NGI Data | Markets | NGI All News Access

NatGas Bulls Hold On to Strong Open Following Unsurprising EIA Data

Natural gas futures were unable to improve upon a sharply higher open Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was about in line with what traders were expecting.

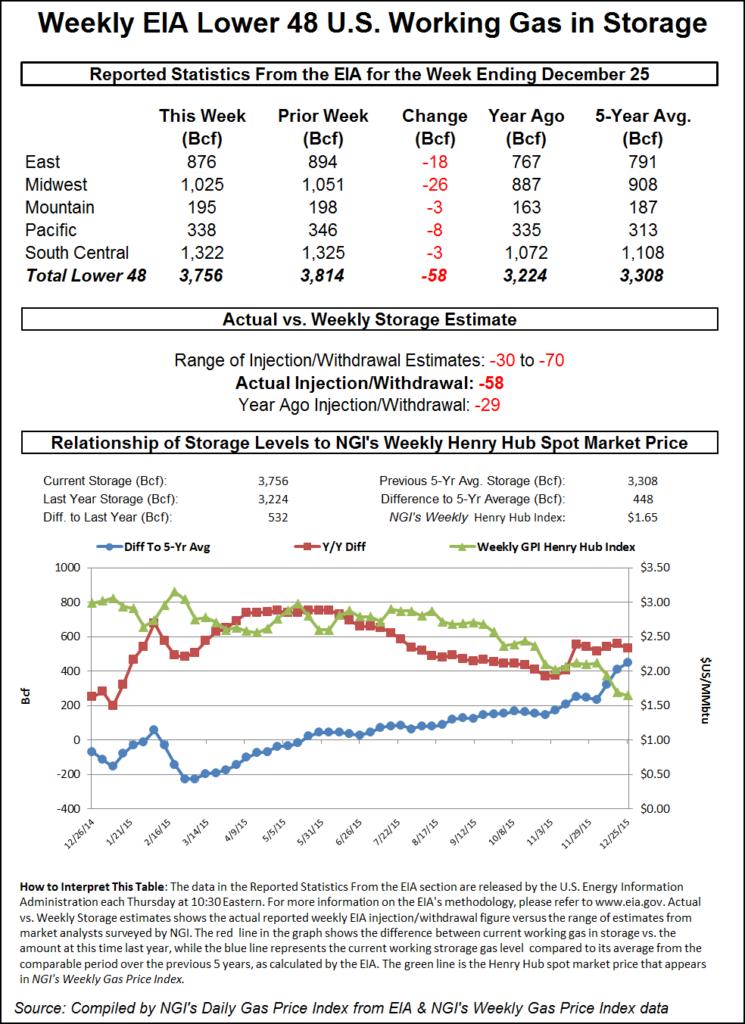

EIA reported a 58 Bcf withdrawal in its 10:30 a.m. EST release, and the pull on storage put inventories at 3,756 Bcf. February futures fell to a low of $2.307 following the release of the storage data, but by 10:45 a.m. February was trading at $2.317, up 10.3 cents from Wednesday’s settlement. During floor trading February opened at $2.329.

Prior to the release of the data, analyst estimates were in the 50 to 60 Bcf withdrawal range. IAF Advisors was looking for a pull of 62 Bcf, and a Dow Jones poll showed a range from -30 Bcf to -70 Bcf with an average of -54 Bcf. ICAP Energy calculated a 66 Bcf withdrawal.

“We were trading at about $2.34 before the number came out, traded down to $2.307 and then moved back up. We didn’t make any new highs or lows off the number,” a New York floor trader told NGI. “Volume is about normal, but there are a lot of people not in today. You can get very choppy markets under those conditions.”

Tim Evans of Citi Futures Perspective said the 58 Bcf pull was “marginally above the 56 Bcf Bloomberg survey figure, a result we’d call more ‘constructive’ than bullish, indicating a somewhat tighter supply-demand balance but still bearish relative to the five-year average benchmark.”

Using the new five-region format inventories now stand at 3,756 Bcf and are 532 Bcf greater than last year and 448 Bcf more than the five-year average. In the East Region 18 Bcf was pulled, and the Midwest Region saw inventories fall by 26 Bcf. Stocks in the Mountain Region were down by 3 Bcf, and the Pacific region was lower by 8 Bcf. The South Central Region, similar to the former Producing Region, shed 3 Bcf.

Salt cavern storage was unchanged at 378 Bcf, while the non-salt cavern figure fell 3 Bcf to 944 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |