NGI Data | Markets | NGI All News Access

Record NatGas Storage? No Problem; December Up 9 Cents Post EIA Report

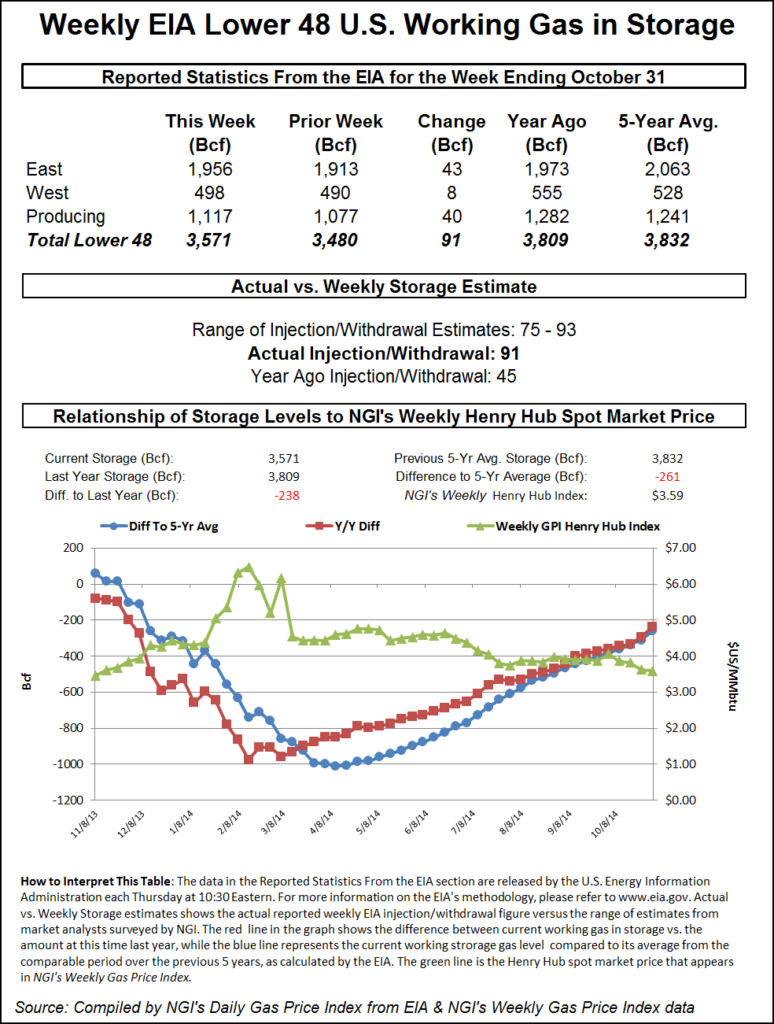

Natural gas futures advanced after the Energy Information Administration (EIA) reported a storage build that was somewhat less than what the market had expected.

EIA reported a 49 Bcf injection in its 10:30 a.m. EST release, and the addition put inventories in new record territory, surpassing the record high of 3,929 Bcf established in October 2012 and also equaled in last week’s report. December futures rose to a high of $2.357, and by 10:45 a.m. December was trading at $2.354, up 9.4 cents from Thursday’s settlement.

Prior to the release of the data, analyst estimates were scattered all over the lot. Industry consultant Genscape was looking for an increase of 44 Bcf, and a Reuters poll of 24 traders and analysts showed an average 51 Bcf with a range of 41-78 Bcf. Ritterbusch and Associates was banking on a 57 Bcf build.

“We’re trading near the highs of the day well after the number came out,” a New York floor trader told NGI. ” I guess people weren’t sure what they wanted to do. Nothing has really changed all that much. We’re still looking at $2.25 support and $2.50 resistance.”

Inventories now stand at 3,978 Bcf and are 373 Bcf greater than last year and 173 Bcf more than the five-year average. In the East Region 31 Bcf was injected, and the West Region saw inventories increase by 3 Bcf. Stocks in the Producing Region rose by 15 Bcf.

The Producing Region salt cavern storage figure was up 2 Bcf at 373 Bcf, while the non-salt cavern figure increased 13 Bcf to 1010 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |