Shale Daily | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Diamondback Expecting to Beat ’15 Production Guidance, Plans 2-3 Rig Program in Permian

Permian Basin pure-play operator Diamondback Energy Inc. said it appears to have eclipsed its 2015 production guidance, thanks in part to strong production in the fourth quarter, and it now plans to spend $280-375 million for a two- or three-rig drilling program in 2016.

Meanwhile, the Midland, TX-based company said it plans to raise about $226 million from selling four million shares of common stock, which initially would be used to pay down debt.

Diamondback said Wednesday 4Q2015 production is expected to average 36,000-38,000 boe/d, putting the company on track to beat its full-year production guidance of 31,000-32,000 boe/d. The tentative increase in 4Q2015 production was attributed to “the continued strength of operated completed wells, as well as the completion of more non-operated wells than anticipated.”

Diamondback said it expects lease operating expenses (LOE) for 2015 to be at the low end of its $7.00-8.00/boe guidance range, again thanks to the fourth quarter, where LOE is projected to total $5.50-6.00/boe.

“In 2015, Diamondback again demonstrated our focus on best-in-class execution, low-cost operations and a conservative balance sheet,” said CEO Travis Stice. “We continued to reduce drilling days, well costs and operating expenses while maintaining a peer-leading leverage ratio.”

Stice said during 2015, Diamondback also de-risked its holdings in Midland and Martin counties in West Texas, which are prospective to the Middle Spraberry and Wolfcamp A formations of the Permian. He said the company also “continued to deliver strong Lower Spraberry completions.”

Diamondback completed 14 operated horizontal wells in 4Q2015, bringing the full-year 2015 total to 65 operated horizontal wells. The 14 completed wells included 11 targeting the Lower Spraberry formation and three targeting the Wolfcamp B interval.

The company said it would continue to focus on reducing well costs and expenses in 2016. With leading edge well costs trending at $5.0-5.5 million for a 7,500-foot lateral horizontal well and $6.5-7.0 million for a 10,000-foot lateral, the company plans to drill and complete a few 12,500-foot laterals in 2016 to focus on capital efficiency. LOE in 2016 is forecast to be $6.00-7.00/boe, down from the $7.00-8.00/boe guidance range for 2015.

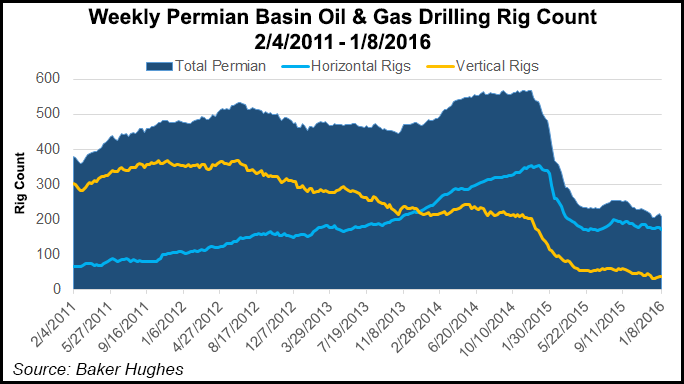

“Given the current commodity situation, we intend to run a two- or three-rig program in 2016 in order to preserve stockholder returns,” Stice said, adding the company holds about 700 gross drilling locations that can be developed economically if West Texas Intermediate (WTI) crude oil prices are about $40/bbl. The company plans to release more details during its 4Q2015 earnings call.

“Diamondback remains a nimble operator that can quickly decelerate if conditions deteriorate, or accelerate when they improve,” Stice said. “When oil prices rebound, we also can begin completing our current backlog of 10 to 15 drilled but uncompleted wells in addition to layering on additional rigs.”

The company’s capital budget guidance for the full-year 2015 was $400-450 million. Last February, Diamondback said it would release two horizontal rigs and one vertical rig, leaving it with three horizontal rigs.

Diamondback said it would release more details on guidance during its 4Q2015 earnings call.

Separately, the company said the four million share offering represented a 1.75 million share upsize from an original proposal to offer 2.25 million shares. The underwriter, Credit Suisse Securities LLC, has a 30-day option to purchase up to an additional 600,000 shares of common stock.

“Diamondback intends to use the net proceeds from this offering to repay the outstanding borrowings under its revolving credit facility, with the remaining net proceeds to be used to fund a portion of its exploration and development activities and for general corporate purposes, which may include leasehold interest and property acquisitions and working capital,” the company said.

The offering is expected to close on Tuesday (Jan. 19), and is subject to customary closing conditions.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |