Eagle Ford Shale | E&P | NGI All News Access | Permian Basin

Rig Rout: U.S. Drops 29, Led by Oklahoma, Texas

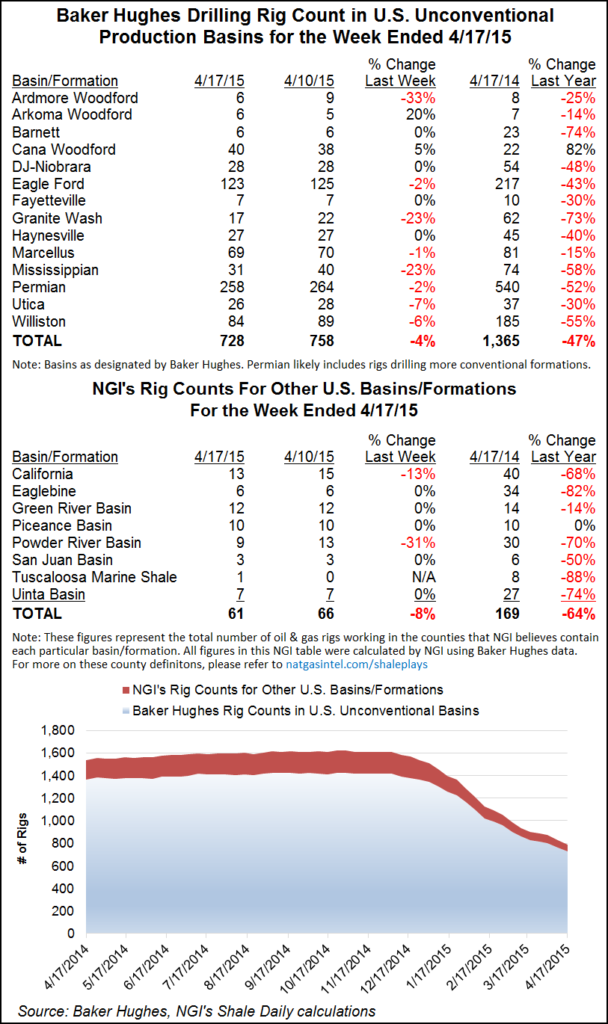

The count of active U.S. drilling rigs plummeted by 29 units, almost 3.5%, to rest at 809 in the latest count by Baker Hughes Inc. for the week ending Oct. 2. Canada added a net of three rigs to bring the North American rig decline to minus 26, about 2.56% down from the prior week.

In the United States by category, oil rigs were down by 26 while natural gas-directed activity saw a contraction of two rigs. The remaining rig lost came from the disposal/other category. Twenty horizontal rigs were lost during the week and six vertical units were stacked. Twenty-four rigs were lost from land drilling while a total of five departed from the inland waters and offshore categories.

There were 614 U.S. rigs targeting oil and 195 targeting gas in the latest count, representing declines from year-ago levels of 61% and 41%, respectively. The count has been dropping in recent weeks, but the latest Baker Hughes report marks an acceleration of the decline (see Shale Daily,Sept. 25).

Oklahoma lost the most rigs (eight), followed by Texas (six), with Louisiana and New Mexico each giving up four.

The Permian Basin saw the biggest rig contraction among the plays, losing five rigs. The Denver Julesburg-Niobrara, Cana Woodford, and Eagle Ford Shale each lost three rigs.

Crude oil production in Texas has continued to post numbers that are higher compared to year-ago levels. Texas crude production in August was an estimated 12.3% higher than in August 2014 and it remains on schedule to break the annual production record set more than 40 years ago, according to industry economist Karr Ingham, who maintains the Texas Petro Index (TPI), a barometer of industry activity and health.

The TPI reflected the ongoing contraction of the upstream oil and gas economy in Texas, falling by 10.7 points from 246.1 in July to 235.4 in August, which was 24.3% less than in August 2014 and about 25% less than the peak index value of 313.0 achieved in October 2014.

Ingham said even though the rate of production growth is slowing with each passing month, analysts have continued revising estimates of monthly oil production upward, both in Texas and across the United States.

“The Energy Information Administration has revised its production-estimation methodology and now says Texas production likely peaked in April,” Ingham said. “That may be right, but either way Texas production is still significantly higher this year compared to last, and that’s not likely going to change by year-end.”

In Canada, four oil rigs were added while one gas rig was lost. Saskatchewan was the big gainer, picking up five units to end at 29 rigs running. British Columbia and Manitoba each lost one rig.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |