Shale Daily | Bakken Shale | NGI All News Access | NGI The Weekly Gas Market Report

Bakken Rig Count Drops Below 60, Notching Lowest Level Since 2009

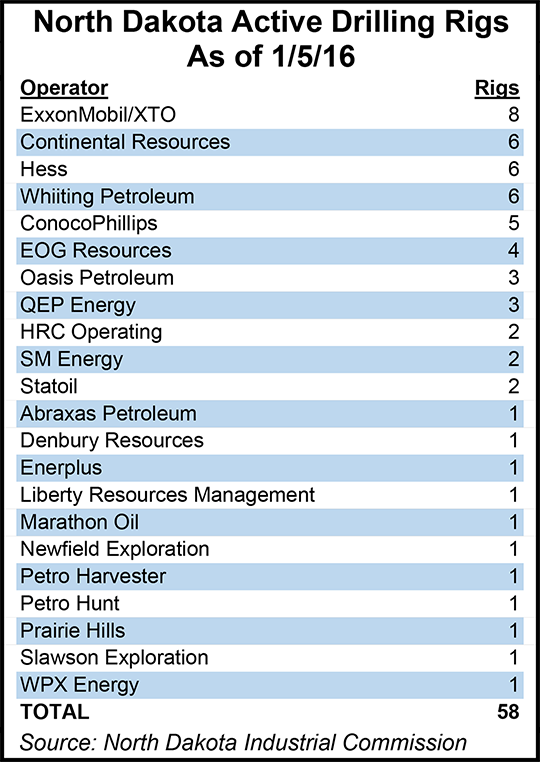

The rig count in North Dakota’s Bakken Shale started the new year at 58, the lowest level since 2009, state officials told NGI‘s Shale Daily on Tuesday, adding that the count is expected to fall further during the first half of the year.

More than six years ago, the rig count stood at 55 (October 2009), said a spokesperson for the state Department of Mineral Resources (DMR), which oversees oil/natural gas activity in North Dakota. “We expect rigs to hover around 50-55 for at least the first half of 2016, if not longer,” said DMR’s Alison Ritter.

Last month, the state’s rig count had risen slightly to 65 on Dec. 8, according to the DMR’s latest statistics (see Shale Daily, Dec. 9, 2015). The count had dropped to 65 in October from 71 in September and was at 64 in November.

At that time, DMR Director Lynn Helms said he had heard from producers that at the then-current price of $27/bbl for North Dakota sweet crude, the state’s rig count could decline by another 10 rigs over the first half of 2016. It has now done that in a matter of weeks — not months.

For comparison, at this time last year, North Dakota had 171 rigs operating, and in 2012 that total was 192, according to DMR. Nevertheless, according to DMR’s most recent statistics covering October, oil and gas production is staying above the 1.1 million b/d and 1 Bcf/d levels, respectively.

Low commodity prices continue to drive the cutback in rigs, although Bakken sweet crude oil was getting about $37/bbl at the start of this week, higher than they were in early December. The downturn so far has proved to be a benefit in the state’s efforts to greatly reduce volumes of flared gas at the wellhead.

In the state’s latest monthly production report, DMR’s Helms reported overall gas capture for October at 86% statewide (87% for the Bakken area), well above a revised December target goal of 77% (see Shale Daily, Dec. 11, 2015).

Currently, there are more than 13,000 active oil wells in North Dakota, which is more than three times the total in 2010 as the Bakken shale boom was beginning to surge. There are currently nearly 1,000 uncompleted wells that the state is giving operators extensions of deadlines for completing or closing them (see Shale Daily, Oct. 23, 2015).

Under current state Industrial Commission rules, once a well is drilled to total depth an operator has one year to bring it into production. After the one-year deadline, the well falls into an abandoned status and is considered in violation. The operator then has three choices: place the well into production, plug and abandon the well, or request temporarily abandoned status, which lasts for one year.

Ron Ness, president of the North Dakota Petroleum Council, told the Associated Press Monday that if rigs and well completions can be kept at current levels, the producers in the state can maintain the 1 million b/d-plus production levels.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |