NGI Archives | NGI All News Access

Recent Rally For Northeast NatGas Forwards Short-lived; SoCal Storage Leak Impact Seen as Mixed

Natural gas forward prices in the U.S. Northeast nearly wiped out last week’s gains as strong production, robust storage and unsteady demand swept the rug out from under markets during the period between Dec. 31 and Jan. 7, according to NGI’s Forward Look.

The dramatic slide occurred as most other markets in the country shifted less than a nickel.

The Nymex February contract was up just 4.3 cents despite wide swings before and after the release of the U.S. Energy Information Administration’s storage report, which came in much larger than expected.

Not surprisingly, New England saw the most extreme volatility as the February package plunged $1.31 to $6.63, Forward Look data shows. March was down about 55 cents to $4.88, while the summer slipped just 9 cents to $3.09.

In New York, Transco Zone 6-NY February tumbled about 55 cents between Dec. 31 and Jan. 7 to reach $5.68, while March fell a meager 4 cents to $3.10.

While recent cold blasts brought demand back to seasonably normal levels, a return to mild weather in the week ahead and some uncertainty beyond that appear to paint varying demand pictures in the Northeast.

In New England, for example, demand is projected to average 3.39 Bcf/d for the period between Jan. 11 and 15 and 3.47 Bcf/d for the period between Jan. 18 and 22, down from the recent seven-day average of 3.53 Bcf/d, according to Genscape.

Appalachian demand, however, is projected to average 18.13 Bcf/d for the period between Jan. 11 and 15 and 17.94 Bcf/d for the period between Jan. 18 and 22, up from the recent seven-day average of 15.56 Bcf/d, Genscape demand projections show.

Genscape, based in Louisville, KY, is a real-time data and intelligence company provider for energy and commodity markets.

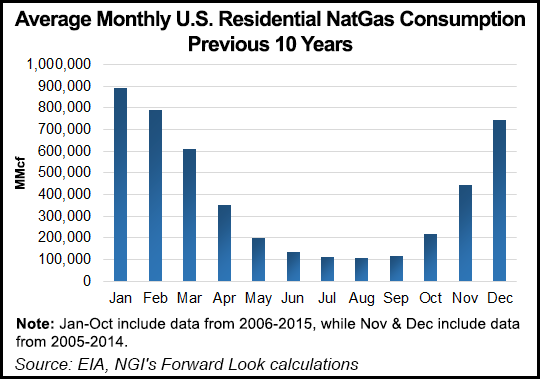

While January tends to be the highest demand month of the year, ample storage heading into winter and below-average demand thus far have left the U.S. with plenty of supply versus what it typically has at this point in the season, said NGI’s Patrick Rau, director of strategy and research.

“That puts even more pressure on cold temperatures, and if we don’t get them, or if perceived cold weather doesn’t materialize, that will cause cash and forward prices to slump all the more,” Rau said.

The main challenge with the end of January pattern is evaluating how a strong Pacific jet stream approaching the West Coast plays out and whether it can sustain itself for more than just a few days, according to forecasters with NatGasWeather.

“I continue to have doubts the Pacific jet will last very long and believe it could be a trap for those expecting warmer patterns after next week, Chief Meteorologist Rhett Milne said. “However, I continue to see a plethora of ways the pattern quickly reverts colder regardless of any milder break, essentially a colder trend in the data going back several days.”

But Rau said any temporary cold snap would likely affect spot prices more than forward prices at this point.

“It would tighten the supply/demand balance on a day-to-day basis, particularly since gas can only come out of storage so fast over the short-term, but it would be less likely to impact the overall longer-term supply/demand picture. We need sustained colder temperatures for that, and if we don’t get those, the forward markets should react accordingly,” Rau said.

Meanwhile, Southern California markets also moved against the pack during the week, at least at the front of the curve.

The SoCal Border February fixed price slipped 3.2 cents between Dec. 31 and Jan. 7 to reach $2.55, while March dropped 5.5 cents to $2.366, according to Forward Look data. The summer 2016 strip, however, was up 4 cents to $2.56, in line with the national average.

The weakness at the front of the SoCal curve comes as the storage crisis at Southern California Gas Co.’s Aliso Canyon facility continues (see Daily GPI, Jan. 6).

A leak detected at the facility’s injection site on Oct. 23 has led to above-average withdrawals this winter in attempts to reduce pressure and mitigate the leak.

Previous attempts to plug the well were unsuccessful, and a relief well being drilled by SoCal is not expected to be completed until later this winter.

But despite news reports of the leak’s supportive impact on near-term forward prices, NGI data shows fixed prices for February, March and the summer have actually fallen since the leak occurred.

SoCal border February prices dropped 13 cents, March prices dropped 17.5 cents and summer prices dropped 4 cents between Oct. 23 and Jan. 7, NGI data shows.

While it’s true that basis has risen during that time, pinpointing whether the leak is behind the runup is difficult since basis is also up across the West.

In fact, at PG&E Citygates, February basis is up some 26 cents since Oct. 23, while the summer strip is up about 4.5 cents. SoCal summer basis is up about 6.5 cents.

And like SoCal, PG&E fixed prices are flat to slightly lower for those months: flat for February, down 7 cents for March and down 5 cents for the summer.

The implications of the ongoing storage crisis at Aliso Canyon are more reflective further out the forward curve, however.

The SoCal Border winter 2016-2017 strip jumped some 18 cents during the week alone, settling at $3.16 on Jan. 7, as California Governor Jerry Brown declared a state of emergency, forcing the evacuation of more than 2,000 residents from the Porter Ranch neighborhood atop the Aliso Canyon field.

The 2016-2017 winter strip sat Oct. 23 at $2.98, according to historical NGI data.

Rick Margolin, senior natural gas analyst for Genscape, said concerns are mounting that the Aliso Canyon storage field — the largest on SoCal’s system and one of the largest in the country — will have to be abandoned.

“Summer-time flows from inbound supply sources (El Paso, Transwestern, Baja Path, etc.) will likely decline as less of that gas could go to storage refilling. But dependence on flowing supply will likely increase in winter due to less storage available for withdrawals,” Margolin said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |