‘Wall’ of LNG Targeting Asia as Prospects Weaken

Cheap and “trapped” liquefied natural gas (LNG) is becoming a significant threat to oil demand growth, which “could derail the substitution story” in overseas markets, according to a Citigroup analyst.

Seth Kleinman, global head of energy strategy for the investment firm, was a keynote speaker Wednesday at the Genscape Oil & Natural Gas Symposium in Houston. He blamed the shale gas and oil boom, which has led to lower prices worldwide, for a somewhat pessimistic view about the potential for exports.

“Asian gas is linked to oil, and if you take down the oil price, you take down the gas price,” he told the audience. “When you look at global LNG prices, we are moving into significant oversupply, which means prices are heading lower from here…effectively trapping a lot of gas.”

Projects “simply aren’t going to happen in a sub-$7/Mcf world, and we’re probably heading close to $5-7” for Asian gas. “Projects in Russia are waking up to this. What do you do with the gas? It’s still going to be there, but LNG is not going to be there. A lot of LNG is targeting the last short in town.”

Australian LNG is targeting Asia. U.S. LNG is targeting European destinations, Latin American ports, “but ultimately it’s going to Asia. What that means is not just oil is trying to jam into the Asian market, but a wall of LNG is heading into Asia…Anyway you slice and dice it, way too many hydrocarbons are trying to jam their way into the Asian market…”

Even though gas remains the “cleanest” of the fossil fuels, it faces mounting pressure from renewables, whose costs have fallen enough to become a bigger part of the global energy picture. Oil, gas and renewables all are targeting Asia, Kleinman said.

“When we talk about market share, it’s Asian market share. Thanks to shale, Asia is really the only energy short left. It’s clear here, that under the Saudi Arabia strategy, if they let prices go up, if they take prices up to $60-70 and shale starts trucking, then they will put all their chips on Asia. And Asia is all on renewables…What that means is that it is only a matter of time when the only short in town starts to get less short…With the growth in power renewables, we start ending that curve of Asian short. If the Saudis keep prices low enough, the meager market stays in play.”

Renewables prices are coming down and “not losing steam on the oil price…Crucially, Asia is concerned about energy security…Yes, they want widely diversified suppliers but energy security really is solar in the backyard and on the roof.”

In the United States, renewables only compete with natural gas, said Kleinman. But in the Asian markets, it’s not about substitution. “When we talk about black swan events, the shift to electric cars is clearly happening…When you see what is happening with renewables, the timing of structural trends is very different. You can identify structural trends, but not the Tesla in Hong Kong…If you drive one, you are telling everyone you have a very big house…The trend is very clear,” with China mandating increasing growth in natural gas and electric vehicle use.

“Renewables then are pushing gas out of the power stack,” said Kleinman. The hurt is on for all global oil and gas producers, and “everyone is chasing market share.” And a lot of exploration and production (E&P) companies are taking a beating.

Smaller producers generally have the weaker financials, as Citi has found. Its analysis of 135 public E&Ps indicated that about half of them, mostly small-caps, are outspending cash flow. Cash flow generation also tends to be weaker among the group because the cash-strapped operators typically produce under 100,000 boe/d in hydrocarbon production.

The capital expenditure (capex) cuts also have yet to have “any clear effect,” Kleinman said. Most of the E&Ps have trimmed first in their least productive fields, while efficiencies have led to more resource recovery at a lower cost in the core operations.

The only clear indication of capex cuts has been on the number of projects that are not being sanctioned, he said. Close to $1 billion of projects have been deferred in the Gulf of Mexico, while about $5.6 billion are deferred in Canada.

Kleinman doesn’t think, as some believe, that Saudi Arabia was attempting to “break shale” by not backing down on oil production as prices fell last year.

“Frankly, that doesn’t make any sense,” he said. When there are positive signals, “shale will only come back stronger…If the Saudis really wanted to be aggressive, they wouldn’t worry about pricing in any particular month but they would come to Citibank and hedge 1-2 million bbl of oil and then go on CNBC or write editorials that they are doing this. Then they can break some in the industry. That’s how to do it properly.”

Unconventional oil and gas has disrupted the global markets to the point that the United States no longer needs an “all of the above” energy strategy, he said.

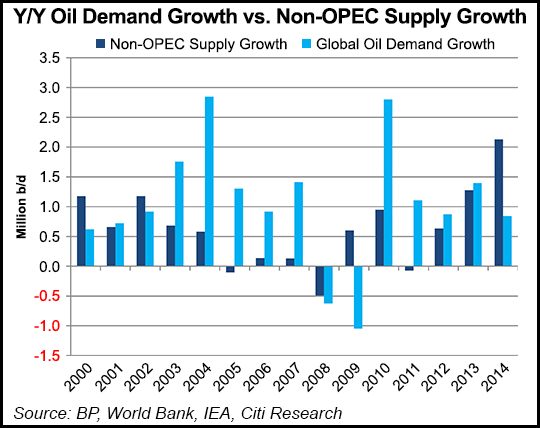

“Shale broke the back of the demand-growth-led supercycle,” he told the audience. “It puts a question mark behind projects at the high end of the cost curve. The arrival of shale means we no longer need ‘all of the above.’ The world no longer needs every high-end Canadian oilsands and ultra deepwater project.”

Unconventionals still are too small of a market today to replace the global conventional oil and gas industry. But unconventional oil still is seen growing, even in a low-priced world. And every move that’s made in the shale oil world, up or down, has a big impact on the U.S. gas markets because associated gas has been the biggest area of gas supply growth.

Shale gas and then oil flipped the bullish dynamic of the 2000s, Kleinman told the audience. The previous decade had been defined by robust demand growth and a constant struggle for supply. Now the trading dynamic has flipped as well. Trading has gone from “a buy the dip to a sell the rally mode” for hedge funds and commercial activities. Asia has become “the only energy short left.”

Demand has responded to low prices, “but only in isolated regions and mainly for gasoline,” he said. “Alone, this is not enough to tighten global oil markets. Outside of the U.S., India and China, oil demand growth has been more muted, while oil exporter countries could see further demand headwinds.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |