NGI Weekly Gas Price Index | NGI All News Access | NGI Archives

Winter’s Chill Sparks NatGas Cash, Futures Rally to Finish 2015

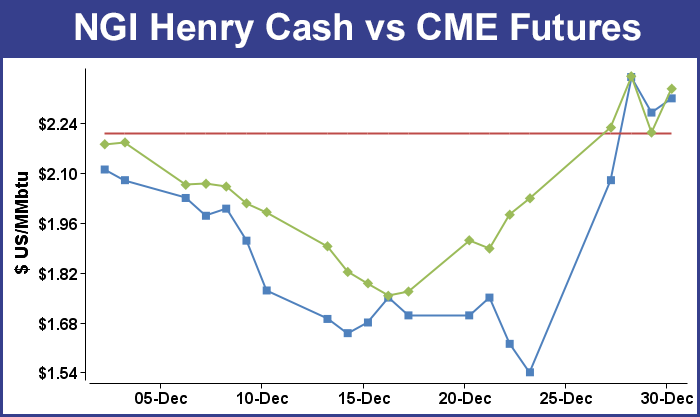

Natural gas futures earned their stripes for the week ending Dec. 24 as the 26-cent surge in the January contract augured robust gains in the physical market a week later. Last week the cash market seemed down and out posting an 11-cent loss to $1.60, but for the three-day week ending Dec. 30, the NGI Weekly Spot Gas Average took a cue from the prior week’s futures move and zoomed 73 cents to $2.33. All points followed by NGI racked up double-digit gains and at some points price gains were measured in dollars.

Winter’s first significant burst of cold into the eastern half of the country brought upon the rise in prices. The individual market point showing the greatest advance was Algonquin Citygate with a rise of $3.18 to average $4.54 followed closely by Tennessee Zone 6 200 L adding $3.12 to $4.77.

Tennessee Zone 4 Marcellus proved to be the week’s laggard adding “just” 33 cents to average $1.03. Regionally the Northeast grabbed the spotlight with a 90 cent rise to $2.02 and California found itself at the bottom of the leader board adding 57 cents to average $2.81.

Quotes in the Midwest were seen 62 cents higher at $2.36, East Texas added 63 cents to $2.24, and South Louisiana was quoted 64 cents higher at $2.22.

South Texas prices came in 67 cents higher to average $2.21 and the Midcontinent changed hands up 75 cents to $2.39. Second only to the Northeast, the Rocky Mountains added 82 cents to $2.68.

For the four-day week ending Thursday, February futures rose 25.8 cents to $2.337 as traders digested what was expected to be a highly uncertain Energy Information Administration (EIA) storage report. “This week’s survey forecast range was wildly wide; -39 to -78 Bcf,” said John Sodergreen, editor of Energy Metro Desk (EMD). He cited a low confidence level among the analysts surveyed, and “The range between the three categories we track is 5.5 Bcf, which according to our Tealeaves points to a possible surprise report out of EIA.” He added that the EMD survey resulted in an average 60 Bcf but “We see a high-side bias to this week’s potential surprise report, so, EIA reporting a draw in the low-to-mid -60’s (or more) should be about right.”

The EIA reported a 58 Bcf withdrawal in its 10:30 a.m. EDT release for the week ending Dec. 25, and the pull on storage put inventories at 3,756 Bcf. February futures fell to a low of $2.307 following the release of the storage data, but by 10:45 a.m. February was trading at $2.317, up 10.3 cents from Wednesday’s settlement. February opened floor trading at $2.329.

Prior to the release of the data, analysts’ estimates were in the 50 Bcf to 60 Bcf withdrawal range. IAF Advisors was looking for a pull of 62 Bcf and a Reuters survey of 17 traders showed a range from -18 Bcf to -78 Bcf with an average -57 Bcf. ICAP Energy calculated a 66 Bcf withdrawal.

“We were trading at about $2.34 before the number came out, traded down to $2.307 and then moved back up. We didn’t make any new highs or lows off the number,” a New York floor trader told NGI. “Volume is about normal, but there are a lot of people not in today. You can get very choppy markets under those conditions,” he said.

Tim Evans of Citi Futures Perspective noted the 58 Bcf pull was “marginally above the 56-Bcf Bloomberg survey figure, a result we’d call more ‘constructive’ than bullish, indicating a somewhat tighter supply/demand balance but still bearish relative to the five-year average benchmark.”

Using the new five-region format inventories now stand at 3,756 Bcf and are 532 Bcf greater than last year and 448 Bcf more than the five-year average. In the East Region 18 Bcf were pulled, and the Midwest Region saw inventories fall by 26 Bcf. Stocks in the Mountain Region were down by 3 Bcf and the Pacific region was lower by 8 Bcf. The South Central Region, closely similar to the former Producing Region, shed 3 Bcf.

Whether cash and futures markets can continue their march higher is an open question, but analysts note that market bears in 2016 will have strong headwinds to face in the form of moderating production and lower capital expenditures.

Jefferies LLC has reduced its 2015 exit rate for U.S. gas, but supplies are forecast to decline in 2016 as exploration and production (E&P) companies for the second year in a row sharply reduce capital expenditures (capex). “More limited evacuation solutions in the Northeast” also are expected, where the mighty Appalachian Basin has continued to push supply higher. (see related story).

Using a 21-basin model for the U.S. onshore, the Jefferies team led by Jonathan Wolff reduced its bottoms’ up estimate for the 2015 exit rate by 1.5 Bcf/d to 70.8 Bcf/d.

Capex cuts for 2016 “will be dramatic,”Wolff said, and less money means less development. “Producers really cannot justify drilling anything at current natural gas price levels,” he said. “We believe E&P’s will have much more dramatic capex cuts than market expects, down perhaps 50%-plus from 2015, as gas producers wait for a price signal that is $2.75/MMBtu-plus.”

In physical market trading Thursday Mid-Atlantic prices posted stout gains as Monday on-peak power pricing provided an incentive to make incremental purchases for power generation. Intercontinental Exchange reported Monday power at the PJM West terminal rose $12.30 to $41.70/MWh and power at the New York ISO’s Zone A delivery point (western New York) added $11.69 to $36.69/MWh. On-peak Monday power at the New York ISO’s Zone G terminal (eastern New York) jumped $23.46 to $49.25/MWh.

Gas onTetco M-3 Delivery rose 24 cents to $1.64, and gas bound for New York City on Transco Zone 6 gained 91 cents to $2.96. Packages on Dominion South were quoted 16 cents higher at $1.39.

In New England traders also had robust power pricing to work with. Intercontinental Exchange reported on-peak Monday power at the ISO New England’s Massachusetts Hub surged $25.26 to $67.82/MWh.

Weekend and Monday gas for delivery to the Algonquin Citygate rose 56 cents to $5.21, and deliveries to Iroquois Waddington were quoted 36 cents higher at $2.82. Gas on Tennessee Zone 6 200 L was seen 22 cents lower at $5.12.

In the Midwest, Intercontinental Exchange reported on-peak Monday power at the Indiana Hub rose $3.68 to $30.60/MWh and natural gas prices took note.

Gas on Alliance rose 8 cents to $2.43, and deliveries to the Chicago Citygate were also seen 8 cents higher at $2.45. Gas on Michcon changed hands up 4 cents to $2.40, and parcels on Consumers gained 7 cents to $2.43.

Weekend temperatures were forecast at or below seasonal norms. Wunderground.com predicted the Thursday high in New York City of 48 would slide to 44 Friday and 36 by Monday, 3 degrees below normal. Chicago’s 30 high on Thursday was anticipated to drop to 27 Friday before rebounding to 32 Monday, the seasonal norm.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |