E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | Permian Basin

Rig Decline Slows Pace, But Analyst Sees Further to Go

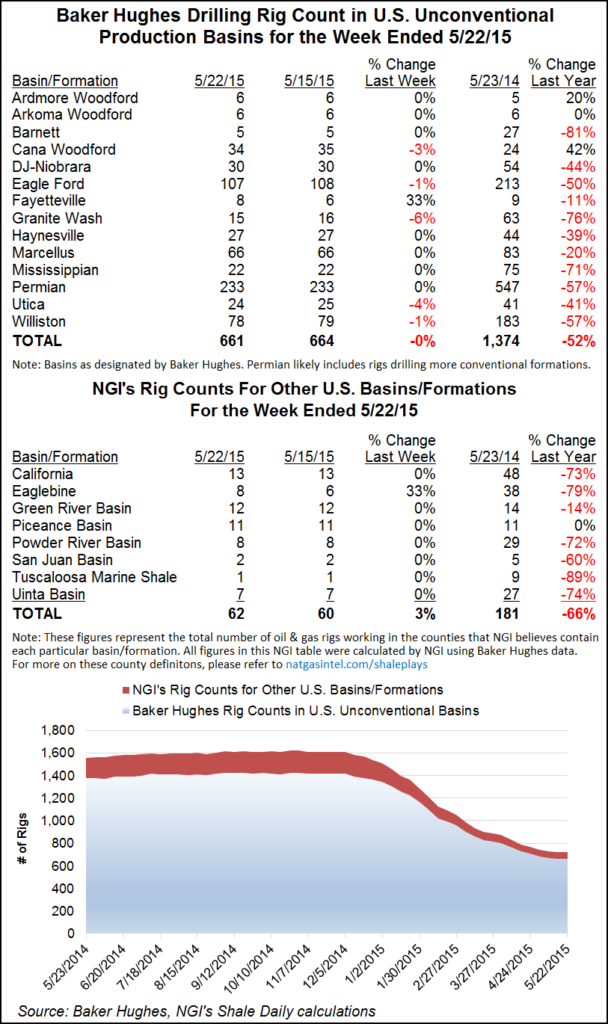

The decline in the U.S. rig count decelerated again to a drop of just four rigs in the count released by Baker Hughes Inc. on Friday (Sept. 25).

During the previous week, a net of six rigs quit (see Shale Daily, Sept. 18), and the week before that the net U.S. loss was 16 rigs (see Shale Daily, Sept. 11). While the decline might be slowing, there’s further to fall, according to analysts at Wunderlich Securities Inc.

“It mystified many that the rig count held up so well, and actually increased, as oil prices tested new lows this summer; but we think that was a function of multiple companies adding rigs when oil was trending higher and those plans were not as quickly reversed as many expected (including us),” the firm’s Jason Wangler said in a note last Monday. “Well, with oil prices remaining low, it looks as if multiple companies are scaling down their programs further and rigs that were either recently added or were on the cusp of coming online now look to be idling once again.”

In the United States, four oil rigs were dropped during the latest report period, and one gas rig was lost, leaving the working tallies at 640 and 197, respectively. Eleven horizontal rigs left the game while four vertical rigs were added.

Canada saw a net decline of six rigs to bring the North American contraction to a loss of 10 rigs. In Canada, four oil rigs were lost and two gas rigs were stacked.

Across the leading U.S. plays, the Eagle Ford and Haynesville shales, and Permian Basin each lost three rigs in the latest count, making them the biggest decliners. Texas saw the largest decline among states, having lost a net of two rigs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |