E&P | NGI All News Access | NGI The Weekly Gas Market Report

Noble’s DJ Basin Still No. 1, but Opportunities Abound Across Onshore

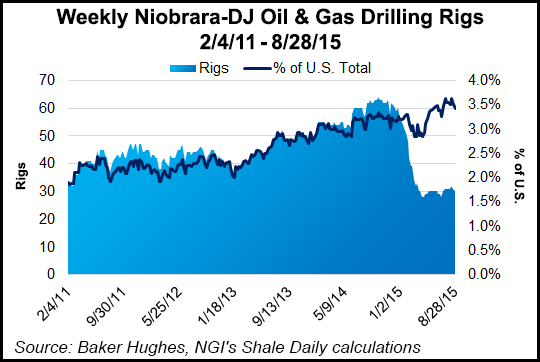

The Denver-Julesburg (DJ) Basin will continue to be the driver for Noble Energy Inc. through the rest of the year, CEO David Stover told a Denver audience at the 27th Annual Rocky Mountain Energy Summit.

Oil prices may be low, but the DJ ranks among the top prospects for the global operator, Stover said during a panel discussion last week.

Noble has seven core positions, “and the DJ has always been at the top,” He told the audience. The returns in the Colorado play, “especially as you move into the oil window, are right up there with the premier fields in the country. I can’t see it never being a core position for us.”

Having a substantial land mass in the basin also helps. Noble holds around 600,000 acres of mineral rights, with 8,400 wells. Close to 1,000 people work directly on the portfolio.

“That’s a huge benefit,” he said.

Like its peers, Noble hasn’t escaped the severe impact of slumping commodity prices. The operator has continued to reduce costs and has restructured, eliminating almost 100 jobs in Colorado alone.

“On a unit cost, we’re down 20% from the same quarter as last year,” Stover said.

Keeping its powder dry and reducing costs helped Noble secure Rosetta Resources Inc., which would give it a hefty position in the Permian Basin and Eagle Ford Shale (see Shale Daily, Aug. 4).

Grabbing new opportunities is easier when the balance sheet is in order and the homework is completed, Stover explained.

“When the market opportunity came up this year, we were prepared to jump in and take advantage of an opportunity,” he said. “We’d done our homework, we understood the opportunity and moved quickly.”

A lot of opportunities may be available to build Noble’s portfolio even more, but the company is satisfied with its realigned portfolio, for now anyway. In any case, “I think the workforce would revolt on me if I told them we had another one,” Stover said of being acquisitive. Rosetta Resources is the focus for now.

He advised the audience to have “confidence and purpose,” besides doing the homework “when an opportunity presents itself…If you do that, you can use the downcycle to make your company stronger. We did that and were able to strengthen our portfolio by adding resources in the Eagle Ford and Permian.”

As Noble has demonstrated, a broad range of opportunities exist across the Rockies and through the onshore, said Claire Farley of private equity giant Kohlberg Kravis Roberts & Co. LP (KKR). She shared the panel discussion with Stover. Keeping an eye on the margins is paramount in any potential deal, however.

“We look at every one of the basins,” Farley told the audience. “Where is the sweet spot? What are those margins?”

Noble’s position in the DJ, as well as that of Anadarko Petroleum Corp., has kept the DJ “at the very top quartile of what’s going to work and what has been working,” she said.

The entire industry has successfully rebooted its operating cost structures, making the once costly western plays more appealing. That means that the efficiencies being generated in the DJ by Noble and others “will continue to flow,” Farley said. As well, the Piceance Basin in Western Colorado and Wyoming’s Powder River Basin are getting a better look as improvements in drilling bring costs down.

Still, many operators won’t be able to take advantage, she explained. When oil prices were higher, producers took on substantial debt. Now they are saddled with low prices and the same amount of debt, or more. Operators that once had “modest leverage are now highly leveraged.”

That means “restructuring opportunities” are ahead, and KKR is planning to take advantage of them.

It’s difficult to pinpoint when there may be a turnaround because of high debt and the big efficiencies, which have skewed what the breakeven prices are for particular basins.

This latest downturn is the “fourth downcycle I’ve been through in my career,” said Farley, a former exploration and production executive. It’s different now “because now the resource is so plentiful…and now we have the ability to access it in a short amount of time. We have to go back to fundamentals and find out where we are making a return.”

The “behavior” by many producers in the past couple of years “belies that.” But she expects to see a lot of asset sales “as people shore up the balance sheets.”

One of the biggest things holding back more mergers and acquisitions (M&A) now may be debt.

“There will have to be some restructuring of the debt for some of the mergers to take place,” Farley said. As well, uncertainty about the direction of the commodity markets is keeping buyers on the sidelines.

A “huge uncertainty” exists about the direction of prices “and that just puts so much sand in the gears in terms of the M&A market…The markets need to settle into a view of a range of prices and a range of costs,” she said.

If a company wanted to sell over the past decade, it wasn’t too difficult to find a buyer, Farley told the audience. “Now, there’s not always a buyer out there.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |