Markets | NGI All News Access | NGI Data

Lean Storage Stats Buoy Futures; October Gains 7 Cents

Natural gas futures jumped Thursday morning following the release of government inventory figures showing an increase in working gas storage far less than what traders were expecting.

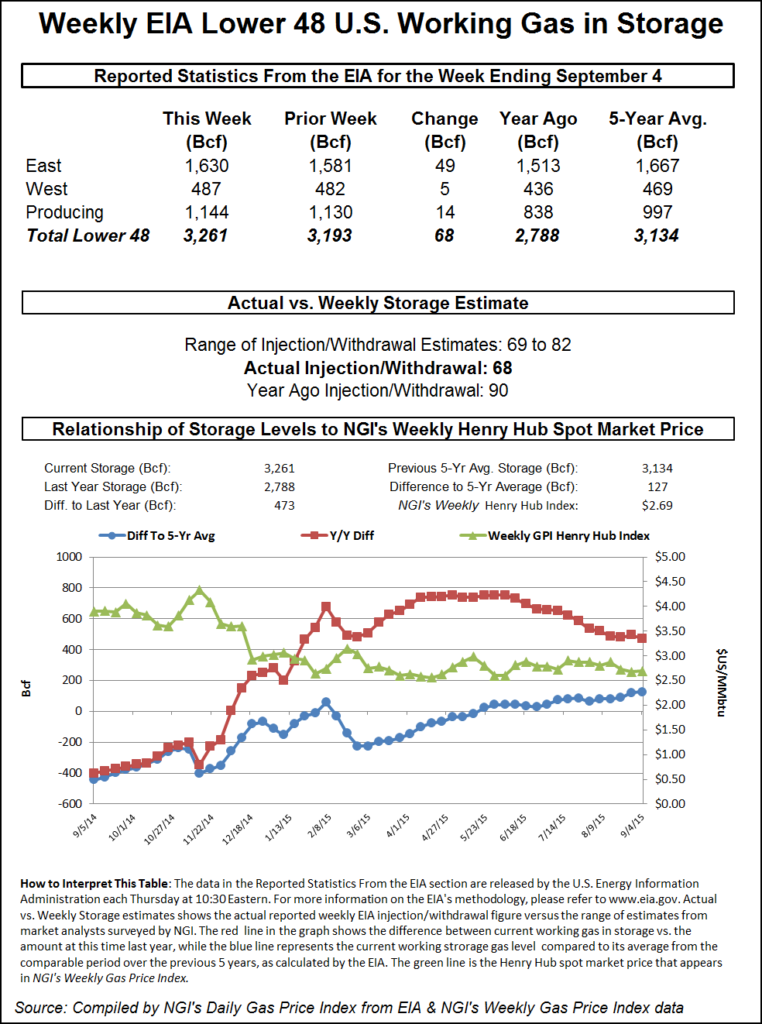

For the week ended Sept. 4, the Energy Information Administration (EIA) reported a 68 Bcf injection in its 10:30 a.m. EDT release. October futures rose to a high of $2.730 after the number was released, and by 10:45 a.m., October was trading at $2.726, up 7.5 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase in the 74 to 75 Bcf range. ICAP Energy estimated 80 Bcf, and IAF Advisors had calculated a 74 Bcf increase. A Reuters poll of 25 traders and analysts showed an average 75 Bcf with a range of 69 to 82 Bcf.

“We were looking for an increase of 74 Bcf to 75 Bcf, so this is something of a bullish surprise,” a New York floor trader told NGI. “I think you have to look at $2.65 support and $2.75 resistance.”

“The DOE reported a clean 68-Bcf net injection into U.S. natural gas storage with no reclassifications or other adjustments this week,” said Tim Evans of Citi Futures Perspective. “While still just above the 63 Bcf five-year average for the data, this was a smaller than expected build that implies at least a somewhat tighter background supply-demand balance. We’d call it constructive overall.”

Inventories now stand at 3,261 Bcf and are 473 Bcf greater than last year and 127 Bcf more than the five-year average. In the East Region, 49 Bcf was injected and the West Region saw inventories increase by 5 Bcf. Stocks in the Producing Region rose by 14 Bcf.

The Producing Region salt cavern storage figure was up 3 Bcf at 293 Bcf, while the non-salt cavern figure increased 11 Bcf to 851 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |