NGI Data | Markets | NGI All News Access

Bears Yawning Despite Low Storage Pull; January Unchanged

Natural gas futures inched lower Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal for the week ending Dec. 11 that was less than what traders had been expecting.

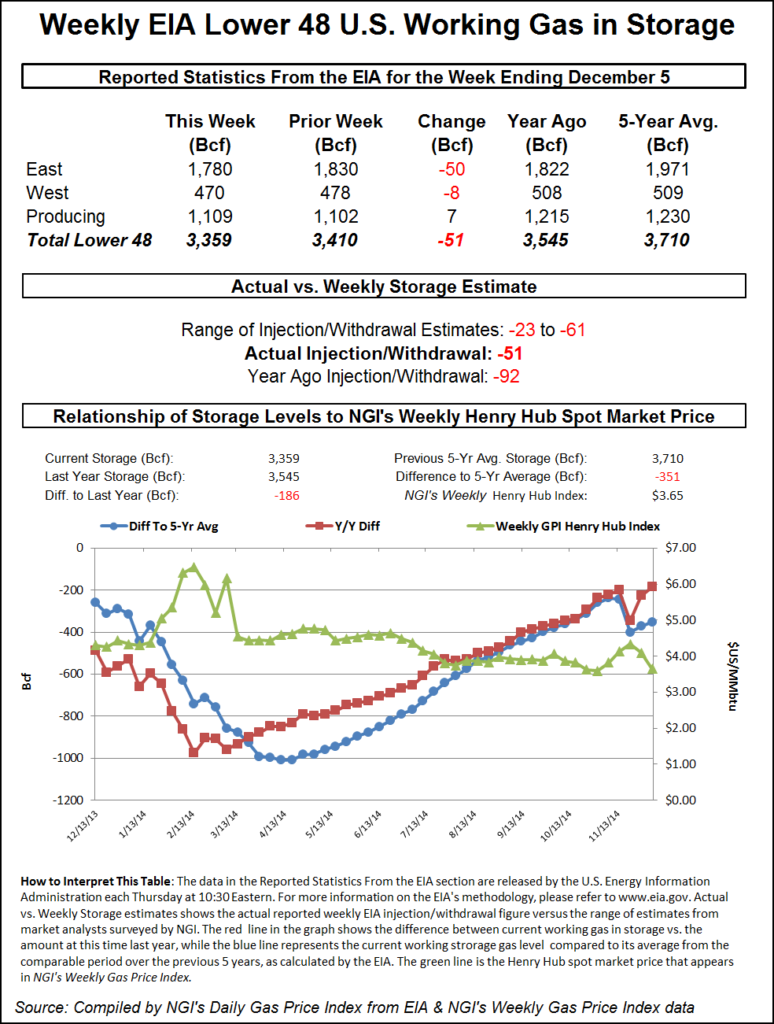

Utilizing its five-region format the EIA reported a 34 Bcf withdrawal in its 10:30 a.m. EST release. The pull on storage put inventories at 3,846 Bcf and January futures fell to a low of $1.782, but by 10:45 a.m. January was trading at $1.789, down one-tenth of a cent from Wednesday’s settlement.

Prior to the release of the data, analysts’ estimates were in the 40 Bcf withdrawal area. Stephen Smith Energy was looking for a pull of 39 Bcf, and a Reuters poll of 21 traders and analysts showed a range from -28 Bcf to -67 Bcf, with an average -40 Bcf. ICAP Energy calculated a 44 Bcf withdrawal.

“We were hearing numbers in the 38 Bcf range, so its not a crazy number off the mark,” said a New York floor trader. “I’m hearing this market could go to $1.50 on the downside, and you have to look at $1.75 and $1.50 support and $2.00 resistance.”

Tim Evans of Citi Futures Perspective called the report “clearly bearish” and said “combined with the ongoing forecasts for warmer-than-normal temperatures in the eastern U.S., we don’t see potential for more than a short-term technical bounce.”

Inventories now stand at 3,846 Bcf and are 541 Bcf greater than last year and 322 Bcf more than the five-year average. In the East Region 16 Bcf was pulled, and the Midwest Region saw inventories fall by 17 Bcf. Stocks in the Mountain Region and Pacific region were unchanged, and the South Central Region, similar to the former Producing Region, shed 1 Bcf.

Salt cavern storage was down 3 Bcf at 376 Bcf, while the non-salt cavern figure rose 3 Bcf to 946 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |