Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Eclipse Resources Curtailing Production, Deferring Completions to Cut Costs Further

Ohio pure-play Eclipse Resources Corp. on Monday offered a sobering outlook for the remainder of the first quarter, announcing that it would curtail natural gas production and defer completions on 21 Utica wells as it grapples with natural gas prices hovering around 15-year lows.

The announcement comes even after the company said at the end of 3Q2015 that it would idle its drilling program to help cut costs (see Shale Daily, Nov. 12, 2015). While the company beat its full-year and 4Q2015 production guidance, financial analysts noted unfavorable strip prices could threaten already thin cash margins and said the small cap producer’s limited liquidity could build financial stress as the year progresses.

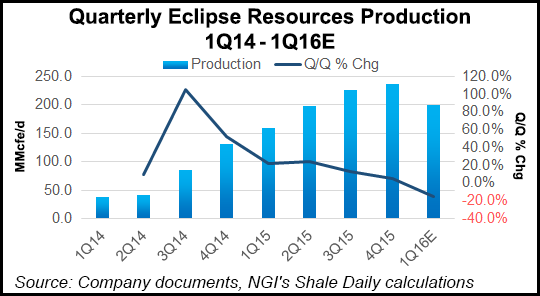

Eclipse’s preliminary estimates show that it should exit 2015 having produced 268 MMcfe/d, well above its 202-205 MMcfe/d guidance for the year. Fourth quarter production, the company said, averaged at least 236 MMcfe/d, a slight beat of its 225-235 MMcfe/d guidance for the period. But given low oil and gas prices and the “uncertain outlook in the near term,” the company said it would voluntarily curtail its operated production to keep volumes in line with last year’s average of roughly 200 MMcfe/d.

Eclipse said it would be selective with production curtailments across its liquids, condensate and dry gas areas in a bid to keep the company’s production mix as valuable as possible according to fluctuations in commodity prices. It said in its investor presentation that it has elected to defer completions on about 18 Utica wells in its condensate window and two in its dry gas window. The move is a deviation from cost-cutting measures the company announced at the end of 3Q2015, when it said it would focus on an inventory of uncompleted wells.

The measures, Eclipse said, are aimed at maintaining cash flows, limiting the use of cash on hand for drilling expenses and avoiding the sale of products in the depressed environment.

Moreover, the company did not provide an update on its capital spending plans for the full year, saying instead that it would spend $33 million in the first quarter to, among other things, drill and complete one well with an extended reach lateral and cover the costs of land and non-operated activity. Eclipse budgeted $330 million for 2015.

“Although we are not setting a capital budget for the year at this time, we currently anticipate that our ultimate capital plan, absent a significant increase in commodity prices, will be constructed with the objective of ending 2016 with a cash balance and no new debt drawn,” said CEO Benjamin Hulburt. “As well, this plan will allow the company the flexibility to adjust which wells are curtailed throughout the year based on operating costs, volume commitments and commodity prices.”

Eclipse ended the year with about $281 million in liquidity, including undrawn funds from its revolving credit facility and $184 million of cash on hand. The company also said it placed seven wells online at its Fuchs and Dietrich pads in Monroe County, with average lateral lengths of 8,800 feet. Those wells came online in the dry gas east area at the company’s initial production type curve of 16.8 MMcf/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |