NGI Data | NGI All News Access

Price Moves Limited In Weekly NatGas Trading

Traders wondered whether Thursday’s futures gains of nearly 8 cents may have signaled an attempt to break out of its longstanding trading range. Reality quickly set in Friday when October’s 7-cent decline took it all back. So went the week with losses offsetting gains, and the NGI Weekly Spot Gas Average added all of one penny to $2.52.

Of the actively traded locations, the market point showing the week’s greatest gain was Texas Eastern M2 Delivery with a rise of 67 cents to $1.92. At the bottom of the standings were El Paso S Mainline with a decline of 11 cents to $2.69 and FGT Citygate with a loss of 10 cents to $3.09. California was the only region to show a loss, 6 cents to $2.78, and the week’s greatest gains were posted in the Northeast with a rise of 8 cents to $2.02.

East Texas added a penny to $2.64, and four regions were up by 2 cents.

South Texas, the Midwest, South Louisiana and the Rocky Mountains finished the week at $2.63, $2.81, $2.66 and $2.51, respectively.

Outside of the Northeast, the Midcontinent was the best performer with a 6-cent gain to $2.59.

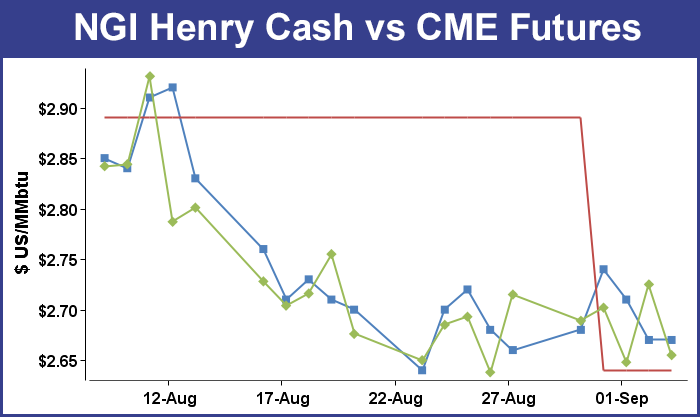

October futures for the week slipped 6.0 cents to $2.655 as a hefty storage build in Thursday’s Energy Information Administration (EIA) storage reminded traders just how well supplied the market is. The EIA reported an increase in storage of 94 Bcf , and even with an 8 Bcf adjustment to determine implied injections, the 86 Bcf was well ahead of historical averages. Markets have a way of making the smartest guys in the room, however, look less than stellar, and in the face of a stout build October futures added 7.7 cents to $2.725 and November rose 7.6 cents to $2.796.

Prior to the release of the EIA storage data analysts were looking for an increase in the 85 to 90 Bcf range without the adjustment. ICAP Energy estimated 94 Bcf, and IAF Advisors had calculated an 85 Bcf increase. A Reuters poll of 24 traders and analysts showed an average 88 Bcf with a range of 79 Bcf to a 97 Bcf injection.

Drew Wozniak, vice president at United ICAP, forecast an implied flow build of 94 Bcf “with a (my probability is 30%) chance that the net change will be +103 if ANR reported their reclassification of 9 Bcf from base to working gas. It is my understanding that the reporting of reclassifications to the EIA is at the discretion of the storage owner, so when exactly this 9 Bcf of increased storage is reflected in the EIA’s report is not exactly known,” he said in a report to clients.

The initial market reaction to the data was underwhelming, at best. The October futures fell to a low of $2.640 after the number was released, and by 10:45 EDT September was trading at $2.647, down a minuscule 0.1 cent from Wednesday’s settlement. October had traded as low as $2.633 earlier in the session.

“I was hearing an 88 Bcf injection, but the 8 Bcf reclassification brings it about in line,” a New York floor trader toldNGI. “We didn’t have much activity off the number.”

“The ‘implied flow’ of 86 Bcf was actually close to our 84-Bcf estimate,” said Tim Evans of Citi Futures Perspective. “There will likely be some confusion off the meaning of the reclassification, but that was a one-off event. The flow figure is more constructive in our view”.

Inventories now stand at 3,193 Bcf and are 495 Bcf greater than last year and 122 Bcf more than the 5-year average. In the East Region 71 Bcf were injected and the West Region saw inventories increase by 3 Bcf. Stocks in the Producing Region rose by 20 Bcf.

When the futures market opened Friday morning traders said that Friday’s weak open “should not come as a surprise since we saw nothing particularly bullish about yesterday’s EIA [Energy Information Administration] report and short-term temperature outlooks that now stretch out to about Sept. 18th are favoring a broad-based cool-down that is expected to cover a major portion of the nation’s Midcontinent,” said Jim Ritterbusch of Ritterbusch and Associates.

“Since we see no items on the horizon capable of forcing a sustainable price advance, we are abandoning a short-term bullish trading posture for now as we will look for a price decline to lower levels to re-establish a long holding. With no help from the temperature factor or storm events amidst a sizable expansion in the supply surplus, it now appears that the next 15-20 cent price swing is more apt to develop on the downside rather than the upside.”

Tom Saal, vice president at FC Stone Latin America LLC, in his work with Market Profile was looking for the market to test Thursday’s value area between $2.734 and $2.668. He added that the week’s Market Profile pattern is a neutral week, which “shows indecision about market direction. Sideways continues for now.” The Cal ’16 strip is “very oversold. Buyers be ready,” he said in a Friday morning note to clients.

In Friday’s trading for the long holiday weekend, physical natural gas values on average eased slightly as broad market weakness was able to outdo market strength in the Gulf Coast and East.

Most points moved a nickel or less, and NGI’s National Spot Gas Average shed 3 cents to $2.45. Forecast major heat in Boston prompted citygate prices there to jump nearly $1, but on the West Coast temperatures were seen at seasonal norms and prices turned in double-digit losses. Futures trading was weak as prices drifted back down to the low end of the trading range. October was down 7.0 cents to $2.655 and November dropped 5.5 cents to $2.741.

Gas out of the Marcellus continues to march west, with producers having to sell their gas on Dominion South and Tetco M-2 hoping that recent expansions will improve their pricing. Genscape said, “The second phase of Spectra’s Uniontown, PA, to Gas City, IN (U2GC) began flowing gas west across Ohio beginning Sept. 1, 2015. Last month, the first 300 MMcf/d of the 425 MMcf/d capacity began flowing west from the Uniontown Compressor Station along the mainline for EQT, Range Resources and Rice Energy, while CNX and East Resources elected to wait for the completion of the facilities required to enable flow along Tetco’s lateral between Lebanon, OH, and Gas City, IN.”

What the project does is provide shippers with an opportunity to obtain firm transportation service from the supply rich area west of Uniontown to the existing interconnect with the Panhandle Eastern Pipe Line system near Gas City for further redelivery to markets in the Midwest.

Analysts close to the project expect prices to improve for Marcellus producers rather than impact prices for gas headed to Midwest or Great Lakes points. “The basis differentials on Tetco M-2 as well as Dominion South have been crushed, and I think it helps that more than anything,” said Pat Rau, NGI director of strategy and research.

“It does dump a little more gas over into the Midwest. Gas City is about 150 miles northwest of Lebanon, OH, and it’s likely to send more gas into Michigan. I don’t think it’s going to do that much to gas [prices] in Lebanon,” he said.

“U2GC, which was originally slated to come online Nov. 1, 2015, consisted mostly of compression upgrades to main compressors along the route, with minor modifications to existing meter and regulation stations, as well as the addition of pig launchers and receivers to allow bidirectional flow of gas along the line. Flows are not expected to test the new capacity limits until winter,” Genscape said.

Gas for delivery over the long weekend and Tuesday at Lebanon was down a penny at $2.62, and packages on Dominion South fell 7 cents to $1.16. Gas on Tetco M-2 Receipt was quoted 11 cents lower at $1.12.

Elsewhere at eastern points, prices varied widely as temperature forecasts called for warmth. Wunderground.com predicted the Friday high in Boston of 68 would rise to 75 Saturday before reaching 93 on Tuesday. The normal high in Boston this time of year is 76. New York City was expected to see its Friday high of 82 hold Saturday before making it to 92 Tuesday. The seasonal high in New York is 77.

Weekend and Tuesday gas at the Algonquin Citygate surged 73 cents to $2.99, but gas on Texas Eastern M-3, Delivery shed 11 cents to $1.24. Gas bound for New York City on Transco Zone 6 fell 48 cents to $1.79.

At other major hubs prices for the extended weekend were seen a few pennies lower. Gas at the Henry Hub changed hands unchanged at $2.67, and deliveries to the Chicago Citygate fell 2 cents to $2.70. Packages on El Paso Permian came in 4 cents lower at $2.47, and gas at the PG&E Citygate skidded 2 cents to $3.06.

Gas buyers pondering weekend power loads may find a healthy dose of renewable energy at their disposal. WSI Corp. in its Friday morning forecast said the MISO power pool should experience “a variable southerly wind will lead to changeable, but elevated wind generation [Friday] into the weekend. Wind gen will likely trend upward ahead of the front with output as high as 5-7 GW during the overnight hours. A westerly breeze behind the cold front could continue to support modest, albeit decreasing wind gen early next week.

“A broad upper-level ridge will encompass the north-central U.S. during the next one to two days. This will result in partly sunny skies along with anomalous late summer heat and moderate humidity, though there is a chance of showers and storms over the upper Midwest and Great Lakes. Highs will range in the 80s to mid 90s along with lows in the 60s to low 70s.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |