Bakken Shale | E&P | NGI All News Access

North Dakota Production May Be Higher, Longer, Helms Says

Amid low commodity prices that may stick around for a year or two, North Dakota’s robust oil and natural production may see higher peaks and longer productivity for its wells than previously forecast, the state’s chief oil/gas official told state and local officials at a meeting of the oil/gas producing counties on Thursday.

In his 16th annual report to the Association of Oil and Gas Producing Counties, Lynn Helms, director of the state Department of Mineral Resources (DMR), said there is growing interest in “the new normal” for drilling efficiencies and well productivity.

Well permitting is down, as is the rig count, which is now at the 2009 level. But one rig today can drill three times as many wells in a year than in 2009. The average six years ago was eight to 10 wells per rig per year, Helms said, compared to current averages of 20 to 24 wells.

In July, Helms said initial production and estimated ultimate recovery were up 20%; well and operating costs were down a combined 26%, while oil prices were down 51%.

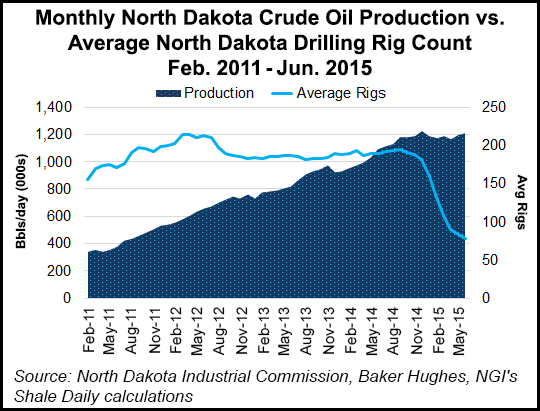

Drilling in the Bakken Shale is concentrated in four counties (Dunn, McKenzie, Mountrail and Williams) where 65 of the remaining 73 active rigs in September are operating. When there were 183 rigs operating last November, 165 were located in the same four counties, Helms said.

There is a wide difference of almost one million b/d between the current projection for the state’s future oil/gas production, compared with a peak production estimate, Helms said. In the latter, he noted that annual production could climb to about 2 million b/d by the 2025-2035 period, compared with the current base case based on low crude prices showing production would sink below one million b/d and keep falling after 2030.

Regardless of which production and price scenario pans out, Helms said increased regulation of the oil/gas sector is here to stay in the state, which in the past has been known for relatively light-handed oil/gas enforcement. Flaring and gas gathering pipelines are two of the focal points for the stepped-up efforts, Helms said.

“We are eagerly awaiting the results of the gathering pipeline study being conducted [by the University of North Dakota’s Energy and Environmental Research Center, EERC],” Helms said, adding that state regulators will “carefully review” the study results and then craft new pipeline rules as necessary that are “cost-effective and feasible” to improve on what was put in place two years ago, following passage of state legislation (HB 1333).

That law required more disclosure on the location and operation of gathering pipelines, and a bill passed this year (HB 1358) requires the submittal of engineering designs, independent inspections and plans for leak detection for all new gathering pipelines, effective Aug. 1 this year. The new law also prompted DMR to consider the creation of additional rules for “feasible, cost-effective and needed improvements to pipeline safety and integrity.”

Helms cited a specific requirement in the latest law calling for gathering pipes to be installed “in a manner that minimizes interference with agriculture, road and utility construction.”

In the area of capturing wellhead natural gas to cut down on the volumes flared, Helms reiterated the current target for getting the statewide capture up to 85% by the beginning of next year, aiming for eventually being at 90-95% by October 2020.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |