E&P | NGI All News Access | NGI The Weekly Gas Market Report

Oil/Gas Price Downturn Could Produce API-ANGA Merger

Negotiations about a possible merger of America’s Natural Gas Alliance (ANGA) and the American Petroleum Institute (API) are said to be ongoing, according to several sources that work in the oil and gas industry and have knowledge of both organizations.

It’s unclear where the talks stand, or what kind of organization would emerge if two of the nation’s leading industry interest groups are combined. While neither ANGA nor API denied the possibility of a merger, they did not confirm it and had no comment. But sources believe ANGA would likely fold into API — an older more established organization with a network that extends throughout the country to reach nearly all corners of the oil and gas industry.

“It is going to happen. I understand it could be as soon as October,” said one industry source who works for an unrelated interest group. “It seems like a situation where everyone’s in the [emergency room] saying what can I save,” he said referring to the decline in oil and gas prices and the effect it’s had on the industry and its representatives across the country.

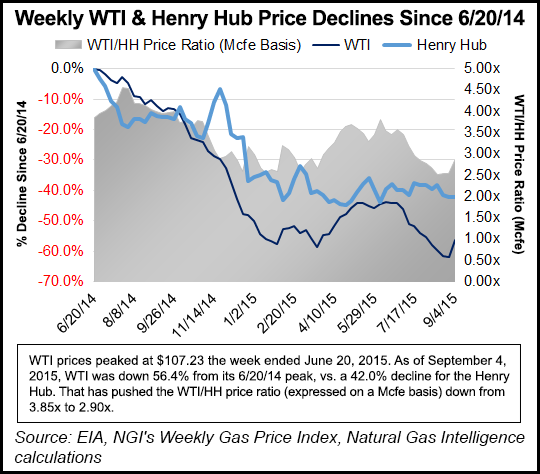

Rumors of an ANGA-API merger come at a time of industry retrenchment as producers have been slashing budgets, cutting their workforces and searching for ways to stretch the cash and credit they have on hand. But while the price of oil has fallen precipitously from more than $100/bbl to less than $50/bbl in a little more than a year, natural gas prices have experienced a more sustained decline as markets and infrastructure have failed to materialize for the abundant supplies generated by the shale boom.

U.S. natural gas benchmark prices have tumbled consistently from a peak of more than $12/MMBtu in 2008 to less than $3/MMBtu this year. ANGA itself has suffered as a result, sources said. Formed in June 2009 at a time when natural gas producers barely had a voice on Capitol Hill for the growing influence of their products, the organization’s revenue and membership has declined (see Daily GPI, Sept. 8, 2009).

At one point, ANGA had more than 20 members, but that number has since fallen to 17. While the organization still collects dues from some of the nation’s largest independent gas producers such as Chesapeake Energy Corp., XTO Energy Inc. and Anadarko Petroleum Corp., others, such as Marcellus Shale heavyweight Range Resources Corp., have recently departed.

“I would see this as a benefit for ANGA to get in and access API’s strength and stability. I think [API] offers a more established network of relationships,” said one source with extensive experience working in the upstream sector and more recently on public policy and legal affairs. Like others interviewed for this story, he agreed to discuss the possible merger anonymously due to its sensitivity and for fear of alienating colleagues.

“The natural gas-specific sector is extremely important, but it’s difficult because the market really isn’t taking off. It is what it is,” he said. “The members that help generate gas-specific lobbying efforts or education are finding it more and more difficult to allocate revenue — they’re peeling an onion that’s getting thinner and thinner, not fatter.

“If you look at the net to these mid-level independent gas producers, they’re running a pretty fine line. As much as it’s shortsighted to cut public perception-type budgets and initiatives, unfortunately they’re not a revenue producer in the long term.”

While ANGA focuses solely on the natural gas industry — primarily its producers — API has more than 625 members working in the oil and gas supply chain, oilfield services, production and midstream, among other sectors. It was founded in 1919 and is considered to wield significant power on Capitol Hill and through its affiliates in states across the country.

“In the current environment, API’s members are focused on improving efficiencies,” said spokesman Carlton Carroll. “API and ANGA have a history of collaborating on issues of importance to U.S. gas producers, and we expect that will continue. We have no comment on internal organization discussions.”

ANGA reported total revenue from its dues-paying members and other investments of about $57 million in 2013, the latest year for which data is available, according to its Internal Revenue Service Form 990 for tax-exempt organizations. That was down from $77 million in the prior year. The API reported total revenue of $225.5 million in 2013 on its Form 990.

“It could be a negative for the gas-only members, but there are fewer of them than when ANGA got started,” said one industry consultant of the possible merger. “And the pressure to reduce expenses would be the driving factor in this commodity price environment.”

Sources also said a merger between both organizations would make sense given their leadership. Martin Durbin, who was named ANGA’s CEO in 2013, previously served as API’s executive vice president for a short time under its current CEO Jack Gerard. Gerard also previously served as CEO of the American Chemistry Council at a time when Durbin was that organization’s vice president of federal relations.

“I’m not surprised. Given that Marty Durbin has been there just over two years, and not done much new in that time, and with members dropping or likely requesting scaled down dues, he would have been smart to approach his old boss at API [regarding] synergies,” the consultant said.

Another source that works closely with ANGA said that in recent years rumors of a merger between the organizations have been swirling. He added, however, that he has not received any internal correspondence regarding a merger that would change his business relationship with the organization.

“It’s not the first time I’ve heard this,” the source said. “It’s sort of insider baseball, but there’s been a lot of chatter from the circle about how ANGA is not fulfilling its mission, how it doesn’t have as many members and rumors have been swirling.”

The shale boom and a new abundance of natural gas served as one of the main drivers in establishing ANGA six years ago. While the organization focuses heavily on liquefied natural gas (LNG) exports, transportation, power generation and supply reliability, its mission also crosses well with API’s. API has put a strong emphasis on LNG and crude oil exports as well as jobs, the economy and emission standards, or energy policy, like ANGA has.

Sources also acknowledged that it wouldn’t be the first time two trade groups have merged, noting that it’s not uncommon for some to serve a temporary purpose. Sources added that some local trade organizations, particularly in the gas-rich fields of the Appalachian Basin, have approached them searching for ideas about how to create more value for their membership.

“I think a lot of the smaller organizations and industry groups are having some pretty hard times too managing their membership base, which is their cash flow,” one source said. “Some events have been canceled or scaled back, and I think that factors into the canvas for this type of merger and consolidation stuff.”

For the first time in recent memory, the U.S. Energy Information Administration forecasted in August that oil and gas production in the nation’s seven major shale plays would decline slightly in September (see Shale Daily, Aug. 7). Given the circumstances, and ANGA’s initial charge to raise awareness about the nation’s abundant natural gas, a merger with API might be the next logical step, said the source with upstream and public policy experience.

“Once that educational hurdle is jumped, maintaining the message becomes more and more difficult and some organizations are often short-lived. You don’t always have that ‘rally around the flag, chase it up the mountain’ consensus that formed the original basis for an organization.”

API and the Independent Petroleum Association of America at one time were the only organizations representing oil and gas producers. The Natural Gas Supply Association (NGSA) split off from API in the late 1970s when natural gas deregulation was a prominent issue. NGSA continues to lobby for natural gas among Washington’s lawmakers. ANGA has weighed more heavily toward changing public perception of natural gas, and some would say it has largely achieved its mission.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |