Markets | NGI All News Access | NGI Data

Futures Gain Despite Outsized Storage Build; NatGas Cash Weakens

Traders typically elect to get their deals done ahead of the morning Energy Information Administration (EIA) storage report and this time around they sold and sold often.

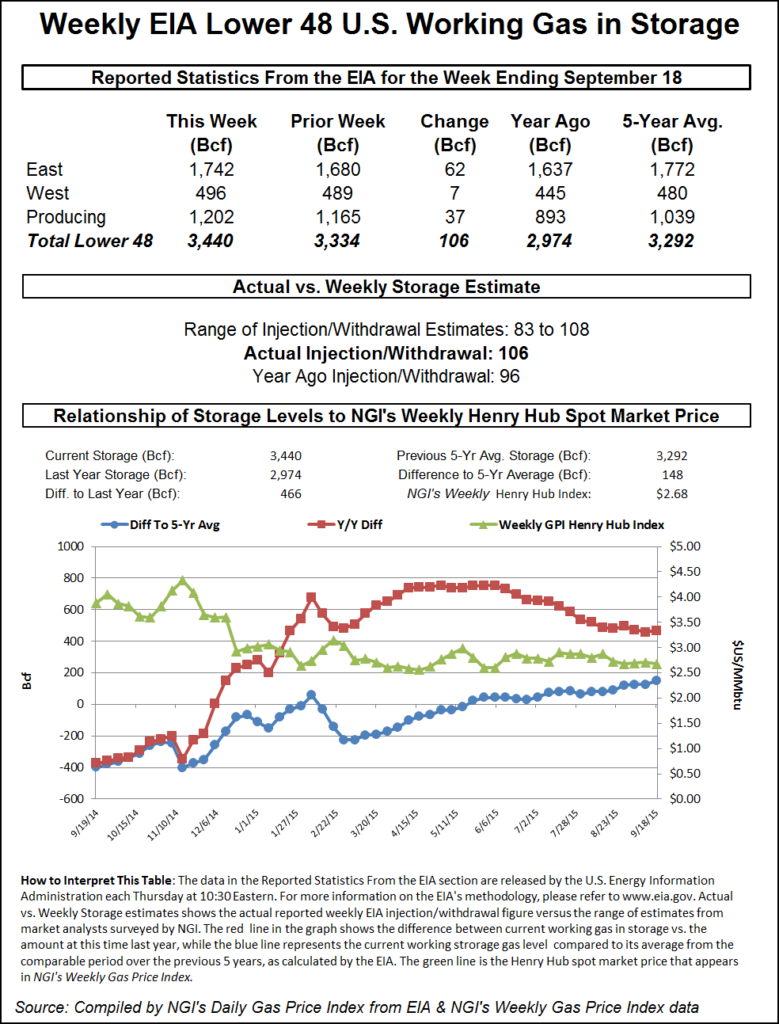

A few scattered gains in the East and California were unable to offset broader declines at most trading points. NGI‘s National Spot Gas Average fell 3 cents to $2.41 and losses in the East flirted with a dime. The EIA reported an outsized build of 106 Bcf, well above expectations, and bears who sold on the number were rewarded with a turnaround that ultimately saw futures settle in the win column. At the close, October had added 2.2 cents to $2.591 and November was higher by 3.6 cents to $2.674. November crude oil gained 43 cents to $44.91/bbl.

Going into the EIA report, analysts were confident that their estimates in the high 90 Bcf area were on target and there was little likelihood of much deviation from expectations.

“We’ve seen little or no indication of a surprise this week; however, the spread between the three categories we track is somewhat elevated: 2.85 [Bcf],” said John Sodergreen, editor of Energy Metro Desk. “Oddly high. If there is a surprise, it would likely be to the high side, we think. Our GWDD forecast came in at 96 Bcf. So 96 to 101 should be right on the money this week, barring any reclassifications, revisions or incomprehensively uneconomic maneuvers at the hands of storage operators. With roughly seven (maybe eight) weeks to go in the storage season, we’d say we’re well on our way to breach the 4 Tcf mark this year.”

Moderating late-summer weather has made heftier storage builds easier, and indications were that Thursday’s build would be significantly greater than last week’s 73 Bcf injection. ICAP Energy calculated a 100 Bcf increase, and Tim Evans of Citi Futures Perspective was up at 108 Bcf. A Reuters survey of 22 traders and analysts revealed an average 96 Bcf with a range of 83 to 108 Bcf. Last year, 96 Bcf was injected and the five-year average comes in at 83 Bcf.

Given the magnitude of the difference between estimated and actual figures, market response was relatively tame. “It basically took a 3-cent dip, and in the scheme of things we are off a penny and a half prior to the number coming out,” a New York floor trader said. “It looks like $2.50 is a big number on the downside, and $2.60 on the upside. If it settles below $2.50, that would be a bearish sign.”

“The 106-Bcf net injection was more than the consensus expectation, a bearish result that was also more than the 83-Bcf five-year average level. It was close to our model’s 108-Bcf estimate however, so we don’t see much need for revisions to our overall storage forecast,” said Tim Evans of Citi Futures Perspective.

Inventories now stand at 3,440 Bcf and are 466 Bcf greater than last year and 148 Bcf more than the five-year average. In the East Region 62 Bcf was injected and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 37 Bcf.

Sodergreen and others were correct that errors were on the high side, but the actual figure of 106 Bcf had many scratching their heads. “Generally speaking, everyone was expecting a risk to the high side,” Sodergreen told NGI in post-report comments. “It [106 Bcf] is not that much of a surprise, but it is a surprise because it was so much higher than I thought. Without question, I think analysts will be tweaking their numbers higher for next week.”

Supplies currently stand at 3,334 Bcf, and to reach the marquee level of 4 Tcf, and a new record, injections a touch over 95 Bcf will be necessary over the next seven weeks.

In the physical market setbacks at eastern points largely were in line with a soft next-day power market. Intercontinental Exchange reported that on-peak power Friday at the ISO New England’s Massachusetts Hub fell $2.73 to $26.25/MWh and at the PJM West terminal peak power for Friday delivery fell $3.04 to $28.96/MWh.

Gas on Tetco M-3 eased 7 cents to $1.31, and gas bound for New York City on Transco Zone 6 shed 11 cents to $2.20. Gas at the Algonquin Citygate fell 2 cents to $1.98.

A Michigan marketer said, “both Panhandle and ANR have some restrictions and that is keeping October basis high, about 35 cents. We are hearing that they may not have their maintenance completed until November.”

Quotes at Midwest points languished, however. Gas on Alliance fell 3 cents to $2.76, and deliveries to Chicago Citygate came 4 cents lower at $2.61. Gas on Consumers changed hands at $2.93, down 4 cents, and deliveries on Michigan Consolidated were quoted 5 cents lower at $2.87.

Weather forecasts remained benign, with no indication that a pool of cool, Canadian air is about to make its way south anytime soon. Commodity Weather Group in its Thursday morning report said, “Another day of mostly small adjustments are noted with some slightly warmer changes for the Midwest to East Coast in the six-10 day and slightly cooler East and warmer West for the 11-15 day range. This continues to be a low-demand pattern situation as late-season cooling demand fades and early-season heating demand starts on a much slower pace.

“Like [Wednesday], the models are at least in general agreement on a warm-sided pattern even if the American ensembles are never quite as intense as the European and Canadian,” said Matt Rogers, president of the firm.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |