (PJM), which already has the new/ready pipeline access to gas and the southeast (SERC), where numerous utilities have already committed to new supply from Appalachia – and with most taking equity interests in pipelines to ensure execution,” the company said.

The current rise in power burn was not enough to save the markets from drowning this week, however, as other Northeast points posted sharp declines across the curve.

Transco Zone 6-NY February dropped $1.30 between Jan. 8 and 14 to reach $4.925, while March fell 63.5 cents to $2.71, according to Forward Look. The winter 2016-2017 strip plummeted 43 cents, more than double what was seen at most other markets.

Tetco M3 February was down about 94 cents to $2.68, while the winter 2016-2017 strip was down 33 cents to $3.26.

Genscape, meanwhile, shows Appalachian demand reaching 20.77 Bcf/d on Jan. 18, but then falling to 18.56 Bcf/d by Jan. 22 and to 17.30 Bcf/d by Jan. 29.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |