Shale Daily | E&P | NGI All News Access

Natural Gas Producers Longing for Days of Auld Lang Syne

The U.S. natural gas market, struggling with continuing oversupply, finally registered a slight production decline year/year in November, but industry watchers are discouraged that 2016 will prove much better for those longing for higher prices.

Jefferies LLC has reduced its 2015 exit rate for U.S. gas, but supplies are forecast to decline in 2016 as exploration and production (E&P) companies for the second year in a row sharply reduce capital expenditures (capex). “More limited evacuation solutions in the Northeast” also are expected, where the mighty Appalachian Basin has continued to push supply higher.

Using a 21-basin model for the U.S. onshore, the Jefferies team led by Jonathan Wolff reduced its bottoms’ up estimate for the 2015 exit rate by 1.5 Bcf/d to 70.8 Bcf/d. The exit rate for 2016 is higher — with a caveat.

“Our 2016 exit rate production estimate of 71.8 Bcf/d remains unchanged but has a downward bias,” Wolff said. Capex cuts for 2016 “will be dramatic,” and less money means less development.

“Producers really cannot justify drilling anything at current natural gas price levels,” he said. “We believe E&P’s will have much more dramatic capex cuts than market expects, down perhaps 50%-plus from 2015, as gas producers wait for a price signal that is $2.75/MMBtu-plus.”

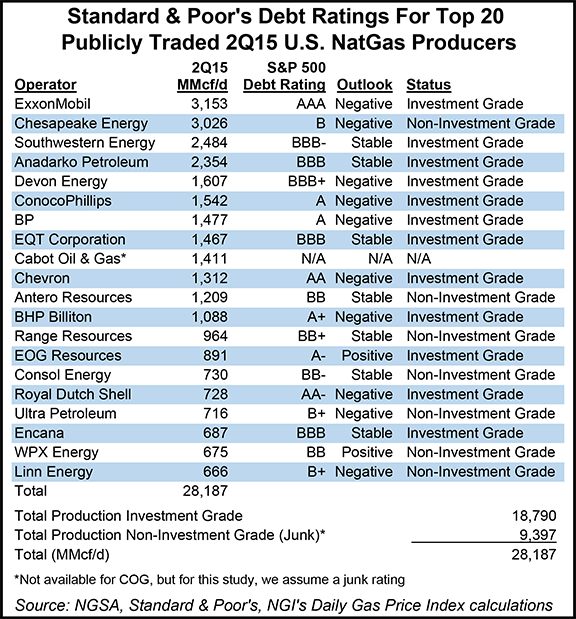

Big Oil and credit-worthy producers may skew the output trend a bit, but even those with the biggest pockets are trimming their plans, said Standard & Poor’s (S&P) Ratings Services credit analysts Stephen Scovotti and Carin Dehne-Kiley. Based on data they collected from more than 100 rated U.S. E&Ps and integrated producers, upstream capex should decrease by “at least” 20% in 2016 after a nearly 35% decline in 2015.

The legacy dry gas basins should see the biggest cutbacks, said Wolff.

“In November, the Piceance, Barnett, Fayetteville and Cotton Valley Trend combined to fall 270 MMcf/d sequentially, with the Piceance falling by the largest amount (130 MMcf/d, down 8.4% sequentially).” A lack of development next year in these basins should continue to push down output in 2016, “with these four areas accounting for an estimated decline of 450 MMcf/d.”

Associated gas production from the diminishing work in the oil plays also has begun to roll over. Eagle Ford Shale production, which rolled over earlier than other oily plays, continued to decline in November, falling by 45 MMcf/d (1%) and fell by 10% — 800 MMcf/d — since peaking last March. Bakken Shale gas production fell by 6% sequentially from October to November and was down by more than 100 MMcf/d from its July peak. Gas production from the Permian Basin, while still rising, had fallen from its peak reached last June.

Production might fall sooner if it were not for the drilled but uncompleted (DUC) well inventory in the U.S. onshore. Halliburton Co. last April estimated that there were about 4,000 DUCs across the United States. Raymond James & Associates Inc. said in November the impact of DUCs is going to be big in 2016, but how big is a mystery (see Shale Daily, Nov. 23, 2015). The problem is how states tabulate DUCs versus how E&Ps compile the data. In North Dakota, counting DUCs is a bit clearer, according to S&P analysts.

“In North Dakota, for example, there were over 1,000 DUCs (an all-time high) at the end of September, primarily in the Bakken/Three Forks formations, according to the North Dakota Industrial Commission,” S&P analysts said. “Current state regulations require that companies complete these wells within 12 months of drilling (though the state has made some exceptions), which could augment oil volumes in 2016” (see Shale Daily, Oct. 23, 2015). Improved drilling efficiencies and well productivity also “will continue to support production in 2016.”

Gas production declines, which for many of the shale players can be about 60% in the first year, should become “a key factor in 2016,” said S&P’s Scovotti and Dehne-Kiley. “We believe aggregate production will be flat to slightly down in 2016 because the natural declines are not fully offset by the positive factors for production previously discussed. We also believe that production declines could accelerate in 2017 if producers don’t increase capital spending significantly by then.”

One thing expected to create havoc among E&Ps in 2016 is even less access to capital markets than this year because external financing markets “are effectively closed” for “all but the highest quality E&Ps,” the Jefferies team said. “Spring bank redeterminations are coming and will likely feature severe cuts to available liquidity. Leverage is generally high for producers, meaning hefty cuts to budgets are likely.”

Most of the U.S. E&Ps that attempted to access financial help this year avoided the expected pitfalls during the two redetermination periods in the spring and fall, according to Fitch Ratings (see Shale Daily, Dec. 21, 2015).

Meanwhile, gas demand could be strengthening because it’s readily available, while coal is limited for power plant expansions because of emissions restrictions. Southeast and Mid-Atlantic power generators are “primed” to use a lot more gas, which should push demand higher in the coming years. There also are rising exports to Mexico, hungry for U.S. gas, which is “far cheaper” than imported liquefied natural gas (LNG).

Bank of America Merrill Lynch said excessive stocks, soft end-user demand because of sluggish industry growth and mild weather suggest it is going to be a long year for the gas bulls.

“We see 2016 average prices at $3.00/MMBtu, but remain constructive for 2017 when we see structurally tighter gas balances,” the BofA Merrill Lynch team said. Among other things, an upcoming drop in LNG demand in Japan, lower oil prices and “imminent” new supply set the stage for lower prices. “Medium-term, new liquefaction capacity may limit the price recovery.”

BMO Capital Markets analysts led by Randy Ollenberger said weather, as always, is the key driver for North American gas prices, and the fundamentals appear to be challenged through next year. BMO is forecasting gas prices to trade in the $2.00-3.00/Mcf range in 2016 assuming “normal” winter weather patterns.

“The rapid growth in natural gas production in the Marcellus and Utica is continuing to displace Western Canadian gas from its traditional eastern Canadian and U.S. Midwest markets,” Ollenberger said. “Moreover, we believe that the pricing point for natural gas has essentially shifted to the U.S. Northeast from the Gulf Coast. These trends have negative implications for Western Canadian natural gas prices.

“We expect the basis spread between Henry Hub and AECO to widen in 2016 to roughly 75 cents-$1.00/Mcf and remain relatively wide until (if) liquefied natural gas projects provide a relief valve for Western Canada.”

Morningstar’s senior equity analyst David Meats said producers want to align spending in 2016 with cash flow. The intention is to reduce oil production, but reduced investment “could also reduce U.S. natural gas production growth in the near term.” Still, “the wealth of low-cost inventory in areas like the Marcellus and Utica ultimately points to continued growth through the end of this decade and beyond.”

In the long run, “we still anticipate relief from incremental demand from liquefied natural gas exports as well as industry. Our midcycle U.S. natural gas price estimate is unchanged at $4.00/Mcf,” Meats said.

“The most pressing question on the minds of energy investors: How long will it take for the industry to work through the current period of oversupply and rebalance itself?,” Meats asked. “The answer: Not anytime soon…For the market to approach any semblance of normalcy before 2017 — and likely for prices to respond accordingly — requires one or more of the following: Saudi Arabia reverses course from its ‘maintain market share at all costs’ approach and cuts production; global demand surprises to the upside from current expectations of 95 million b/d in 2016 and 96 million b/d in 2017; or a geopolitical event occurs (for example, political upheaval in Venezuela or another oil-exporting nation).

“Without one or more of these occurring, ‘lower for longer’ looks to be the unavoidable near-term course for the industry.”

U.S. E&Ps shouldn’t expect many more concessions on price from the oilfield services sector, according to S&P.

“The magnitude of service-cost reductions is similar to the reduction oilfield services companies implemented during the last industry downturn in 2009; however, we don’t expect additional cost reductions in 2016 because many service providers are already operating at near break-even levels…We believe the expected 20% decline in E&P capital spending next year will stem mostly from the ongoing drop in drilling activity, continued efficiency gains in drilling and well completion, and increased productivity, as companies continue to streamline operations and allocate capital to their highest return assets.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |