Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Petrochem, Power Gen, LDCs Riding Shale Gas Wave

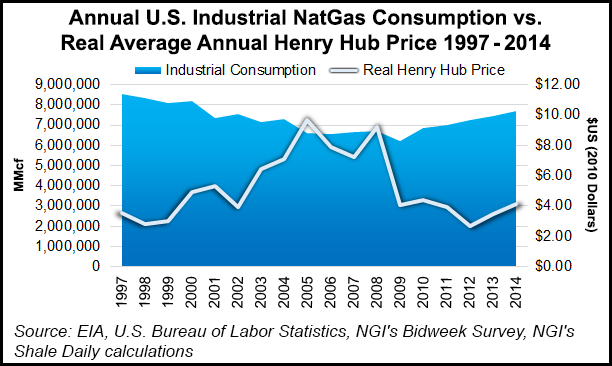

With confidence that U.S. natural gas supplies will be abundant at $4.00/Mcf or less for years to come, a wave of interest continues to grow in the petrochemical, independent power and local distribution utility sectors, said experts Tuesday at the LDC Mid-Continent Gas Forum in Chicago.

“The chemical industry feels comfortable that there is at least a 30-year supply of gas that can be produced under $4.00, so we are confident in making new investments in plants,” said Chemical Industry Council of Illinois Executive Director Mark Biel. A key for the industry, he said, is growth in natural gas liquids (NGL).

“The advantage we have right now over many of our competitors worldwide is significant cost advantages, particularly regarding ethane,” Biel said. “It is estimated that the ethane production in the Marcellus area will shoot up to 590,000 b/d — up from zero in 2012. Right now we produce about 1 million b/d [nationally], so we are looking at a 60% increase in ethane production by 2020.”

Similarly, the shale boom is causing European-based independent power producer (IPP) Advanced Power and local gas utilities, such as UGI in Pennsylvania, to build gas-fired power plants and convert customers that previously had no gas utility service.

“Natural gas is effectively setting the price for electricity,” said Advanced Power’s Jonathan Winslow, senior vice president for U.S. operations. He acknowledged that the lower gas prices have shrunk the margins of IPPs, while the lack of infrastructure in areas like the Northeast prevents more gas-fired generation from being built. “On the other side of that, the margins for coal-fired plants have been killed by continued low gas prices.”

Winslow said an estimated 35.5 GW of U.S. coal-fired generation was retired from 2012 through mid-2015, representing 11% of domestic coal-fired generation. In Ohio, home to a large swath of the Utica Shale, 25% of the coal-fired generation capacity has been retired.

Advanced Power has a 20% interest in building a $700 million, 700 MW gas-fired combined-cycle power plant in Carroll County, OH, the most actively drilled county in the Utica, according to Winslow.

“This is a very significant infrastructure project for the area,” he said.

With financing lined up last April for the power plant, Winslow said the plant is slated to come online in 2018, with a 30-month construction period anticipated by engineering/construction contractor Bechtel.

“Low natural gas prices are obviously very supportive of the construction of this project, but they are not the only factor in covering the cost of this development,” Winslow said. Hedging and firm gas supply contracts for operating in the PJM grid are also essential, he noted.

In Pennsylvania, UGI Utilities has joined the shale boom by converting 45,000 customers to gas service since 2008 under an aggressive “Get Gas” marketing campaign, said program manager Jyothi Gubbala. UGI, which obtains 90% of its gas supplies from the Marcellus Shale, serves 600,000 gas utility customers with 30,000 miles of distribution pipelines.

Gubbala said the impact of Marcellus gas is that residential customers are saving an average of about $700 a year on their utility bills. In 2014, customers converted to gas saved $50 million for the year, she said. Extending gas service is “complicated,” even with the supply boom, and even with high demand among communities an extension of the utility pipeline system has to pencil out economically, and not all of the proposed extension projects do that.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |