NGI Data | NGI All News Access

Weekly NatGas Quotes Continue Broad Retreat; All Active Points Lower

Amongst market bulls there wasn’t a dry eye in the house as weekly trading drew to a close Oct. 2. With the exception of a couple of New York market points, all actively traded locations followed by NGI endured double-digit losses. The NGI Weekly Spot Gas Average fell 21 cents to $2.20.

The market point with the least decline proved to be Transco Zone 6 non New York North serving southeasternmost Pennsylvania and southern New Jersey, with a drop of just 2 cents to $2.09. Greatest setbacks were seen at the Algonquin Citygate and Tennessee Zone 4 200 L, which both lost 48 cents to $1.82 and $1.31, respectively.

California and the Rocky Mountains suffered the week’s greatest regional losses of 25 cents to $2.54 and $2.24, respectively, and the Northeast was right behind dropping 24 cents to $1.58.

The Midwest retreated 23 cents to $2.49 and the Midcontinent shed 21 cents to $2.30.

South Texas and South Louisiana both declined 17 cents to $2.33 and $2.34, respectively, and East Texas proved to be the most resilient region giving up 16 cents to $2.35.

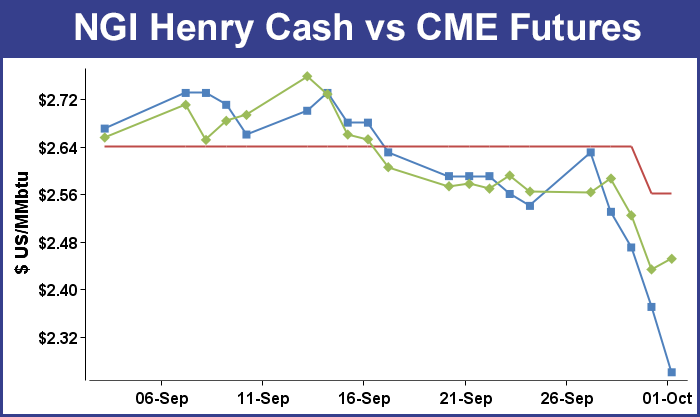

October futures expired Monday at $2.563, down 7.5 cents from the September contract settlement.

For the week November futures fell 18.1 cents to $2.451, and a healthy chunk of that 18.1-cent decline was realized Thursday following the release of storage figures by the Energy Information Administration (EIA). It reported an increase of 98 Bcf, putting record storage clearly in the crosshairs. Futures at first didn’t react much to the stout storage build, but by the end of the day November had fallen 9.1 cents to $2.433 and December was off 7.0 cents to $2.631.

With five weeks remaining in the traditional injection season futures traders were closely following the EIA report. Figures show that 92.4 Bcf would have to be injected weekly to reach a record 4 Tcf, but if November should turn out to feature net injections as well, the figure could go even higher. The week’s storage report was right on track, if not more so, to hurdle 4 Tcf. Last year, 110 Bcf was injected, and the five-year pace stands at 94 Bcf. The week prior 106 Bcf was injected and caught almost all analysts off guard about 10 Bcf shy of the mark.

For the week, the estimates were coming in right around the century mark. Stephen Smith Energy calculated a 98 Bcf build, and Bentek Energy was also looking for 98 Bcf utilizing both its flow model and supply-demand models. A Reuters survey of 21 industry traders and analysts showed an average 100 Bcf with a range of 94 to 110 Bcf.

John Sodergreen, editor of Energy Metro Desk, saw a 100-Bcf build as well but hinted this week that the actual figure might come in on the low side.

Once the number was released November futures dropped to a low of $2.482 and traded as high as $2.502, and by 10:45 EDT November was trading at $2.497, down 2.7 cents from Wednesday’s settlement.

“The number didn’t impact the market at all, but we may actually be seeing a day where we settle under $2.50,” a New York floor trader told NGI.

“I figure it would have to settle under $2.50 for a few days for it to sink in that maybe you might see some lower numbers.”

Inventories now stand at 3,538 Bcf and are 454 Bcf greater than last year and 152 Bcf more than the 5-year average. In the East Region 62 Bcf were injected and the West Region saw inventories increase by 6 Bcf. Stocks in the Producing Region rose by 30 Bcf.

In Friday’s trading weekend and Monday gas plunged as almost nonexistent incremental demand prompted little interest in making three-day deals.

Wet, soggy weather up and down the Eastern Seaboard limited buying interest, and average eastern prices fell by close to 40 cents. Several Marcellus points approached 2015 lows. The NGI National Spot Gas Average was off 18 cents to $2.06, and all but 2 points followed by NGI were deep in the red by double digits.

Futures trading was not as active, and prices were held to a modest 6-cent range. At the close, November had added 1.8 cents to $2.451 and December was up 3.3 cents to $2.664. November crude oil gained 80 cents to $45.54/bbl.

Weekend temperatures about 15 degrees below normal were enough to limit demand throughout the East. Forecaster Wunderground.com predicted that a rain-soaked Boston’s high Friday of 54 would fall to 52 by Saturday before clearing and reaching 62 on Monday. The normal high in Boston is 66. New York City’s 58 high Friday was seen dropping to 55 Saturday before making it to 69 on Monday, right at the seasonal norm. Philadelphia’s high Friday of 54 was expected to climb to 56 Saturday and 68 by Monday, also the normal high.

With little in the way of incremental demand prices at eastern points gravitated to the lowest cost gas in the area, namely the Marcellus and Utica. Weekend and Monday gas at the Algonquin Citygate shed 58 cents to $1.47, and deliveries to Iroquois Waddington tumbled 32 cents to $2.26. Gas on Tennessee Zone 6 200 L was quoted 71 cents lower at $1.31.

The Marcellus and Utica are not the sole determinant of eastern gas prices as “all the gas out of the Marcellus that can hit Transco [for example] does, but some of it goes elsewhere. Some gas goes west as well,” said a pipeline industry veteran. “Not all that Marcellus gas hits the New York area; some of it tends to go south as well.”

Marcellus points flirted with 2015 lows. Gas on Tennessee Zone 4 Marcellus came in at 70 cents, up a penny but just 10 cents off the 2015 lows, and gas on Transco Leidy changed hands at 79 cents, a mere 12 cents off 2015 lows, and up 13 cents on the day.

Deliveries to Millennium fell 14 cents to 83 cents, and gas on Dominion South was quoted at 85 cents, down 35 cents.

Mid-Atlantic gas took some big hits as well. Gas on Tetco M-3 Delivery fell 36 cents to 96 cents, and gas bound for New York City on Transco Zone 6 shed 57 cents to $1.56.

At the crux of the low demand and low prices is a weather system that just won’t quit. “Despite a forecast that shows Hurricane Joaquin increasingly likely to miss the Atlantic Coast of the U.S., several East Coast states are bracing for potentially unprecedented rainfall and life-threatening flooding as a complex weather pattern promises to deliver tropical downpours to an already soggy region,” said Chris Dolce, Wunderground.com meteorologist.

“Significant impacts are likely in portions of the East, regardless of how close Hurricane Joaquin tracks to the United States, due to the large-scale weather pattern taking shape. This will include flash flooding, river flooding, gusty winds, high surf, beach erosion and coastal flooding.”

Futures traders are not looking for a cataclysmic fall in prices. “You can be sure we are not going to see a $1 handle because we’ve got winter coming up,” a New York floor trader said. “Ultimately I think we’ll get above $2.50. I think we could see prices stay here for at least a couple of weeks; you might even see $2.30. I would ultimately be buying call options for January or February.”

According to one analyst, if natural gas prices are going to advance, it will require significant coal-to-gas switching and a hefty blast of cold air. “While this week’s selling has largely emanated from a shift back toward milder temperature trends that have now been extended out to about mid-month, a lack of meaningful production response to low prices also continues to weigh on the front of the curve. The reduced output that we had expected to spin off of the recent reduction in declining oil rigs has not been as pronounced as anticipated,” said Jim Ritterbusch of Ritterbusch and Associates in Friday morning comments to clients.

“[G]iven limited elevation in HDDs or CDDs at this early stage of the shoulder period, it would appear that additional above-normal storage injections lie ahead. With the supply surplus expected to stretch further, an end-of-season stock of 4 Tcf that will likely be established in about five weeks will be restricting buying interest even into the winter contracts that were supported by weather uncertainties until this week.”

Buyers for power generation across the PJM footprint are likely to have ample renewable generation to offset purchases over the weekend. WSI Corp in its Friday morning report said, “A complex and potent storm system will lead to cloudy skies, periods of rain, windy and cool conditions across the Mid Atlantic and the majority of the power pool today into the weekend. Temps will only range in the 50s to mid 60s. It now appears that Hurricane Joaquin will spin out to sea, and the ongoing storm system will depart early next week.

“As a result, it will be partly sunny and seasonable with highs in the mid 60s to low 70s. A north-northeast flow between high pressure over Ontario and the complex frontal system along the East Coast will support elevated wind generation through the weekend. Output is expected to range 3-5 GW at times. Wind gen will subside early next week.”

The National Hurricane Center (NHC) reported that at 5 p.m. EDT Friday Hurricane Joaquin was holding winds of 125 mph. It was about 825 miles southwest of Bermuda and was moving to the north at 7 mph. NHC projections showed Joaquin turning to the north and northeast and heading away from a U.S. landfall.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |