NGI Archives | NGI All News Access

Lower Spending in 2016 by E&P, OFS Sectors Inevitable, Analysts Say

Energy analysts are beginning to piece together capital spending outlooks for 2016 based on surveys, conversations and anecdotes, with one common theme emerging: it’s lower for longer. Just how much longer is the puzzle.

Sanford C. Bernstein & Co.’s senior energy analyst Bob Brackett said he’s been listening to exploration and production (E&P) management teams at recent energy conferences and has found some commonalities about projected capital expenditures (capex) in 2016.

“The focus of the E&P sector has clearly shifted from preparing for a return to production growth to living within cash flow in anticipation of continuing low oil prices,” he said. “While the mood is gloomy, this is a bullish development for the sector, as we expect capex budgets for 2016 to be set in the coming months and remain in force through mid-2016.

“If the sector lives within cash flow at the current oil price, activity levels will decline further and supply will fall faster.”

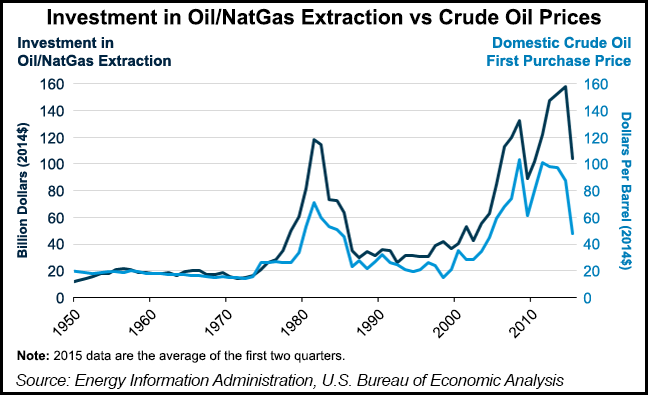

Based on the analysis, the current price environment “is on par with 2008-2009 and 1998-1999 in terms of severity,” Brackett said. “In both cases, the rebound was significant. We believe oil prices are significantly below marginal cost and as they rise, E&Ps will benefit.”

A few common themes have emerged at recent E&P conferences, with the No. 1 theme: oil prices aren’t budging. The other themes flow from that assumption.

“Based on the companies which have given their 2016 preview, we believe that reductions in capital spending will continue in 2016,” an “inevitable” consequence of mid-$40/bbl West Texas Intermediate. Lower activity also has been a common talking point, but efficiencies in drilling also have allowed operators to get more with less, which should continue. In addition, “balance sheet health” has been discussed by almost every management team.

Bernstein analysts expect asset sales “at reasonable prices” to move the needle for some E&Ps. How much industry consolidation is ahead has been tricky to predict and “remains a theme that has yet to play out, but this could change,” Brackett said.

No doubt, there are mountains still to climb for the E&P sector, said Wunderlich Securities Inc. analyst Irene Haas, whose team put together a preliminary 2016 capex outlook. Analysts reviewed 67 North American E&Ps and 10 large international/integrated companies.

“From 2014 to 2015, capex for the E&P names declined by 44%, and capex for the large integrated players declined by 11%,” Haas said. No forward guidance for the group is public, but “we can see trends developing.” The large integrated players are expected to cut capex by around 8% from this year, while the independents now are seen reducing their spending by 23% — at least.

“As we get more data points, we believe that capex declines in 2016 could be even greater than 23%,” Haas said. “This should hit production hard, shrink the U.S. oil surplus and set the stage for recovery in late 2016 and early 2017. We believe that while there is more pain to be felt in 2016, companies that have outperformed this year should still shine next year against a more challenging backdrop.”

The integrated operators have a clearer line of sight, with half of those surveyed (five) providing guidance for 2016 and “sometimes beyond.” From the sample of 67 E&Ps surveyed, 13 offered formal guidance, including the largest independent, ConocoPhillips. Twenty-two other E&Ps provided “soft” guidance laying out a possible scenario at the current strip of around $50/bbl.

The preliminary survey by Wunderlich of all the companies — integrateds and E&Ps — indicated a 23% decline in capex for 2016. For the 32 E&Ps that didn’t offer specific guidance, analysts reviewed Wall Street consensus outlooks.

“Based on these analyst estimates, capex would decline only 2% in 2016,” Haas said. “With such a wide difference between the 2% decline and 23% decline, there clearly appears to be a disconnect between consensus estimates and the companies with clearer guidance. As a result, we would not be surprised to see analysts pulling down their capex estimates and believe it could be a negative catalyst for those names given it also likely reduces production guidance for the year.”

One thing has become clear — companies are looking for ways to raid the piggy bank to raise cash. Midstream assets, if they are within the portfolio, “can still fetch a pretty penny,” Haas said.

She sees “two ends of the spectrum — the consolidators and the walking dead. Having a strong balance sheet and first-class assets matters. We are seeing the stronger companies getting stronger by taking advantage of the disarray and making purchases…Then, there are the walking dead — companies with second-tier assets and worsening balance sheets that face very uncertain and difficult futures.”

BMO Capital Markets analysts said it’s now a “duration game” for the small-cap E&Ps, which are doing what they can to burn the least amount of liquidity until prices strengthen.

Ahead of third quarter reports, producers aren’t expected to “message anything different than what was professed last period: preserving liquidity is paramount,” said BMO’s Dan McSpirit. Many already have sketched a no/less growth picture for 2016 and that’s unlikely to change, as hedges roll off in the new year.

The relationship between capex/cash flow at $52/bbl still is out of sync in 2016 for many of the small caps, even on a hedged basis, which “tells us there’s downside risk to our already low/no growth estimates,” McSpirit said.

If E&Ps are cutting capex, that means the oilfield services (OFS) sector isn’t going to be doing well either, said Rystad Energy. The low/no growth scenario already has had a sharp impact this year, but analysts also are predicting a rapid recovery.

“After years of rising costs followed by a total collapse in oil price, the global oilfield services purchases are set to see a record decline of 18% in 2015,” Rystad analysts said. “This is double the decline following the financial crisis in 2009…The resilience of each of the segments in the market for oilfield services highly depends on contract backlogs.”

Seismic and well services were the hardest hit this year, according to Rystad. Those two segments likely have nearly bottomed, however, with only a modest decline of 1% (seismic) and 3% (well services) predicted in 2016.

For the subsea OFS sector, it’s a different story. It is the only segment seen worsening next year “as scarce backlogs become a reality,” Rystad said. And as development projects become uncommercial, the market for engineering, procurement, construction and installation is facing “the biggest decline among all oilfield service segments next year.”

Douglas-Westwood Ltd. (DW) also is forecasting a marked impact on the OFS sector through 2019 as a consequence of lower E&P spend. Total OFS spending over the forecast period is expected to rise at a compound annual growth rate of 7%, versus 12% between 2010 and 2014.

U.S. onshore spend “is expected to see a slow recovery through the forecast — reaching $92 billion in 2019, compared to $133 billion in 2014,” according to DW. Offshore spending generally is less affected by commodity prices in the short term because the pricey projects are planned and built over many years.

In the long term, DW is forecasting a “lagged effect” on the OFS sector from the price downturn as E&Ps delay final investment decisions for new projects.

“Consequently, offshore OFS expenditure will see activity driven decline post-2016 before an uptick in 2019 — though this will not be significant enough to bring spend back to 2015 levels,” DW said.

“Overall, depressed oil prices, dayrates and U.S. onshore drilling activity cast a significant shadow over the global OFS sector. While some services may benefit from sustained activity in the Middle East, the industry as a whole is suffering and faces a gradual recovery rather than a sudden bounce-back in activity.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |