Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Alaska Governor Wants to Tax Unproduced North Slope NatGas

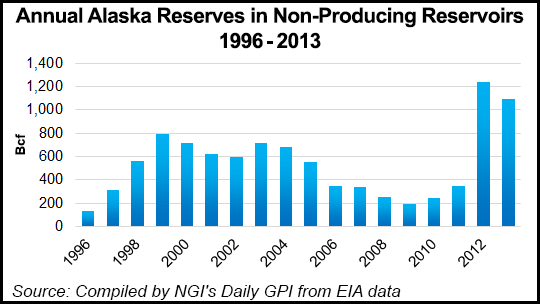

Alaska Gov. Bill Walker plans to introduce legislation that would include a tax on North Slope natural gas reserves that lie fallow. It is intended to spur producers to commercialize the reserves, but the move has antagonized Republican state lawmakers.

Walker said his forthcoming bill — focused on the Alaska LNG project — would reinstate a reserves tax on North Slope resources in the ground that are not developed. In 1975, Gov. Bill Egan signed a similar piece of legislation allowing the state to collect oil revenue prior to the Trans-Alaska Pipeline being built.

“For far too long, Alaska’s gas has been treated like milk with no expiration date, and it never gets to the front of the cooler,” Walker said. “Without this insurance policy, Alaska runs the significant risk of never monetizing our gas resources for the benefit of all Alaskans and future generations.”

The governor had been expected to call a special session for October, which he has done, but that had been expected to mainly address the governor’s desire to buy TransCanada Corp.’s share of the project to pipe and liquefy for export the North Slope reserves (see Daily GPI, Sept. 23). The special session is to begin Oct. 24. In the meantime, a sense of urgency has grown around the Alaska LNG project as the state’s oil-based fortunes wane.

“With a $3.5 billion budget deficit, this gasline project has gone from a wish-list item to a must-have,” Walker said. “Under the negotiation process I inherited, very little has been accomplished on the commercial agreements. It is time to make the necessary legislative changes so a single party cannot delay the production of Alaska’s natural gas resources and sway our destiny.”

Leadership of the Alaska House Majority Caucus responded to what it said was the governor’s “resurrection of a failed plan” to tax Alaska gas reserves. “We are shocked, frankly,” said Alaska Speaker of the House Mike Chenault (R-Nikiski). “This reserves tax proposal wasn’t mentioned by the governor, at all, during our meeting to discuss special session options this past Monday. Why now?”

Issues still to be worked out between the state and the North Slope producers (BP plc, ConocoPhillips and ExxonMobil Corp.) include an agreement for fiscal certainty that ensures producers that taxes on natural gas produced would not be raised in coming years. The state wants a provision in agreements that would keep any partner’s withdrawal from the Alaska LNG project from impeding its progress.

“What’s going so wrong in his negotiations [with producers] that he has to take this unusual and confrontational step [of proposing a reserves tax] — out of the blue — and why hasn’t he been up front and straight-forward with us on this?” Chenault said. “Voters spoke in 2006, overwhelmingly, against this Democrat-led idea of a gas reserves tax — by a 2:1 margin. I think the governor has some explaining to do. We have between now and the end of the special session to get answers to these critical questions, in order to protect the progress and efforts made to keep this vital pipeline project moving.”

The governor’s legislation is to be introduced before the start of the special session; details on proposed terms with TransCanada and taxation of producers were not yet available.

“This legislation will vastly improve the probability of an Alaska gasline being built,” Walker said. “It ensures that, if one or more producers delay construction of the gasline, Alaska still receives critical tax revenues from our natural gas resources. But only if we have the political will and courage to do so.”

Earlier this year, Walker angered Republicans by promoting a proposed smaller, in-state gasline as a potential alternative to the Alaska LNG project (see Daily GPI, March 4). Walker told NGI that he was trying to keep pressure on the producer trio to bring the larger project to fruition (see Daily GPI, July 10).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |