Midwest Winter Natural Gas Prices Kept in Check by New Capacity, Strong Production

While early indications point to a repeat of last year’s harsh winter for the U.S. Midwest, it appears natural gas markets in the region are well-prepared as forward prices are currently averaging about 40 cents below year-ago levels thanks to ample production and increased pipeline capacity.

At the Chicago Citygate, winter 2015-2016 fixed prices sat at $3.17 on Sept. 10, 40 cents below the average price during winter 2014-2015, according to NGI’s Forward Look. Looking ahead to next winter, prices recover to only about $3.30.

Other regional market hubs are experiencing similarly steep discounts to year-ago levels. Along the Northern Natural Gas Pipeline, prices at Ventura sat Sept. 10 at $3.20, some 36 cents below last winter’s prices. Prices for the winter 2016-2017 are currently averaging $3.31.

Meanwhile, Henry Hub winter prices are currently averaging only about 27 cents below last winter, at $2.94.

So what’s behind the dramatic decline in prices for this winter?

For starters, several pipeline projects aimed at delivering the robust production coming out of Appalachia to markets in the Midwest have recently commenced service or will go into service soon.

Most recently, several new interconnects for the Rockies Express Pipeline East-to-West project have been completed, including ANR’s interconnect with REX at Shelby, which increased the operational capacity from 608 MMcf/d to 1,235 MMcf/d, according to NGI’s Rockies Express Zone 3 Tracker.

REX and NGPL also increased the capacity at the Moultrie interconnect in Illinois, from 686 MMcf/d to 1,395 MMcf/d.

The capacity expansion at REX’s Rice-Gunslinger receipt point in Monroe County, OH, also has been completed, increasing from 205 MMcf/d to 669 MMcf/d, according to NGI data.

“I definitely think the REX reversal and impending OPEN start-up are affecting the Midwest basis this year versus last. So, too, is the Spectra Energy Uniontown to Gas City project, which went into service recently,” said NGI’s Patrick Rau, director of strategy and research.

Indeed, the Uniontown to Gas City project adds some 425,000 Dth/d of contracted capacity into the Midwest.

Meanwhile, Spectra’s Ohio Pipeline Energy Network project is expected to bring online an additional 550,000 Dth/d of capacity later this month.

The new infrastructure being brought online by pipelines is a direct response to the growing production coming out of supply-rich regions like Appalachia.

With new take-away capacity and ample gas supplies being socked away, it appears price volatility in the Midwest may be somewhat tempered this winter, Rau said.

“Ultimately, however, it all depends on the big unknown: actual weather. What I can say is U.S. gas burn tends to peak around Jan. 15 on average each year. Historically, gas prices tend to suffer the rest of winter if there is still ample gas in storage at that time,” Rau said.

After this week’s reported 68 Bcf build, which came in lower than market expectations, there is at least some hesitation that inventories will end the injection season above the 4 Tcf mark.

“Even if the industry replicates last year’s refill pace, working gas in storage at the end of October would fall short of the 4 Tcf mark — the level likely required to reset prices lower,” said Teri Viswanath, director of commodity research at BNP Paribas.

“As late as last month, the market consensus held that the industry would most likely top 4 Tcf — a presumption supported by injections running 20% higher than the five-year average during the first four months of the season,” Viswanath said. “Consequently, with ample storage capacity still available to store excess supplies should prevent an exaggerated sell-off as the industry winds down the injection season.”

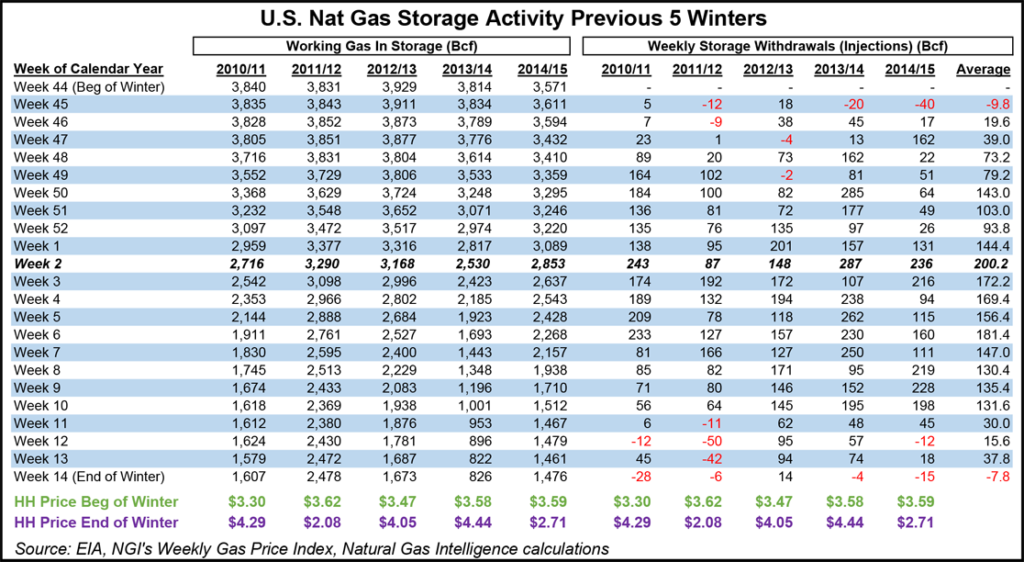

But with inventories running 473 Bcf above year-ago levels and 127 Bcf above the five-year average of 3,134 Bcf, Rau said the healthy storage picture makes it all the more difficult to draw down storage by mid-January, especially without severe cold.

“Now throw in the fact the Midwest LDCs can get more gas from the rapidly growing Appalachia region, and it increases the need for a fast start to winter that much more.”

Although winter forecasts are preliminary at this point, early signs indicate another bitterly cold season is in store for the eastern half of the country.

And it seems some early-season cold arriving in the Midwest this week lends support to that outlook. Forecasters with NatGasWeather are expecting some light early-season heating demand over the Midwest and Ohio Valley during the next several nights as lows drop into the 40s, locally upper 30s as the core of the passing cold pool tracks overhead.

Still, it appears prices in the Midwest are facing a new reality. As NGI illustrated in July, Midwest markets, though once premiums to the Henry Hub, are set to average below the benchmark beginning this year.

In fact, it appears the only time Midwest prices retain their premium over the Henry Hub is during the peak winter months. Prices for the coming winter are currently averaging more than 20 cents above the benchmark, Forward Look data shows.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |