Traders Anticipating Stout Storage Build; NatGas Cash, Futures Barely Move

Both physical natural gas and futures moved little on Wednesday ahead of Thursday’s Energy Information Administration (EIA) storage report, with a handful of northeastern points reporting sizeable double-digit losses. Strength in the Midwest, Midcontinent, and Rockies, however, was able to buttress the market.

At the end of the day, NGI”s National Spot Gas Average had softened 2 cents to $2.44. Futures drifted lower, moving less than one cent. October lost 0.8 cent to $2.569, and November fell 0.1 cent to $2.638. November crude oil fell $1.88 to $44.48/bbl.

Although a price surge higher doesn’t seem in the cards anytime soon, analysts are gravitating to the camp that sees little likelihood of significantly lower prices.

BNP Paribas analyst Teri Viswanath, who directs natural gas strategy, said that despite misgivings about the “pace of price increases ahead next year…we feel that the summertime sell-off has likely run its course.

“With storage concerns easing, prices should soon recover on heightened winter demand expectations. Indeed, there is a strong possibility that the same sort of ”seasonal reset’ that occurred with the Oct. ”12 futures expiry might take place this year as summer stock concerns begin to fade,” she said in a note to clients.

The market has already digested storage, according to Tim Evans of Citi Futures Perspective. “The rising storage surplus may send the market to new lows in the near term, but at some point we think the market will have anticipated and priced in the coming seasonal peak in storage,” said Evans. “Once that peak has been priced in, we expect the next fundamental focus for the market will be rising seasonal heating demand.

“The storage injection season will have been priced in, but not the coming winter, at least not entirely. We think this might allow prices to work higher in the months ahead, culminating in a Q42015 price peak above the $3.00 mark.”

Going into Thursday’s EIA storage report, Evans is forecasting a stout triple-digit build, about 10 Bcf more than his peers, thus setting up the possibility of a bearish surprise. However, he does not advise selling the market ahead of the report.

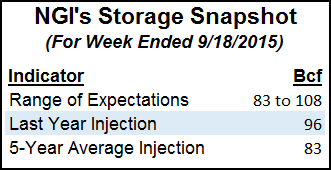

Industry consensus is starting to gel around a 95-98 Bcf increase, but Evans is calculating a build of 108 Bcf.

The industry estimates “would be a near match with the 96 Bcf build a year ago but moderately bearish relative to the 83 Bcf five-year average refill for the date,” he said. “Our model projects a somewhat larger 108 Bcf gain, which we view as some risk of a bearish surprise, but not enough reason to sell ahead of the report.”

Viswanath said she thinks that the industry “likely built 98 Bcf of inventories last week, with early interstate storage receipts suggesting a similar build this week. Moreover, the near absence of weather load suggests to us that the next four EIA storage releases will likely average 100 Bcf or roughly equivalent to the 102 Bcf average weekly builds reported last year.”

If the market is going to ratchet lower, it would likely need ending inventories of more than 4 Tcf, a long shot at best, Viswanath says.

“Nevertheless, even if the industry replicates last year’s refill pace, working gas in storage at the end of October would fall short of the 4 Tcf mark possibly required to reset prices lower. To be sure, the resilient cooling demand over the past month has left more space in storage to stock away the surplus as the industry winds down the injection season.”

ICAP Energy is estimating a storage build of 100 Bcf, while a Reuters survey of 22 traders showed a mean of 96 Bcf with a range of 83 Bcf to 108 Bcf. Last year 96 Bcf was the build, and the five-year pace stands at 83 Bcf.

Next-day gas price movement on the West Coast mirrored that of the United States as a whole as prices moved little and power prices were mixed. Intercontinental Exchange reported that next-day peak power at NP-15 fell 71 cents to $39.50/MWh, but at SP-15 next-day on-peak power rose $3.48 to $39.98/MWh.

Gas at the PG&E Citygate gained a penny to $3.07, but packages at the SoCal Citygate came in unchanged at $2.90. Deliveries to SoCal Border Avg. points shed 2 cents to $2.70, and on El Paso S. Mainline/N. Baja, gas was quoted at $2.72, down a penny.

California’s grid operator CAISO forecast that Thursday’s peak power load would reach a stout 40,651 MW, up from Wednesday’s forecast peak of 36,374 MW.

Other market hubs reported little movement as well. Gas at the Henry Hub was flat at $2.59, and deliveries to the Chicago Citygate changed hands at $2.65, no change from Tuesday. Gas on El Paso Permian fell a penny to $2.54, and gas at Opal was seen at $2.55, down one cent.

Tuesday night weather model data came in a little milder.

“The six-10 day period forecast is once again cooler, or not as warm as previous forecasts across the northern Plains, Midwest into the East,” said WSI Corp. in its Wednesday morning report. “The western U.S. is generally warmer.” Population-weighted cooling degree days “are up 1.3 to 23.7.” Heating degree days were at 9.2.

“Forecast confidence has improved and can be considered average at best,” said WSI. “Medium-range models have come into better agreement, but there are still differences due in part to tropical activity.

“The forecast still has room to swing in either direction at this point given the model spread. The general trend and an amplified pattern support a slight risk to the cooler side over the East and West. The central U.S. and Rockies could run even warmer.”

FC Stone Latin America LLC’s Tom Saal, vice president, in his work with the Market Profile, expected the market to test Tuesday’s value area at $2.590-2.578. Market Profile methodology is a breakout system from an initial balance, which Saal currently places at $2.550-2.597. Targets higher include $2.621 and $2.644 on the upside, and $2.527 and $2.503 on the downside. Saal said the market could test a second value area at $2.632 to $2.614.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |