Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

TGP Files at FERC For Northeast Energy Direct Certificate

Kinder Morgan Inc.’s (KMI) Tennessee Gas Pipeline Co. LLC (TGP) on Friday filed its FERC certificate application for the Northeast Energy Direct (NED) Project. TGP said it would bring New Englanders relief from natural gas and power price spikes, but many of them have told the Commission they don’t want it.

“The NED Project is a transformative project for the Northeast United States,” said KMI East Region Natural Gas Pipelines President Kimberly S. Watson. “Despite being just a few hundred miles from the most abundant and low-cost natural gas production area in the country, consumers in the Northeast pay some of the highest natural gas and electricity rates in the continental United States. These higher prices are due, in large part, to natural gas pipeline infrastructure that is insufficient to meet the winter heating demand of local distribution companies (LDC) and electric generators.”

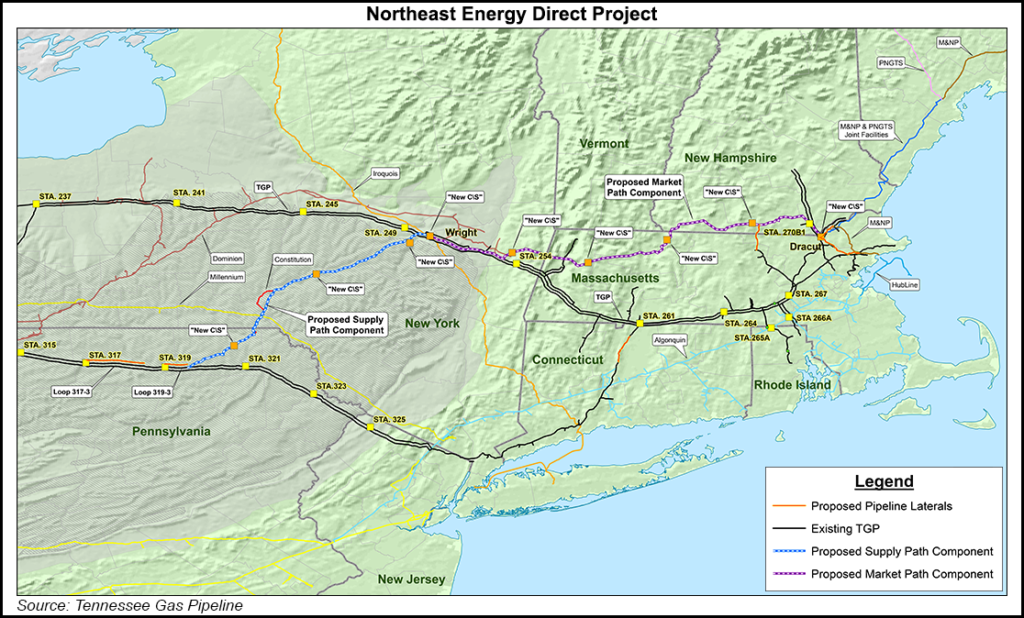

Costing $5 billion, NED would expand the TGP system in Pennsylvania, New York and New England, connecting Marcellus Shale gas from northern Pennsylvania to consumers in New York and New England. Last July, the KMI board gave the go-ahead for the project’s market path segment (see Daily GPI, July 16). The board has yet to approve the supply path portion of NED. The filing at the Federal Energy Commission Friday is for the entire project. It is made up of more than 240 files totaling more than 20,000 pages.

The project’s supply path component would have a maximum design capacity of 1.2 Bcf/d and consist of 133 miles of 30-inch diameter pipeline extending from TGP’s existing 300 Line system in northern Pennsylvania to an interconnection with TGP’s 200 Line system and Iroquois Gas Transmission System LP at Wright, NY; and 41 miles of 36-inch diameter looping pipeline along TGP’s 300 Line in Bradford and Susquehanna counties in Pennsylvania.

The market path component would have a maximum design capacity of 1.3 Bcf/d and consist of 188 miles of 30-inch diameter pipeline extending from Wright to Dracut, MA, five delivery laterals in Massachusetts and New Hampshire, and one pipeline loop in Connecticut. The market path facilities would be owned by Northeast Expansion LLC, which is a joint venture of Kinder Morgan Operating Limited Partnership A, Liberty Utilities (Pipeline & Transmission) Corp., and UIL Holdings Corp. TGP would construct the facilities on behalf of Northeast Expansion LLC.

TGP has executed precedent agreements with seven New England LDCs and other market participants for firm transportation service on the market path for 552,262 Dth/d (see Daily GPI, July 30, 2014). The Massachusetts Department of Public Utilities and New Hampshire Public Utilities Commission recently approved TGP’s agreements with the LDCs in these states.

For the supply path component, TGP has also executed precedent agreements with various market participants, including four New England LDCs that have subscribed on the market path, as well as two natural gas producers, one municipal light department and a power generator for a total of 751,650 Dth/d of firm capacity.

TGP said it is confident it will secure additional commitments as a result of the initiatives under way with five of the six states in New England to facilitate the ability of electric distribution companies to contract for pipeline capacity and recover the costs in their rates (see Daily GPI, Nov. 4;Oct. 5; Sept. 18).

“Adding the NED Project capacity to transport incremental natural gas supplies will ease natural gas capacity constraints and stands to provide significant benefits to energy consumers in the region in the form of lower natural gas and electricity prices in coming years,” Watson said. “In order to meet demand during the past two winters, New England’s electric generators have had to rely on high-priced natural gas, expensive imported LNG and costly fuel oil purchased on the spot market. In short, New England has insufficient natural gas pipeline capacity serving the region.”

Not everyone agrees. On Wednesday Massachusetts Attorney General (AG) Maura Healey said, NED, and a competing project called Access Northeast with a lower price tag of $3 billion, and backed by Spectra Energy Corp. (see Daily GPI, Feb. 19), are not needed (see Daily GPI, Nov. 18). During the prefiling process for NED, the comments from landowners, local officials and some politicians against the project have piled up at the Commission. Some of the commenters have called for New England to turn to more renewable energy instead of natural gas.

“I do believe that natural gas has a symbiotic relationship with renewables,” Watson told NGI during an interview in advance of TGP’s FERC filing. “Because even as you get the renewables to scale whether it’s solar or wind, the sun’s not always going to shine; the wind’s not always going to blow, and natural gas is a perfect component to help backstop and make that a reliable resource.

“We think additional natural gas capacity into the region helps encourage renewables to be developed. That said…the power generation market that we’re talking about is not some dreamed-up power generation. It’s existing generation that’s there today. So the region has done a very good job of converting their power generation from coal and fuel oil to be capable to run on natural gas. But over the past eight years as they’ve done that, there wasn’t capacity…to be able to get that supply physically to that plant.”

Not only is there enough demand for NED’s 1.3 Bcf/d of capacity, there is also room for Spectra’s smaller Access Northeast project, Watson said. But it is NED that will be able to move the needle on natural gas and power prices in the New England states, permanently bringing down prices for everyone in the region, Watson said.

“When you can crush the pricing, now you’ve got a situation where everybody on the existing TGP system, everybody on the new NED, everybody on [Spectra’s] Algonquin [Gas Transmission], everybody is going to get lower gas prices,” she said. “So your gas prices are going to get lowered. And because there’s additional capacity, it can now reach those power generation plants that have been running on alternative fuels; they can now run on inexpensive natural gas. And now your electricity prices get cheaper. So the prices get cheaper for gas and electricity for everybody.”

TGP asked FERC to issue the necessary approvals for the project during the fourth quarter of 2016 to allow for a construction start in January 2017 and in-service of Nov. 1, 2018. Some minor pipeline looping facilities in Connecticut are expected to be placed in service Nov. 1, 2019 based on the in-service date requested by project shippers.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |