NGI Archives | NGI All News Access

As Summer Wanes, Natural Gas Forward Locations Follow Hub Lower

October forward fixed prices fell across the board between trading Friday, Aug. 28, and Wednesday, Sept. 2, as traders started to focus on fall and began to put summer temperature concerns in the rearview mirror. On average, points covered by NGI’s Forward Look dropped 4.4 cents and were brought lower by a falling Henry Hub October futures contract that dropped 6.7 cents from $2.175 to $2.648 over the period.

Not every point joined in the melancholy of this week’s futures trading, however. Both Northwest Sumas and Southern Star managed to post forward fixed price gains. Southern Star rose 1.3 cents since Friday trading to $2.441 and Northwest Sumas shot up 16.7 cents to $2.273.

The past few weeks have been pretty quiet in the forward basis markets with only Algonquin Citygates and Northwest Sumas making any large gains. With October fresh on the board, traders will likely focus on the remaining storage injections and any forthcoming projections of early fall weather.

For the week ending Aug. 28, the Energy Information Administration (EIA) reported a 94 Bcf injection in its storage report, but an 8 Bcf reclassification in the East Region indicates an implied injection of 86 Bcf. While within the industry expected range of a 79 to 97 Bcf injection, the figure was definitely at the high end. Currently, Lower 48 stocks sit comfortably above the five-year average by 122 Bcf.

Citi Futures Perspective analyst Tim Evans said that while the topline 94 Bcf build “looks larger than expected and bearish” at first glance, the 8 Bcf reclassification had already been announced by ANR Pipeline.

The level of volatility in the forward price markets will likely continue to be set by action in the Henry Hub futures price as it has done for the past few weeks. “During the shoulder months a lot market volatility tends to come from the Henry Hub futures,” said NGI markets analyst Nathan Harrison. “That is to say there’s generally not much volatility to speak of.”

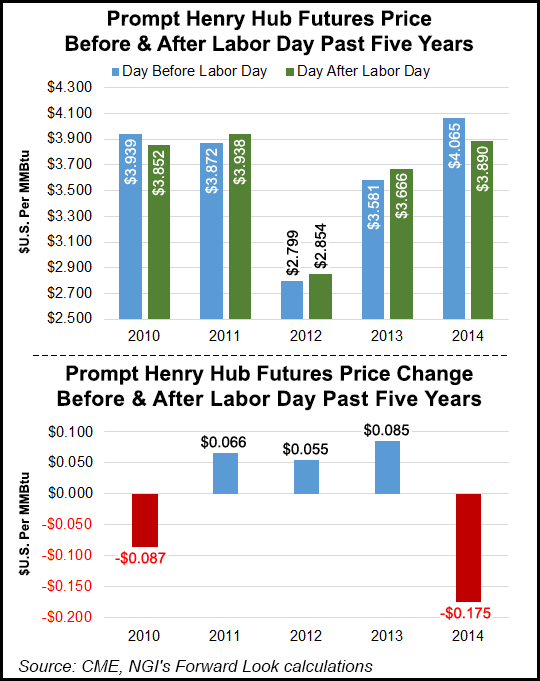

Teri Viswanath, director of natural gas strategy at BNP Paribas, said the Labor Day weekend traditionally marks the end of summer, so short-term weather demand will no longer provide support to the market. “Indeed, a relatively important reset in prices took place following Labor Day last year, when the front October futures contract tumbled $0.175 in the Tuesday trading session following the holiday.”

She added that the third week of September traditionally marks the low point in the season for weather-related demand. “As traders return from the holiday, they will have a much clearer view of the seasonal slide in cooling demand. To be sure, the likelihood of reaching daily highs in the 90s becomes a relatively rare occurrence in the second half of the month, even for those states located in the southern tier of the country.

“Consequently, the elimination of this key element of support might prompt follow on selling next week,” Viswanath added. “With working gas in storage already at 3.2 Tcf and the possibility of heavy restocking ahead, the short-covering that likely took place [Thursday] will likely open the door to additional price weakness next week as traders potentially re-establish short positions.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |