NGI Archives | NGI All News Access

Shoulder Season Hits NatGas Forwards Markets; AGT Nosedives

A storage report that was generally in line with market expectations and a lack of demand sent natural gas forwards markets tumbling between 15 and 20 cents across most of the U.S. during the week.

Not to be outdone, though, the volatile New England market saw the November fixed price contract plunge more than 40 cents and the balance of winter (December-March) drop more than 50 cents, according to NGI’s Forward Look.

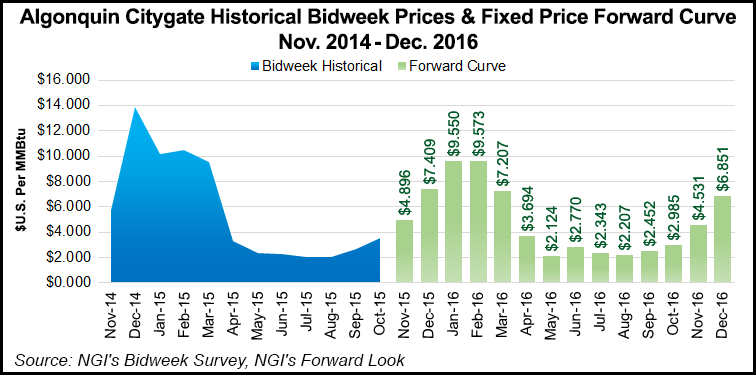

The Algonquin Gas Transmission citygates November fixed price contract sat Oct. 1 at $4.90, a decline of 44 cents from Sept. 25 and $1.31 below the average price in November 2014, NGI Forward Look data shows.

Other U.S. markets followed in line with the Nymex, which saw the prompt month shed about 20 cents.

“Until the other day, traders were still concentrating on October, meaning there was still a chance things that could happen to impact winter,” said Patrick Rau, NGI director of strategy and research. “But now, the market is much more squarely focused on November, and the reality is probably setting in that fundamentals aren’t looking too good. Production is still strong, and storage seems to be in good shape heading into the winter.”

A Northeast trader echoed that sentiment, saying the lack of significant heating demand means the market could be facing a few more weeks of triple-digit storage injections.

“We’re still waiting for that big winter premium,” the trader said. “El Nino has gotten so much press, and it’s staying the course. Production is still strong, and there is no weather in the near term.”

The U.S. Energy Information Administration reported a 98 Bcf build to storage inventories for the week ending Sept. 25, putting stocks 454 Bcf above year-ago levels and 152 Bcf above the five-year average.

In the East, stocks grew to some 5.9% over year-ago levels and lagged the five-year average by a mere 1.4%.

Meanwhile, weather forecasts show temperatures remaining several degrees above normal for this time of year as truly cold Canadian air has yet to reach key market areas in the northern part of the country.

“There will still be some demand for heating over the northern U.S. with lows dropping into the 40s, but with the lack of subfreezing temperatures, it will be light overall,” forecasters with NatGasWeather said. “We expect some glancing blows from more impressive cold blasts over the upper Midwest late next week and beyond, although, they would need to trend a bit further south to intimidate the markets.”

Although near-term outlooks aren’t very supportive for demand, the agency said weather data indicates it won’t be too much longer before considerably stronger cold blasts arrive.

And that is exactly what could breathe some life back into natural gas markets.

“If December gets off to a good start in terms of heating demand, that could give rest-of-winter prices a chance to rebound,” Rau said. “But if December is weak, prices for the first half of 2016 could really suffer, considering peak demand tends to hit around the middle of January.”

The balance of winter (December-March) at Algonquin sat Sept. 25 at about $8.44, down 54 cents on the week and down $1.71 from the average price for the December-March period, according to NGI’s Forward Look.

Other markets were down about 15 cents on average for the balance of winter.

Prices do have a couple more lifelines before the calendar flips to 2016, Rau said.

“One is that bank revolving credit line re-determinations are this October. They will be down, but if they are down significantly, that will impact drilling budgets for 2016,” Rau said.

Meanwhile, many exploration and production companies will announce their capex budgets for next year in December, and that will provide major clues into planned natural gas production for 2016, he added.

Even as prices are currently averaging well more than $1 below year-ago levels, there could be continued weakness in the short term, Rau said.

“Hedges for 2015 don’t run out for another three months, and many producers are desperate for cash flow, to fund operations and to service debt,” Rau said. “That will likely keep the spigots on for a few more months, everything else being equal.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |