NGI The Weekly Gas Market Report | E&P | NGI All News Access

Rigs Continue Decline; Texas Feels The Pain

It used to be that about half of the operating drilling rigs in the United States were doing their thing in the Lone Star state. Texas only accounts for about 44% of the total now, according to Baker Hughes Inc., and Texas energy payrolls are in steep decline, too.

According to the Railroad Commission of Texas (RRC), 822 original drilling permits were issued in October. That’s only 27% of the year-ago total of 3,046.

And completions are down, too, according to the RRC. In October, there were 1,138 oil, 196 gas and 53 injection well completions compared with 2,035 oil, 354 gas and 63 injection well completions in October 2014. Total Texas well completions year to date are 17,545, down from 25,604 during the same period of 2014.

Turning to the Baker Hughes rig count for Nov. 13, Texas only lost two rigs from the previous week to land at 338 units running.

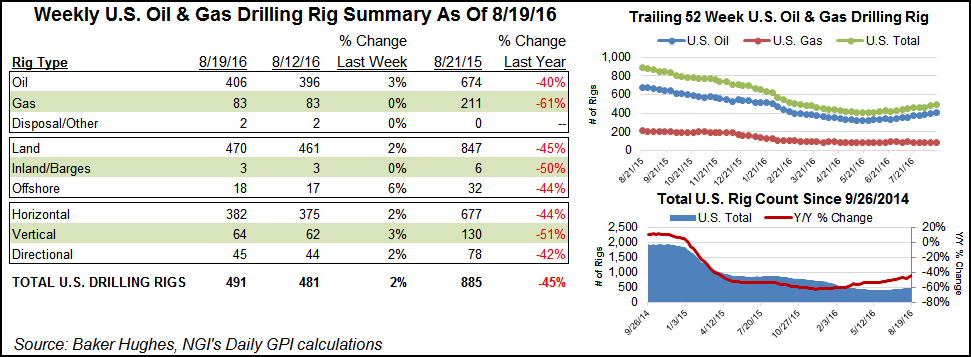

Overall, the latest rig count saw a decline of four rigs for the United States, nine for Canada and 13 for North America overall.

In the United States, three land rigs were lost while two gave it up in the inland waters and one rig was added in the offshore. Six natural gas rigs departed to be offset by two returning oil-directed rigs. Nine directional rigs were lost, but two horizontals and three verticals came back. The U.S count landed at 767, down from 1,928 one year ago.

In Canada, 11 oil rigs left and two natural gas-directed rigs returned.

The Permian Basin was the biggest mover among U.S. plays, losing three rigs. Across the remainder of plays and the states, changes from last week were no more than two units in either direction.

Every component of the Texas Petro Index (TPI) was down again in September — except for crude oil and natural gas production volumes. And the economist who compiles the TPI warned that industry job losses could be even greater than his previous estimates.

The TPI fell to 226.2 in September, nearly 28% below its October 2014 record of 313.0. But Karr Ingham, who compiles the index, said he’s concerned that upstream job losses might be higher than previously thought, based on data from the Texas Workforce Commission (TWC).

“We use two data sets from the TWC’s Current Employment Statistics (CES) series in calculating the TPI because it is monthly and timely and reflects the industry standard for reporting monthly employment data,” Ingham said. “The CES, when a seasonal adjustment is applied, indicates the upstream oil and gas industry lost about 30,000 jobs through September since peaking in December 2014 at 305,000.

“That’s certainly significant enough, but it appears to be inaccurate when compared to the TWC’s Quarterly Census of Employment and Wages (QCEW), which measures jobs at the county level and sums up by industry.”Evidence of steeper job cuts than indicated by the TPI can be found in the QCEW’s most recent estimate of upstream oil and gas employment, which totaled 258,200 as of the end of the second quarter 2015, Ingham said. That was about 47,800 fewer jobs than the 306,000 jobs indicated by the QCEW at the end of fourth quarter 2014, which was “amazingly close to the 305,000 jobs estimated by the TPI in December,” Ingham said.

“The loss of nearly 48,000 jobs in just six months is staggering, and again, that only represents industry employment loss through the second quarter of this year.” Although the TWC has not yet reported QCEW data through the third quarter, Ingham said, “It is certain that job losses have continued.” Extrapolating from the QCEW estimate at the end of second quarter, Ingham said he “conservatively estimates” upstream oil and gas job losses at 56,000.

“When the upstream oil and gas economy in Texas entered into the current contraction, we estimated jobs lost over the length of the downturn could total 40,000-50,000 jobs,” Ingham said. “We now appear to be well beyond that estimate, and the end is not in sight.”Ultimately, the TPI will be revised downward when CES employment data are corrected early next year. So the contraction is actually worse than the Texas Petro Index presently indicates as well.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |