Shale Daily | E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

Swift Energy Files for Bankruptcy Protection; Terry Swift Stepping Down as Chairman

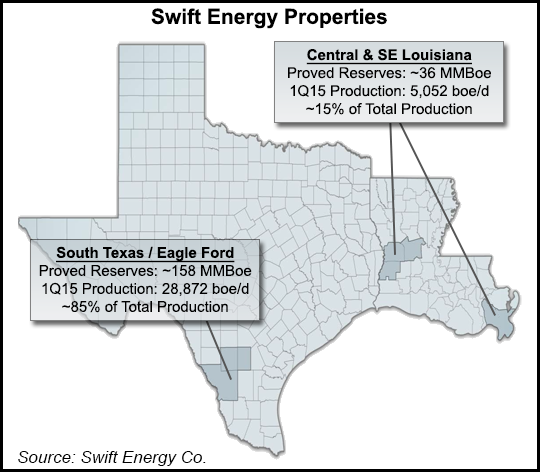

Houston-based Swift Energy Co., whose primary operations are in the Eagle Ford Shale and Louisiana, filed for voluntary bankruptcy protection in the waning hours of 2015, and has begun a restructuring process that includes turning over control of the company and selling assets.

The Chapter 11 plan was filed late on New Year’s Eve in the U.S. Bankruptcy Court for the District of Delaware.

“The company had to take action in response to the significant reduction in oil and gas prices that the entire industry has been facing,” CEO Terry E. Swift said. “We expect that Swift will exit bankruptcy with a greatly improved balance sheet and additional liquidity to realize the full potential of our assets for all stakeholders, while having sufficient funding to maintain, if not improve, our asset base during the Chapter 11 process.”

At the end of 2014, Swift’s total proved reserves were 193.8 million boe, 59% weighted to natural gas. About 81% of the reserves are in Texas.

Terry Swift, who also is chairman and president, would step down as chairman under the restructuring plan. The son of founder Aubrey Earl Swift, he joined the company in 1981, became CEO in 2001 and was named chairman in 2006. An independent chairman is to be appointed by the new majority equity group, which also plans to appoint board members to constitute a majority.

The turnaround plan has backing from a committee representing bondholders of about half of the bond debt, the filing stated. Swift and the bondholders still have to come to terms with how to pay off $330 million in bank debt. If approved, Swift would swap $905 million in bond debt for most of its equity. Bank debt from a syndicate led by JPMorgan Chase & Co. would have to be amended, refinanced or resolved in a way that is satisfactory to bondholders and to bank lenders, who hold liens on most of Swift’s assets.

Swift has lined up $75 million in debtor-in-possession (DIP) financing from bondholders and intends to seek early court approval to allow it to continue to operate as it restructures its balance sheet. About $45 million of the DIP is contingent on reaching an agreement regarding the bank debt. The restructuring agreement could result in the company emerging from bankruptcy within 110 days, the filing noted. Operations are to continue as normal during the restructuring, with royalty payments and payments to working interest owners still made when they are due.

The agreement provides for executive management to retain positions once the restructuring is approved. Dean Swick, managing director at Alvarez and Marsal, has been appointed as chief restructuring officer during the reorganization process.

“Employees should expect no change in their daily responsibilities and to be paid in the ordinary course,” the company said.

Swift missed a Dec. 1 interest payment with bondholders as it struggled to address a debt load of more than $1.2 billion. On Dec. 18, the New York Stock Exchange suspended trading because of its “abnormally low” trading price levels, and said it would begin proceedings to delist the shares. Swift closed on Dec. 31 trading at 9 cents/share and finished on Monday at 14 cents in heavy trading.

Shortly before the bankruptcy filing, Swift reached a deal to sell a 75% interest in some Central Louisiana oil-weighted properties to Texegy LLC for a “favorable price.” Texegy, formed in late 2014 to acquire producing conventional properties in Texas and Louisiana, would become majority owner of the South Bearhead Creek and Burr Ferry fields in a deal set to close by March 15, subject to bankruptcy court approval. The plan would allow a Texegy-run joint venture, SV Energy Co. LLC, to operate the properties.

“This arrangement marks the beginning of a strategic partnership while strengthening our liquidity profile,” Terry Swift said.

“This acquisition is part of a series of acquisitions, we intend to conclude in the near future, of similar assets in Texas and Louisiana,” Texegy President Michael S. Pedrotti said. CEO Rajan Ahuja added that the Swift assets “fit perfectly in our portfolio of producing conventional assets in Texas and Louisiana.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |