NGI Archives | NGI All News Access

Weekly NatGas Inches Higher In Lackluster Trading

If ever there was an opportune time for traders to take a vacation, this was it. NGI‘s National Weekly Spot Gas Average moved all of 2 cents from the previous week to record a gain to $2.54, and most points stayed within a few pennies of unchanged. Several regions of the country showed no movement at all.

Of the actively traded points the week’s greatest gains went to El Paso S Mainline with a rise of 15 cents to average $2.84 followed closely by Kern Delivery, up 13 cents to $2.83, and Tennessee Zone 4 Marcellus, up 13 cents as well to $1.14. The bottom of the standings were relegated to Transco non-NY North serving southeasternmost PA and southern New Jersey with a drop of 16 cents to average $2.38 and Algonquin Citygate gas with a drop of 13 cents to $3.02.

South Louisiana was the only region to record a loss, a penny to $2.65, but South Texas, East Texas, the Midwest and Midcontinent were all unchanged at $2.63, $2.64, $2.81, and $2.59, respectively.

The Northeast advanced a penny to $2.03, and the Rocky Mountains added 7 cents to $2.58. A heat wave in California prompted the week’s greatest gain with a rise of 11 cents to $2.89.

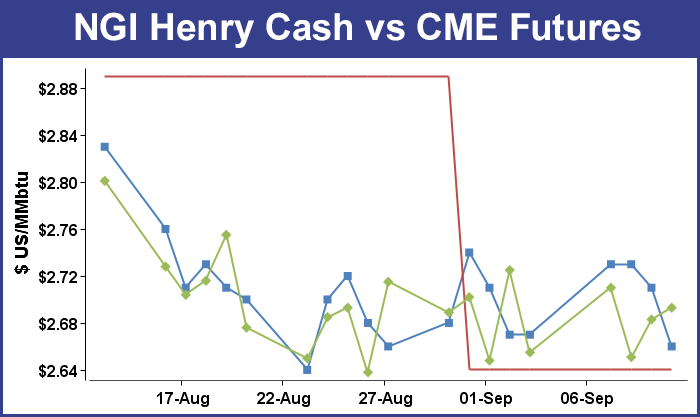

October futures managed a gain of 3.8 cents to finish the week at $2.693, and a good chunk of that gain came following Thursday’s Energy Information Administration (EIA) inventory report, which showed a smaller than expected storage build.

Traders were caught a little off-guard by the storage figures. For the week ending Sept. 4 the EIA reported a 68 Bcf injection in its 10:30 a.m. EDT Thursday release. October futures rose to a high of $2.730 after the number crossed trading screens, and by 10:45 EDT October was trading at $2.726, up 7.5 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for an increase in the 74 to 75 Bcf range. ICAP Energy estimated an 80 Bcf build, and IAF Advisors had calculated a 74 Bcf increase. A Reuters poll of 25 traders and analysts showed an average 75 Bcf injection with a range of 69 Bcf to 82 Bcf.

“We were looking for an increase of 74 Bcf to 75 Bcf so this is something of a bullish surprise,” a New York floor trader told NGI. “I think you have to look at $2.65 support and $2.75 resistance.”

“The DOE reported a clean 68-Bcf net injection into U.S. natural gas storage with no reclassifications or other adjustments this week,” said Tim Evans of Citi Futures Perspective. “While still just above the 63-Bcf five-year average for the data, this was a smaller than expected build that implies at least a somewhat tighter background supply/demand balance. We’d call it constructive overall.”

Inventories now stand at 3,261 Bcf and are 473 Bcf greater than last year and 127 Bcf more than the 5-year average. In the East Region 49 Bcf were injected and the West Region saw inventories increase by 5 Bcf. Stocks in the Producing Region rose by 14 Bcf.

With 3,193 Bcf in storage and nine weeks to go on the traditional injection season, weekly increases of 90 Bcf will be required to reach the marquee level of 4 Tcf and set a new inventory record in the process.

After this week’s reported 68 Bcf build, which came in lower than market expectations, there is at least some hesitation that inventories will end the injection season above the 4 Tcf mark.

“Even if the industry replicates last year’s refill pace, working gas in storage at the end of October would fall short of the 4 Tcf mark — the level likely required to reset prices lower,” said Teri Viswanath, director of commodity research at BNP Paribas.

“As late as last month, the market consensus held that the industry would most likely top 4 Tcf — a presumption supported by injections running 20% higher than the five-year average during the first four months of the season,” Viswanath said. “Consequently, with ample storage capacity still available to store excess supplies should prevent an exaggerated sell-off as the industry winds down the injection season.”

But with inventories running 473 Bcf above year-ago levels and 127 Bcf above the five-year average of 3,134 Bcf, NGI’s Patrick Rau, director of strategy and research, said the healthy storage picture makes it all the more difficult to draw down storage by mid-January, especially without severe cold.

“Now throw in the fact the Midwest LDCs can get more gas from the rapidly growing Appalachia region, and it increases the need for a fast start to winter that much more.”

Weather forecasts at major population centers in the East and Midwest Friday showed a mild temperature regime, and physical natural gas buyers for the most part elected to take a pass on three-day deals for weekend and Monday volumes.

Big declines were seen a eastern points, close to 20 cents on average, and the overall NGI Daily Spot Gas Average fell 9 cents to $2.42. Futures managed to wrestle their way to a small gain with the October contract adding 1.0 cents to $2.693 and November gaining 0.8 cent to $2.767. October crude oil skidded $1.29 to $44.63/bbl.

Weekend and Monday gas prices fell hard in the Northeast, but prices in the Marcellus were mixed as buyers and sellers sort out ways to take advantage of newly developed capacity to move gas west into higher-value Midwest markets.

The large volumes of eastbound Colorado gas that used to arrive at Clarington (non-Tenn), OH, on Rockies Express Pipeline (REX) have now been replaced by gas out of the Marcellus and Utica shale basins seeking higher value in the Upper Great Lakes and Midwest markets. As shown on the NGI‘s Rockies Express Zone 3 Tracker, stout volumes are making their way west on REX to interconnects with major Midwest shippers such as Panhandle, Trunkline, NGPL, Midwest and ANR.

For the moment, however, producers, marketers and shippers out of the Marcellus are trying to get their ducks in a line to deliver the gas. Cooling demand is waning and winter heating has yet to begin and at present there is extra capacity, and Marcellus and Utica gas has a lot of catching up to do to establish any kind of parity with markets to the east and west.

According to NGI markets analyst Nate Harrison, REX Zone 3 receipt capacity jumped Friday from 1,565.5 to 2,029.5 Dth/d due entirely to an increase at Rice/Rex Gunslinger Monroe in easternmost Ohio. “At Gunslinger, receipt capacity increased from 205,000 Dth/d, where it had been since Sept. 1, to 669,000 Dth/d. The increase in Zone 3 capacity without a corresponding increase in actual receipts brought overall Zone 3 receipt point utilization down from 87% to just 69.5% for Sept. 11 flow,” he said.

Gas for weekend and Monday delivery on Millennium was flat at $1.15, and gas at Transco Leidy shed 3 cents to $1.13. Deliveries to Tennessee Zn 4 Marcellus was up a nickel to $1.11, and gas on Dominion South fell 6 cents to $1.16.

Midwest and Great Lakes markets, by contrast, held lofty premiums. Gas on Alliance for the weekend and Monday shed 2 cents to $2.74, and deliveries to the Chicago Citygate eased 3 cents to $2.68. On Consumers, gas changed hands at $3.01, up 2 cents, and packages on Michigan Consolidated 2 cents higher as well to $2.97.

Other market points were soft. Gas at the Henry Hub fell 5 cents to $2.66, and deliveries to El Paso Permian shed 7 cents to $2.53. Gas at Opal was quoted 2 cents lower at $2.57.

Weather forecasts for the weekend were not particularly supportive of firmer pricing. Wunderground.com reported that Chicago’s high of 67 degrees Friday would slump to 62 Saturday and reach 77 on Monday, the seasonal norm. Boston’s 73 maximum Friday was seen rising to 75 Saturday but dropping to 70 on Monday, 4 degrees below normal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |