Markets | E&P | LNG | NGI All News Access | NGI The Weekly Gas Market Report

NatGas Industry ‘Healthy’ Despite Low Prices, Analyst Says

Perhaps suffering from a misguided lack of self-esteem, the U.S. natural gas industry deserves more respect as the world’s best functioning energy market, which is healthy even amid low commodity prices, a veteran energy analyst told a Chicago audience Tuesday.

RBN Energy LLC Managing Director Rick Smead, who helped to quantify U.S. shale potential in 2008, told an audience at the LDC Mid-Continent Gas Forum that there is reason for optimism in the gas sector driven by supply/demand growth despite despite low gas prices and the crude oil price crash.

Even with conservative growth projections for liquefied natural gas (LNG) exports and power sector gas demand, Smead stressed that the efficiency gains by producers bode well for production staying at least at current levels through 2020.

“There have been staggering increases in efficiency,” said Smead, citing a 630% increase in drilling rig efficiency. He said the average time for completing a well has dropped from 18 to six days in the past year.

Smead maintained his positive outlook while acknowledging an oversupply of global gas. Following his speech, he told NGI that it is possible but unlikely that eventual U.S. LNG exports could settle below the 9 Bcf/d level.

U.S. supplies tend to be more stable and not as susceptible to the winds of war and politics as some others. The global LNG market “likes U.S. supplies, and our suppliers tend to basically be more price flexible on contract terms,” he said.

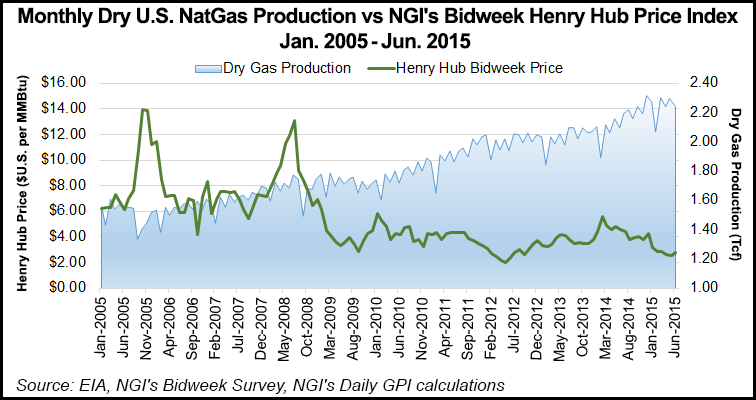

Domestic gas prices skyrocketed following hurricanes in the Gulf of Mexico as supplies diminished around 2008, before shale gas came to the rescue, Smead said.

“As a result, we have had a period of uncommonly stable prices, and after 50 years of being busted, the natural gas market in the United States is the best functioning energy market in the world.”

He illustrated the dramatic change in market since 2008. He cited the Energy Information Administration (EIA) predictions then that estimated the United States would need to import 7-8 Bcf/d of LNG by 2030. Now, EIA is projecting 9 Bcf/d of exports within 15 years.

“The swing between these two numbers spread over seven years is 16-18 Bcf/d, which is the equivalent of two Qatars,” Smead said.

The oil price crash has impacted both natural gas and natural gas liquids (NGL) as liquids have decoupled from crude, he noted. All of the wet gas coming on the market has affected both NGL and LNG prices, he said.

Low crude prices affect “associated gas coming into the market, and it affects LNG prices as the spread between oil and gas prices is tiny now compared to what it was. That, in turn, was driving LNG and gas-to-liquids technology and whether global buyers wanted to replace their oil with LNG,” Smead said.

The consultant is cautiously optimistic about supplies, noting that the narrowing spread between gas and oil prices hurts expansion in the industrial sector. He cited exports of LNG and more supplies sent to Mexico, as well as U.S. power sector coal-to-gas conversions as the main source of domestic demand growth in the next few years.

During another presentation at the conference, Paul Copello, who is president of Industrial Info’s IIR Energy, an industrial infrastructure tracking firm, credited the shale boom with “changing every part” of the North American energy sector, and bringing a “renaissance” back to the manufacturing sector.

The industries vary over time, but there is a rebirth, according to Copello, whose company follows more than 95,000 projects collectively worth $13.7 trillion worldwide for energy trade, producer and transporter clients.

“There is no one silver bullet that is going to make a difference in natural gas demand,” Copello said. “You have to look at all the sectors — power generation, industrial, LNG, Mexico, etc. You really need to find the sectors that are up and coming, and [be] ready to make a move.”

Rig counts and commodity prices have fallen and yet production is maintained, which tends to be “a buy signal for the chemical industry and industrial development generally,” he said.

“If we can have comfortable price ranges and production numbers that a developer can hang his hat on, then he can build for the next 15 years and count on low gas prices. That is definitely an upswing for project activity.”

Smead said the litmus test for the gas supply market would be whether dry gas prices can rebound to reasonable levels of around $4.00/Mcf and avoid spikes to $8.00-9.00/Mcf. “If they go high that means something is still wrong and the industry is in a state of dysfunction, so we really see modest prices being around for a long time.

“The breakeven prices on the major plays continue to drop because every time we make a technological advance it causes prices to drop 50% or more, and those are real price-killers,” Smead said. There are a lot of dynamics in favor of greater efficiencies for the companies able to survive the low commodity prices.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |