Markets | NGI All News Access | NGI Data

Double-Digit Gulf Gains Pace NatGas Cash Advance; Futures Float Higher

Lower next-day gas prices at eastern locations were not enough to offset broader gains at other market points in Wednesday’s trading. Eastern locations proved to be the weakest, but the overall market gained ground.

The NGI National Spot Gas Average added 4 cents to $2.27, in spite of overall losses in the East of about a penny. Power prices gained, but not enough to prompt incremental purchases in the East as near-term weather forecasts called for temperatures right at seasonal norms. Futures trading was limited to about a 7-cent range, and at the close November was up by just 0.4 cent to $2.474, while December rose an equally unimpressive 0.3 cent to $2.676. November crude oil skidded 72 cents to $47.81/bbl.

Marcellus points softened as weather forecasts from the Mid-Atlantic to the Ohio Valley to the Great Lakes offered little in the way of increased heating or cooling load. Wunderground.com forecast that the high Wednesday in New York City of 72 would slide to 69 Thursday before rebounding to 78 on Friday. The seasonal norm in New York is 67. Pittsburgh’s high of 70 was seen advancing to 74 Thursday before easing to 67 on Friday. The early October maximum in Pittsburgh is 69.

Marcellus points failed to make it above $1.00. Gas for next-day delivery on Millennium fell 1 cent to 92 cents, and gas on the Transco Leidy Line skidded 9 cents to 84 cents. Parcels on Tennessee Zn 4 Marcellus shed 7 cents to 78 cents, and gas on Dominion South was seen 3 cents lower at 98 cents.

Gas on Texas Eastern M-3, Delivery fell 3 cents to $1.05, but gas bound for New York City of Transco Zone 6 managed to trade in the plus column gaining a nickel to $2.45.

Next-day power prices in the region rose, but not enough to warrant paying up for any incremental gas. Intercontinental Exchange reported that Thursday on-peak power at the ISO New England’s Massachusetts Hub rose $1.19 to $36.96/MWh, and power at the PJM West Hub gained $1.61 to $35.66/MWh.

Next-day prices in the Gulf posted double-digit gains as an outage on Transcontinental Gas Pipe Line (Transco) prompted rerouting and shutting in gas offshore Louisiana.

According to a Federal Energy Regulatory Commission filing, Manta Ray Offshore Gathering said an emergency action was begun Tuesday to use its gathering system offshore Louisiana temporarily as an intermediate link to restore flow of deepwater gas produced in association with oil by Chevron U.S.A., BHP Billiton, and ExxonMobil Gas & Power Marketing during an outage on Transco.

The Transco outage near Compressor Station 62 in Terrebonne Parish, LA required shutting in all receipt locations upstream of Station 62 to perform maintenance on its onshore slug catcher. The line was shut down Monday (Oct. 4) and is expected to return to service next Monday (Oct. 12). In the meantime, Transco’s existing 24-inch pipeline from ST300 to Manta Ray’s platform at Ship Shoal Block 332 is reversing flow to deliver into Manta Ray facilities, which in turn would transport to Nautilus Pipeline and TC Offshore for delivery onshore.

Manta Ray estimated that during the outage about 5,000-5,550 MMBtu/day would be transported for an estimated total of 30,000-38,500 MMBtu. The transportation is being performed on an interruptible basis for a charge of 12 cents/MMBtu.

Gas on ANR SE jumped 13 cents to $2.42, and deliveries to the Henry Hub added 11 cents to $2.46. Gas on Tennessee 500 L rose 11 cents to $2.42, and gas at Katy gained 8 cents to $2.44.

Weather, or a lack thereof, continues to steer natural gas prices within a narrow trading range, and forecasters are struggling with their weather models to determine if a series of systems expected across the northern United States will tap into cold Canadian air. Apparently, their model solutions offer a wide range of interpretations making forecasts difficult.

“There will be a cool blast into the Midwest and Northeast Friday, dropping highs back into the 50s to lower 60s, but we’ll still need to wait until later next week for stronger cold blasts to arrive, at least ones with greater potential in tapping more impressive Canadian air,” said Natgasweather.com in a Wednesday morning report.

“We do need to consider [whether] it’s possible the markets again get frustrated waiting on cold blasts if the weather data doesn’t offer convincing evidence of more impressive winter-like temperatures over the U.S. soon. The latest weather data again shows a series of weather systems, but still with mixed results in how much cold air will push across the border.

“Unfortunately, we will need to be patient a little while longer to find out just how much colder air is going to spill into the U.S. late next week and beyond, but we continue to see opportunity for it.”

Market technicians looking at Elliott Wave and retracement data see a “heavy” market, implying further price weakness.

“For the past few weeks my two nearby candidates for support have been $2.385 and the $1.880 area,” said United ICAP Vice President Walter Zimmermann in a weekly analysis. “Friday’s tiny bounce from a $2.403 low looked more like end-of-week profit-taking by nervous new shorts than the start of a larger advance. To have any case from here the first thing bulls need to do is break above $2.600.

“Last week gave a surgically precise breakdown through the triangle support line [from mid-May]. And there is nothing the least bit bullish about last week’s candlestick. Expecting further weakness. It certainly looks like this market is capable of retesting the $1.902 low from April 2012.”

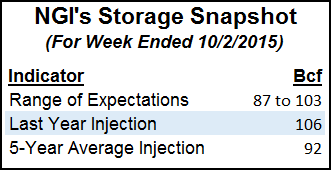

Thursday’s Energy Information Administration storage inventory report will likely prompt prices to move to one side or the other of a broadly downward trending price channel. Last year 106 Bcf was injected and the five-year pace stands at 92 Bcf. IAF Advisors calculated an increase of 99 Bcf, and ICAP Energy is looking for an injection of 97 Bcf. A Reuters poll of 26 traders and analysts revealed a sample mean of 98 Bcf with a range of 87 Bcf to 103 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |