LNG | NGI All News Access | NGI The Weekly Gas Market Report

Use of Brent Oil Price Benchmark For European NatGas Declines Along With North Sea Supply

The supply behind the global Brent crude oil benchmark is declining at the same time natural gas buyers are increasingly rejecting oil as the index for their natural gas trades.

“Twenty or 10 years ago, if you wanted to buy natural gas in Europe and you had a long-term contract, it was always linked to the price of oil,” said Bluford Putnam, chief economist at CME Group. “That link is breaking down because the European buyers don’t like it, and they want natural gas to trade on its own dynamics.”

Putnam said Russian-based Gazprom is the one holdout trying to retain the oil price link, and “it is losing the battle. So as the linkage between natural gas and oil breaks down in Europe, you’re going to see natural gas dance to its own drummer more often, and that makes Brent a less useful benchmark tied to natural gas.”

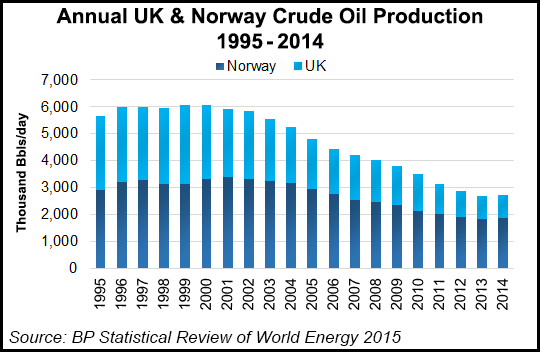

The decline of Brent crude, which is tied to North Sea supplies, is part of the breakdown of crude oil prices, Putnam told the audience at the LDC Mid-Continent Gas Forum in Chicago Monday. And the increased oil supply coming from the United States has raised the value and use of West Texas Intermediate (WTI) oil prices.

With supply and demand converging for what could be a relatively long period of low energy prices, for oil “this does increase the use of WTI on U.S. production relative to Brent,” Putnam said.

Harsh North Sea weather makes for harsh conditions and high maintenance costs for producers there, he said. It’s “…nine months of winter and three months of bad weather,” he said. “It is a hard place to produce oil, and that means the maintenance costs are high,” and North Sea producers are impacted more by lower [global] oil prices than U.S. producers are.

When you combine those realities with the fact that the North Sea has been a declining production area for some time, it is doubtful that investors are going to spend a lot of capital trying to find more oil there right now, Putnam said. He is concerned about the fact that most of the world’s economies are facing slower growth, which doesn’t bode well for oil prices rebounding substantially any time soon.

As a result, “Brent is a declining benchmark in terms of production,” Putnam said, adding that this carries over to the Brent benchmark’s historic tie to global natural gas contracts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |