Markets | NGI All News Access | NGI Data

NatGas Traders Greet EIA Data With Big Yawn Following On-Target Build, Reclassification

Natural gas futures were largely unchanged following the release of government inventory figures showing an increase in working gas storage that was about what the market was expecting.

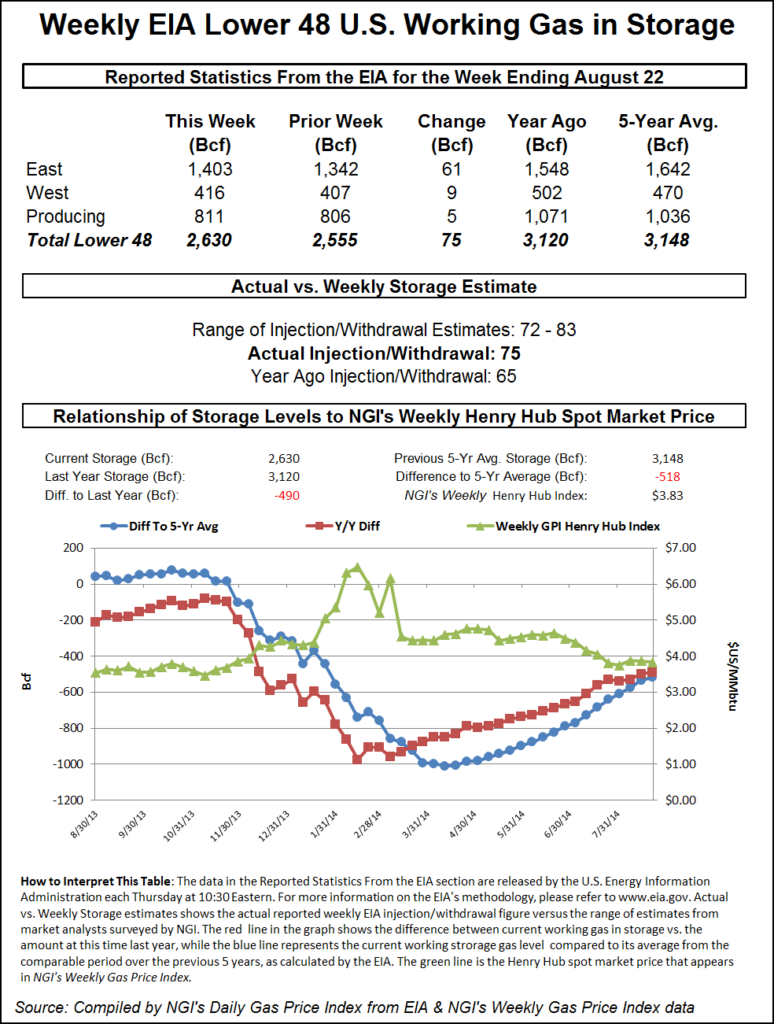

For the week ending Aug. 28, the Energy Information Administration (EIA) reported a 94 Bcf injection in its 10:30 a.m. EDT release, but an 8 Bcf adjustment in the East Region indicates an implied injection of 86 Bcf.

October futures fell to a low of $2.640 after the number was released. By 10:45 a.m. September was trading at $2.647, down 0.1 cent from Wednesday’s settlement. October had traded as low as $2.633 earlier in the session.

Prior to the release of the data, analysts were looking for an increase in the 85-90 Bcf range without the adjustment. ICAP Energy estimated 94 Bcf, and IAF Advisors had calculated an 85 Bcf increase. A Reuters poll of 24 traders and analysts showed an average 88 Bcf with a range of 79-97 Bcf.

“I was hearing an 88 Bcf injection, but the 8 Bcf reclassification brings it about in line,” said a New York floor trader. “We didn’t have much activity off the number.”

Citi Futures Perspective analyst Tim Evans noted that while the topline 94 Bcf build “looks larger than expected and bearish” at first glance, the 8 Bcf reclassification had already been announced by ANR Pipeline.

“The ”implied flow’ of 86 Bcf was actually close to our 84 Bcf estimate,” Evans said. “There will likely be some confusion off the meaning of the reclassification, but that was a one-off event. The flow figures is more constructive in our view.”

Inventories now stand at 3,193 Bcf and are 495 Bcf greater than last year and 122 Bcf more than the five-year average. In the East Region 71 Bcf was injected and the West Region saw inventories increase by 3 Bcf. Stocks in the Producing Region rose by 20 Bcf.

The Producing Region salt cavern storage figure was up 3 Bcf at 290 Bcf, while the non-salt cavern figure increased 17 Bcf to 840 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |