E&P | NGI All News Access | NGI The Weekly Gas Market Report

Rigs Depart, But Leading Gas Plays Stable in Latest Count

For the week ending Sept. 11, U.S. producers dropped six natural gas-directed rigs, according to the latest count from Baker Hughes Inc. However in Canada, six natural gas rigs were added. Meanwhile, the U.S. Energy Information Administration (EIA) is projecting continued natural gas price weakness and stubbornly strong production.

EIA said Wednesday that gas will average $2.84/MMBtu this year and $3.11/MMBtu next year (see Daily GPI, Sept. 9). That’s down from the $2.89/MMBtu in 2015 and $3.21/MMBtu in 2016 that EIA had forecast just last month (see Daily GPI, Aug. 11), and a significant decline from EIA’s July forecast of $2.97/MMBtu this year and $3.31/MMBtu next year (see Daily GPI, July 7).

And the agency said it expects moderate growth in production through 2016, with increases in the Lower 48 more than offsetting long-term production declines in the Gulf of Mexico. Increases in drilling efficiency will continue to support growing natural gas production in the forecast, despite relatively low natural gas prices, EIA said.

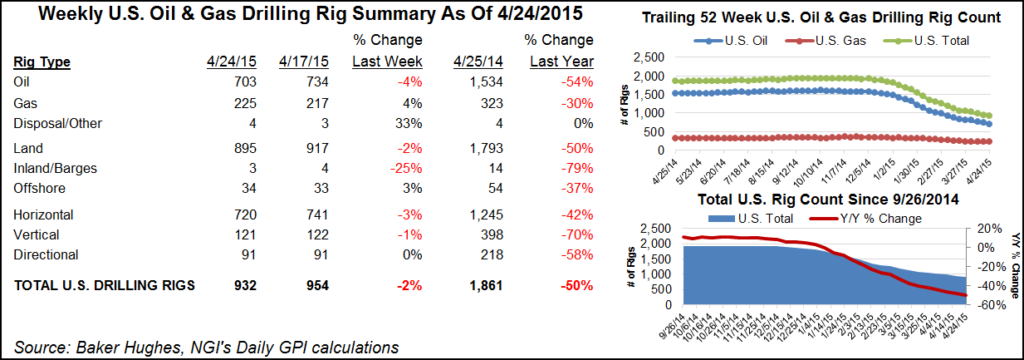

According to Baker Hughes, the United States dropped a net of 16 rigs, giving up 10 oil and six natural gas units. Canada was down a net of two after giving up eight oil rigs but adding six gas units. The U.S. count settled at 848, and Canada landed at 185. For North America, the tally was down a net of 18 rigs for a count of 1,033, which is 44% of the year-ago tally of 2,336.

Texas was the biggest loser among states, giving up nine rigs, which far eclipsed the pullback seen in other states. Texas had 366 rigs running, which is just 40% of the year-ago tally of 905. The oil-rich Permian Basin and Eagle Ford Shale were also the biggest losers among leading plays, with each dropping three rigs.

Natural gas-oriented plays were holding their own in the latest count, though. The Barnett Shale only lost one rig to end at six, still far from the year-ago total of 25. The Haynesville, Fayetteville, Marcellus and Utica shales were all flat with the count from a week ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |