NGI All News Access | E&P | Markets

Futures Grind Higher Following Bullish EIA Storage Data Surprise

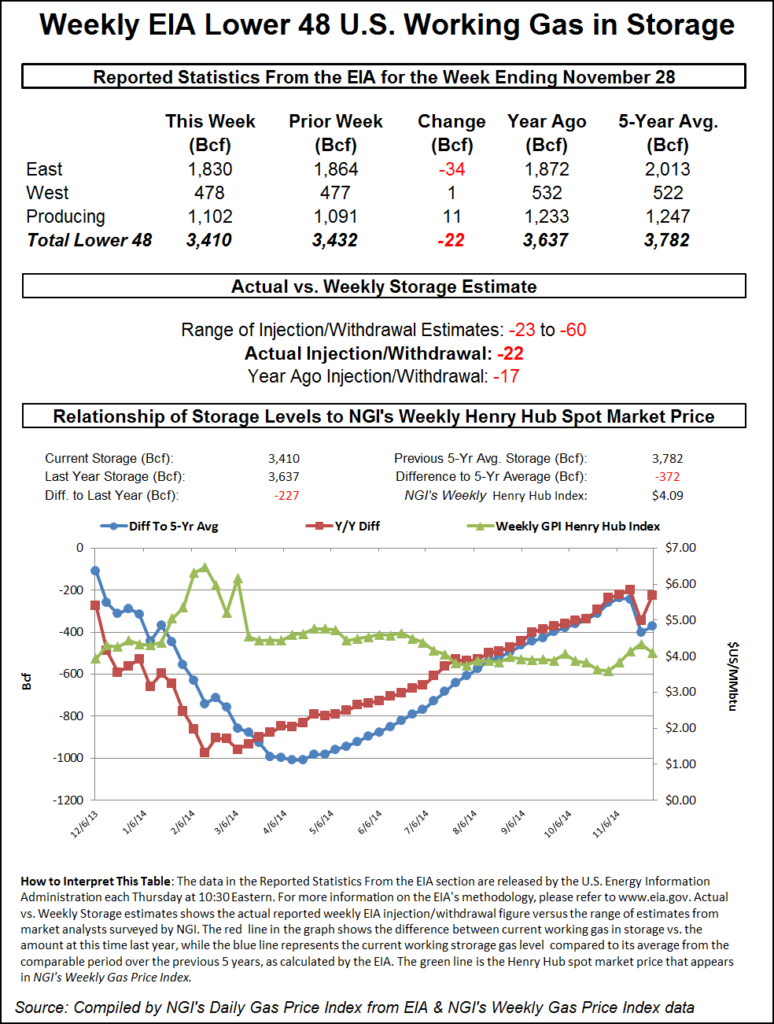

Natural gas futures scooted higher after the Energy Information Administration (EIA) reported a storage draw larger than what traders were expecting.

Utilizing its new five-region format, the EIA reported a 76 Bcf withdrawal in its 10:30 a.m. EST release for the week ending December 4. The pull on storage put inventories at 3,880 Bcf. January futures rose to a high of $2.099, but by 10:45 a.m. January was trading at $2.087, up 2.5 cents from Wednesday’s settlement.

Prior to the release of the data, analyst estimates were in the mid-60 Bcf withdrawal area. PIRA Energy was looking for a pull of 62 Bcf, and a Reuters poll of 26 traders and analysts showed a withdrawal range from 48 Bcf to 75 Bcf, with an average 64 Bcf pull. Industry consultant Genscape calculated a 69 Bcf withdrawal.

“We were looking for a 64 Bcf number, so 76 Bcf is significant,” said a New York floor trader. “I think this was a little bit of a surprise to most. I don’t think that was in the market.” He added that the number did seem a little strange given the mild weather and an average five-year withdrawal of 65 Bcf.

Analysts see missed supply-side assumptions. “The 76 Bcf in net withdrawals was a clear bullish miss versus expectations,” said Tim Evans of Citi Futures Perspective. “With the draw more than implied by the temperature data for last week we suspect a supply-side shift, either from U.S. producers pulling back on production or possibly a drop in imports from Canada in response to low prices.”

Using the new five-region format inventories now stand at 3,880 Bcf and are 514 Bcf greater than last year and 236 Bcf more than the five-year average. In the East Region 9 Bcf was pulled, and the Midwest Region saw inventories fall by 26 Bcf. Stocks in the Mountain Region were lower by 8 Bcf, and the Pacific Region was down 14 Bcf. The South Central Region, similar to the former Producing Region, shed 19 Bcf.

Salt cavern storage was down 1 Bcf at 379 Bcf, while the non-salt cavern figure declined 19 Bcf to 943 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |