Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Northeast Shales Still Power NatGas Output in 2016, Jefferies Says

Domestic natural gas production should fall slightly in 2016, with the Northeast showing much stronger gains than any other part of the country, according to a survey by Jefferies LLC.

Jefferies completed a 21-basin model for 2016 that captures more than 90% of U.S. production, taking into account expected completion schedules and the timing of new midstream/pipeline solutions,” said lead analyst Jonathan D. Wolff.

For 2016, the analyst is projecting a dry gas exit rate of 71,953 MMcf/d, down 0.8% from 2015’s projected exit rate of 72,504 MMcf/d. Slowing growth in the Northeast, as well as a decline in associated and dry gas production, is expected to push down domestic supplies net of exports by 1.5%.

Jefferies forecast used a gas price of $3.50/MMBtu in 2016 and $4.00 in 2017 (New York Mercantile Exchange).

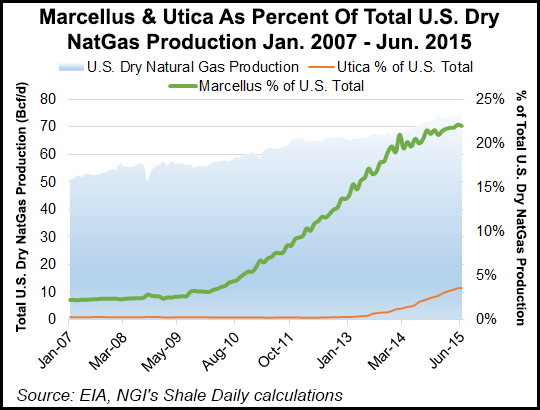

U.S. gas supplies have risen every year for the past six years by about 3 Bcf/d to about 20 Bcf/d, but production should slow through 2017 as the Appalachian engine is stymied by weak local prices and pipeline bottlenecks that may not improve overall until 2018, Wolff said. However, Appalachia still will lead the race, with stronger gas output over the coming year than anywhere else in the country.

The Utica Shale is seen as the overall basin leader, with output rising 15% from 2015 to 4,700 MMcf/d. In West Virginia, output is forecast to increase 8% to 3,500 MMcf/d. Marcellus Shale gas from Pennsylvania is seen 4% higher at 13,500 MMcf/d.

“For 2016, we forecast Northeast supply growth of 1.4 Bcf/d, with a fairly equal split between the Marcellus and Utica developments,” Wolff said.

Based on the modeling, Pennsylvania production should increase 0.5 Bcf/d between September and the end of this year as more pipeline takeaway capacity arrives. In 2016, output overall should increase another 0.5 Bcf/d. Gas production in the southwestern part of Pennsylvania, however, “should be fairly flat through at least 1Q2016, given a limited completion schedule” by producers to date.

Elsewhere, the picture is mixed. Excluding the Northeast, gas production has continued to decline as many dry gas producers moved their investment dollars to the Marcellus and Utica. Excluding the Marcellus, gas production has been running about 27.5 Bcf/d, but this year it’s expected to decline 6% from 2014.

Still, there are some notable dry gas producing areas growing year/year in 2016 beyond the Northeast, Jefferies said.

The Permian Basin’s gas output is seen rising by 4% to 4,300 MMcf/d, while a 4% gain in the Denver-Julesburg Basin would bring gas output to about 1,525 MMcf/d. Offshore gas output, meanwhile, is expected to be flat at 3,625 MMcf/d.

The Haynesville Shale, which has seen a bit of a resurrection by select producers, should see flatter output in 2016, with output rising only 1% to 3,675 MMcf/d. Haynesville production has fallen from 6 Bcf/d a few years ago to current levels of 3.5 Bcf/d as more producers pursued Appalachia gas.

Specifically, Jefferies is modeling the western Louisiana ‘core’ of the Haynesville to increase slightly “on rising completions driven by more efficient completion design, significant producer midstream requirements and our view of better gas prices,” Wolff said.

Meanwhile, associated gas production has declined with pullback in oil drilling. Associated output is expected to be flat this year and decline by 5% or 1 Bcf/d in 2016 from a 20 Bcf/d base as oil well completions remain shelved and capital spending is restrained.

As a proxy to determine how much associated gas production could fall, data was reviewed in five key oil producing regions: the Eagle Ford and Bakken shales, and the Permian, Anadarko and Denver-Julesburg basins. For 2016, Jefferies is modeling a 300,000 b/d decline in U.S. oil production with a downward bias.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |