Rig Count Declines Again, But at Slower Pace

The combined North American oil and natural gas rig tally was down again in the count issued by Baker Hughes Inc. on Friday (Sept. 18), but the drop was less steep than in the previous week.

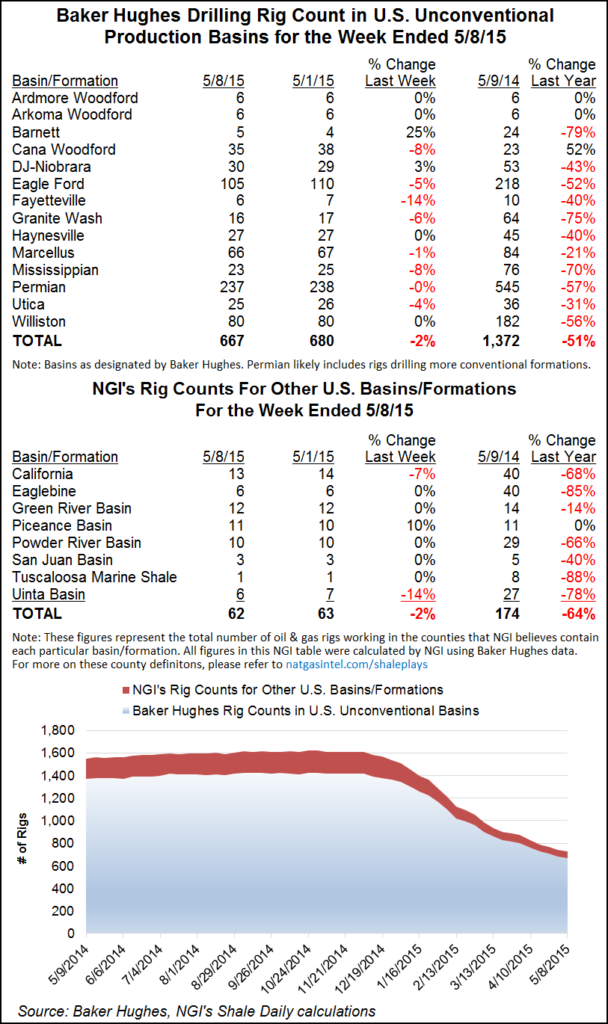

A net of nine rigs gave up the hunt in North America, representing a net loss of six in the United States and three in Canada. The U.S. rig count landed at 842, which is down from 1,931 one year ago. The Canadian count ended at 182, down from 377 one year ago.

The United States gave up eight oil rigs but added two natural gas-directed units. In Canada, three gas rigs were lost while oil held steady. In the previous count, a net of 16 U.S. rigs were lost while Canada was down a net of two (see Shale Daily, Sept. 11).

Back in the United States, eight horizontal rigs were lost to leave 640 still working, but vertical rigs were flat with the previous week, with 119 working.

In a low-price environment, vertical wells can make more sense, Wood Mackenzie analyst Benjamin Shattuck told Reuters recently. While vertical wells might give off a smaller bang, it comes at the cost of fewer bucks, which is important during a belt-tightening cycle. Vertical wells can be drilled more quickly and at lower cost, he said.

Among unconventional plays followed by Baker Hughes and NGI, the Mississippian saw the largest decline, losing five rigs to end at 14 for the week. That’s down 82% from the play’s year-ago tally of 78 rigs. That is the second-highest percentage decline from year-ago tallies among the unconventional plays tracked, save for the Tuscaloosa Marine Shale (TMS).

The TMS, in Louisiana and Mississippi, is down by 83% from one year ago, but back then the play only had six rigs running; now it has one in action after climbing back from zero in recent weeks.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |