Markets | NGI All News Access | NGI Data

Near-100 Bcf NatGas Storage Build On Target With Expectations

Natural gas futures moved little following the release of government inventory figures showing an increase in working gas storage right at what the market was expecting.

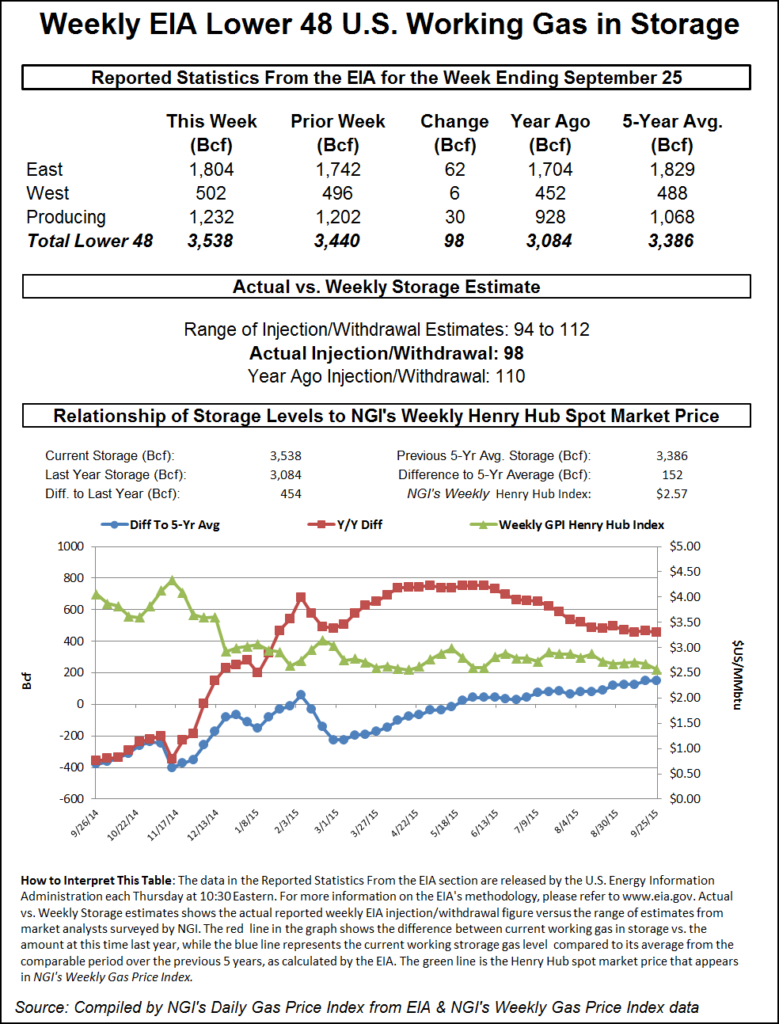

For the week ended Sept. 25, the Energy Information Administration (EIA) reported a 98 Bcf injection in its 10:30 a.m. EDT release. November futures dropped to a low of $2.482 and traded as high as $2.502 after the number was released, and by 10:45 a.m., November was trading at $2.497, down 2.7 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase in the upper-90 Bcf area. Bentek Energy estimated 98 Bcf, utilizing both its flow model and supply-demand model, and Stephen Smith Energy was also figuring on a 98 Bcf build. A Reuters poll of 21 traders and analysts showed an average of 100 Bcf with a range of 94 to 110 Bcf.

“The number didn’t impact the market at all, but we may actually be seeing a day where we settle under $2.50,” a New York floor trader told NGI. “I figure it would have to settle under $2.50 for a few days for it to sink in that maybe you might see some lower numbers.”

Inventories now stand at 3,538 Bcf and are 454 Bcf greater than last year and 152 Bcf more than the five-year average. In the East Region 62 Bcf was injected, and the West Region saw inventories increase by 6 Bcf. Stocks in the Producing Region rose by 30 Bcf.

The Producing Region salt cavern storage figure was up 9 Bcf at 321 Bcf, while the non-salt cavern figure increased 21 Bcf to 911 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |