Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

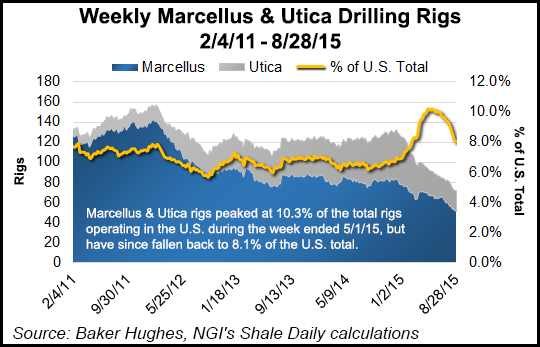

Feds Report Marcellus, Utica Drilling Down 40% Since 4Q2014

Ongoing low commodity prices have the energy sector either stuck in neutral or slowing down, depending on the section of the country, with the slowdown most evident in the Cleveland District, where Marcellus and Utica shale drilling is down 40% since peaking in 4Q2014, according to the Federal Reserve Board (FRB).

In the latest issue of its Beige Book, the FRB said that in the Cleveland District — an area that includes Ohio, western Pennsylvania and eastern Kentucky, and therefore large portions of the Marcellus and Utica — natural gas production through the first half of the year was actually higher compared to the same period one year ago. Wellhead prices for oil fell during 1H2015 and natural gas prices remained stable, but at a low level. Energy sector hiring in the district was modest.

“We heard several reports about capital budgets being adjusted downward as companies trim back their exploration and production plans,” the FRB said. “In contrast, already contracted midstream infrastructure projects are moving forward. Because of weak exploration activity, hiring within the oil and gas industry is modest and tightly controlled. Industry wage pressures have dissipated with the decline in natural gas prices.”

In the Kansas City District, the energy sector stabilized but remained flat, and expectations are that oil and gas producers will remain cautious for the rest of the year with commodity prices continuing to remain low. The number of drilling rigs deployed in the district rose slightly, as did the number of drilling permits issued, but the overall number of rigs deployed was still low and some respondents said well completions were on hold.

“Several respondents also expressed concerns about the lifting of sanctions against Iran and its potential negative effects on prices and production,” the FRB said. “Seasonal demand for air conditioning has increased the use of natural gas in the power sector and lifted prices slightly.”

The FRB added that crude oil inventories at Cushing, OK, were mostly flat, “despite record high refinery utilization rates and strong seasonal demand for petroleum products.” Oil prices were currently at a six-year low.

The Kansas City District includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri and northern New Mexico, and includes the Niobrara and Woodford shales, as well as the Denver-Julesburg, Piceance and San Juan basins.

In the neighboring Dallas District — which includes Texas, southern New Mexico and northern Louisiana, thereby comprising the bulk of the Barnett, Eagle Ford and Haynesville-Bossier shales and the Permian Basin — the FRB reported a “modest uptick in drilling in the Permian Basin,” but the demand for oilfield services remained depressed and companies continued to cut jobs and capital expenditures, although at smaller levels.

“Multiple contacts reported that the credit situation is worsening for small to midsize producers as balance sheets deteriorate and the likelihood of a significant increase in oil prices has declined,” the FRB said. “In general, more contacts are resigned to ‘lower for longer’ oil prices. Outlooks for the next two quarters are negative.”

In the Minneapolis District — which includes North Dakota and Montana, and therefore much of the Bakken Shale — the number of active drilling rigs didn’t change between mid-July and mid-August. North Dakota’s daily oil production increase in June close to the record it reached last December (see Shale Daily, Aug. 14).

The FRB said that in the Atlanta District — Alabama, Florida, Georgia, southern Louisiana, southern Mississippi and eastern Tennessee — refineries were continuing to make investments to expand their capacity and be able to handle lighter crudes from shale. Meanwhile, large oil and gas producers were reassessing the timing and scale of projects in the deepwater Gulf of Mexico (GOM), and smaller producers were taking advantage of cheaper prices to drill offshore and expanding their presence in the GOM.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |