Both NatGas Cash, Futures Suffer Altitude Sickness; February Falls 15 Cents

It was a tale of two physical markets Wednesday as Thursday gas traded sharply lower at Rockies and California points, but in the Northeast next-day deliveries added about a dime on a firm power market. NGI’s National Spot Gas Average fell 13 cents to $2.32 and futures prices weakened as well.

At the close, February was down 15.6 cents to $2.214, and March had fallen 14.2 cents to $2.255. February crude oil fell $1.27 to $36.60/bbl. on an unsupportive inventory report.

Rockies and California points plummeted as temperatures warmed just enough to prompt a sizeable loss in demand.

“Coming out of the Christmas weekend, both the El Paso – Mainline and SoCal Border Avg./Ehrenberg points were strong (the latter traded 10 cents over SoCal Citygate) as the desert Southwest [West Texas, San Juan] was experiencing freeze-offs and the demand in the Phoenix area was stout as the overall temperatures dropped well below normal,” said EnergyGPS principal Jeff Richter of Portland, OR.

That all changed Wednesday.

“About 0.6 Bcf/d of Southern California demand is going to be lost with the higher average temperatures, so the market had to go down, and basis came in as well. SoCal definitely got a double-whammy in regards to price,” Richter said. “.If it drops down to 46 degrees on average, you will get quite a bit more demand, but once it goes up to 50 you have half a Bcf less. After that it can warm up another 10 degrees and it doesn’t matter.”

Gas at Malin shed 25 cents to $2.65, and deliveries to the PG&E Citygate dropped 16 cents to $2.79. Gas at the SoCal Citygate was seen 26 cents lower at $2.75, and Kern Delivery shed 36 cents to $2.69. Gas on El Paso S. Mainline changed hands 42 cents lower at $2.68.

Next-day Southern California power prices also slumped. Intercontinental Exchange reported that on-peak power at SP-15 for Thursday delivery fell $6.55 to $31.75/MWh. CAISO also forecast that peak load Thursday would fall to 29,271 MW from 30,708 MW Wednesday.

Eastern prices managed gains on supportive next-day power markets, thanks to the first real burst of winter cold for the region. Intercontinental Exchange reported on-peak Thursday power at the ISO New England’s Massachusetts Hub rose $3.92 to $42.56/MWh, and power at the PJM West Hub added $1.04 to $29.40/MWh.

Gas at the Algonquin Citygate gained 22 cents to $4.65, and deliveries to Tenn Zone 6 200L came in 60 cents higher at $5.34. Gas on Dominion South added 3 cents to $1.23.

Near-term cold is decidedly in play, but forecasters said more market-moving weather may be in store by mid-January.

“Colder temperatures are still on track over the eastern U.S. for this coming weekend into early next week, but all eyes should be focused on whether polar air over Canada arrives after Jan. 10 to bring much stronger than normal natgas demand, which we continue to see decent potential for,” said Natgasweather.com in a Tuesday update.

“Until then, a potent winter storm continues to sweep across the Midwest and into the Northeast with areas of snow and ice into the cold air, with rain and thunderstorms out ahead of it. Milder temperatures will return to the East the next few days, with warmer than normal conditions continuing until the cold pool finally gets tapped late this week through the coming weekend with subfreezing temperatures expanding to cover many U.S. regions.”

In spite of the forecast cold, the National Weather Service (NWS) predicted diminished near-term heating requirements. For the week ended Jan. 2, NWS predicted that New England will see 205 heating degree days ( HDD), or 66 below normal. The Mid-Atlantic is expected have 177 HDD, or 74 below normal, and the greater Midwest from Ohio to Wisconsin is anticipated to have 228 HDD, or 57 below normal.

The forecast cold has a way to go to impact overall supplies. Tim Evans of Citi Futures Perspective calculated a 48 Bcf withdrawal for this week’s storage report, well below the five-year average of 95 Bcf, but the stout, longer-term surplus isn’t expected to decline until mid-January.

“With storage as forecast, the year-on-five-year average storage surplus that was 412 Bcf as of Dec. 18 would expand to 518 Bcf as of Jan. 8 before declining to 508 Bcf as of Jan. 15m” Evans said. “In general, we view a rising year-on-year five-year average surplus as confirming the market is becoming better supplied on a seasonally adjusted basis, a downward fundamental pressure on prices.”

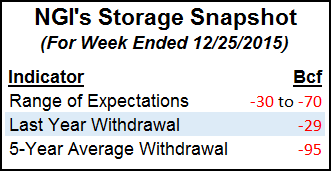

Nonetheless, Thursday’s inventory report will give traders an idea of how high surpluses may go before normal drawdown patterns set in. Last year 29 Bcf were withdrawn and the five-year average comes in at a 95 Bcf pull.

IAF Advisors calculated a 62 Bcf withdrawal, and ICAP Energy is looking for a decline of 66 Bcf. A Dow Jones Survey revealed an average 54 Bcf withdrawal with a range of -30 Bcf to -70 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |