Physical NatGas, Futures End Year On A Positive Note; February Adds 12 Cents

Physical natural gas for delivery over the extended holiday period gained ground in Thursday’s trading as losses at California and Rocky Mountain points were easily offset by gains in the Gulf, Midcontinent and Northeast.

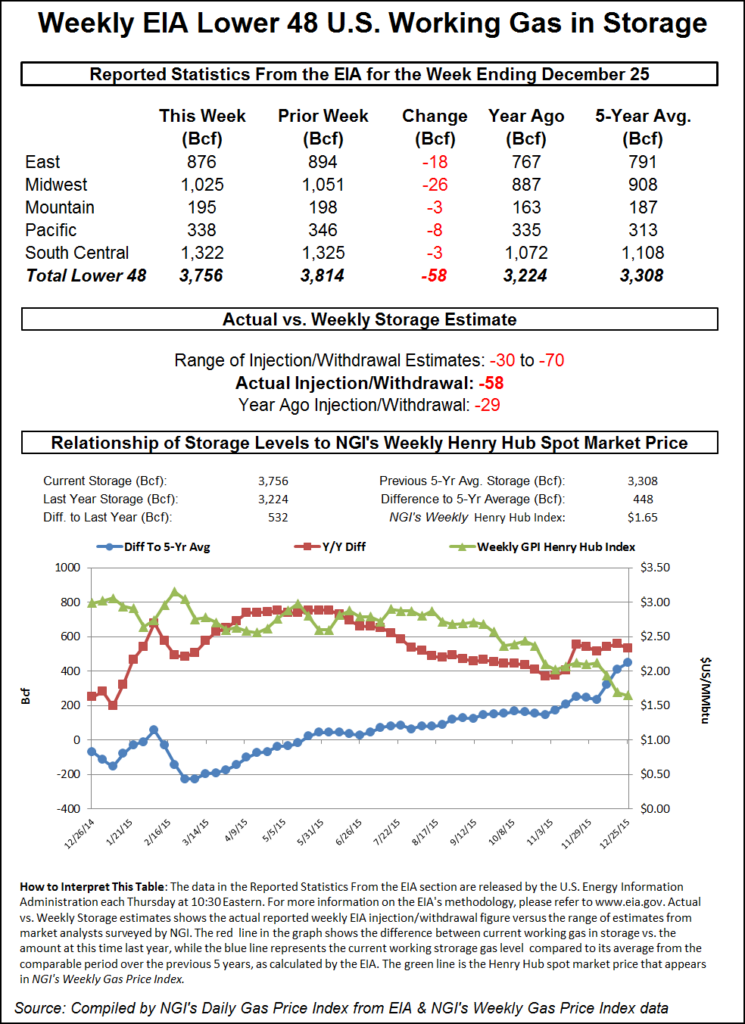

The NGI National Spot Gas Average rose 8 cents to $2.40, and surging Monday on-peak power pricing provided a nice cushion for traders making incremental gas purchases for power generation. The Energy Information Administration (EIA) reported a withdrawal of 58 Bcf for the week ending Dec. 25, but most of the day’s price movement was registered by the open, and the inventory decline registered nary a blip on trading screens. At the close, February was up 12.3 cents to $2.337 and March had gained 10.8 cents to $2.363. February crude oil rose 44 cents to $37.04/bbl.

Traders were looking down the barrel of what was thought to be a high-risk EIA storage report with a great degree of uncertainty. “This week’s survey forecast range was wildly wide; -39 to -78 Bcf,” said John Sodergreen, editor of Energy Metro Desk (EMD). He cited a low confidence level among the analysts surveyed and said, “The range between the three categories we track is 5.5 Bcf, which according to our Tealeaves points to a possible surprise report out of EIA.” He added that the EMD survey resulted in an average 60 Bcf draw but “We see a high-side bias to this week’s potential surprise report, so, EIA reporting a draw in the low-to-mid -60s (or more) should be about right.”

Last year 29 Bcf was withdrawn and the five-year pace stands at a stout 95 Bcf pull for the week. IAF Advisors was looking for a decline of 62 Bcf and ICAP Energy calculated a 66 Bcf withdrawal. A Reuters survey of 17 traders and analysts revealed an average withdrawal of 57 Bcf with a range of -18 Bcf to -78 Bcf.

Once the number hit trading screens, February futures fell to a low of $2.307, but much of the day’s advance was in place when floor trading opened. By 10:45 a.m. EST, February was trading at $2.317, up 10.3 cents from Wednesday’s settlement and floor trading in February opened at $2.329.

“We were trading at about $2.34 before the number came out, traded down to $2.307 and then moved back up. We didn’t make any new highs or lows off the number,” a New York floor trader told NGI. “Volume is about normal, but there are a lot of people not in today. You can get very choppy markets under those conditions,” he said.

Tim Evans of Citi Futures Perspective said the 58 Bcf pull was “marginally above the 56 Bcf Bloomberg survey figure, a result we’d call more ‘constructive’ than bullish, indicating a somewhat tighter supply/demand balance but still bearish relative to the five-year average benchmark.”

Using the new five-region format inventories now stand at 3,756 Bcf and are 532 Bcf greater than last year and 448 Bcf more than the five-year average. In the East Region 18 Bcf were pulled, and the Midwest Region saw inventories fall by 26 Bcf. Stocks in the Mountain Region were down by 3 Bcf and the Pacific region was lower by 8 Bcf. The South Central Region, similar to the former Producing Region, shed 3 Bcf.

Futures traders for the moment are standing aside given the recent wide market swings. “We have shifted to a sideline stance this week amid some extreme price volatility that is seeing market swings as much as 9% in both directions amid an unusual mix of short term temperature forecasts,” said Jim Ritterbusch of Ritterbusch and Associates in a note to clients. “Wednesday’s] price plunge negated the prior day’s up- spike and today’s renewed lift is largely offsetting yesterday’s losses. Within such an environment, selectivity would be advised in approaching the market from either direction. Given our view that a sizable supply surplus of around 12% will be available to meet the needs of an unusually cold January-February period, we feel that entry into the short side on further rallies would be the more favorable trade.”

In physical market trading Mid-Atlantic prices posted stout gains as Monday on-peak power pricing provided an incentive to make incremental purchases for power generation. Intercontinental Exchange reported Monday power at the PJM West terminal rose $12.30 to $41.70/MWh and power at the New York ISO’s Zone A delivery point (western New York) added $11.69 to $36.69/MWh. On-peak Monday power at the New York ISO’s Zone G terminal (eastern New York) jumped $23.46 to $49.25/MWh.

Gas onTetco M-3 Delivery rose 24 cents to $1.64, and gas bound for New York City on Transco Zone 6 gained 91 cents to $2.96. Packages on Dominion South were quoted 16 cents higher at $1.39.

In New England traders also had robust power pricing to work with. Intercontinental Exchange reported on-peak Monday power at the ISO New England’s Massachusetts Hub surged $25.26 to $67.82/MWh.

Weekend and Monday gas for delivery to the Algonquin Citygate rose 56 cents to $5.21, and deliveries to Iroquois Waddington were quoted 36 cents higher at $2.82. Gas on Tennessee Zone 6 200 L was seen 22 cents lower at $5.12.

In the Midwest, Intercontinental Exchange reported on-peak Monday power at the Indiana Hub rose $3.68 to $30.60/MWh and natural gas prices took note.

Gas on Alliance rose 8 cents to $2.43, and deliveries to the Chicago Citygate were also seen 8 cents higher at $2.45. Gas on Michcon changed hands up 4 cents to $2.40, and parcels on Consumers gained 7 cents to $2.43.

Weekend temperatures were forecast at or below seasonal norms. Wunderground.com predicted the Thursday high in New York City of 48 degrees would slide to 44 Friday and 36 by Monday, 3 degrees below normal. Chicago’s 30 high on Thursday was anticipated to drop to 27 Friday before rebounding to 32 Monday, the seasonal norm.

Forecasters see increased cooling in the medium term. Commodity Weather Group in its morning 11- to 15-day outlook showed below-normal temperatures extending west of a sinuous line extending from Montana to Illinois to Louisiana. Above-normal temperatures are seen along the Atlantic Seaboard from Connecticut to Florida.

“The last few days have seen the biggest model swings of the entire heating season to date with the European moving heavily warmer for two cycles in a row two days ago and now the most recent two runs have flipped strongly colder thanks to a combination of a stronger cold push to the East Coast early next week and a faster timing of the big cold front in the 11-15 day range.

“The stronger cold in the Northeast early next week is something that has been brewing on the operational models for a few days now and with blocking building in the high latitudes, the transport of a stronger event is a reasonable risk,” said Matt Rogers, president of the firm.

Tom Saal, vice president at FC Stone Latin America LLC in Miami, in his work with Market Profile expected the market to test Wednesday’s value area at $2.229 to $2.199 before moving on to test value areas at $2.377 to $2.351 and $2.089 to $2.059. Saal said he was unsure in which order the last two value areas would be tested.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |