NGI Data | NGI All News Access

Widespread September Natural Gas Bidweek Slump Hits Producing Regions Hard

September natural gas bidweek trading at first glance shows widespread declines of about 15 to 20 cents from August bidweek levels, but on further examination, it appears that hefty gains at Northeast points were able to pull NGI’s SeptemberNational Bidweek Average up to a more respectable drop of just 13 cents to $2.43.

That, however, may be small comfort to producers in South Louisiana who regionally endured the largest bidweek loss of 25 cents to average $2.60. The Northeast region, which endured a setback of just a penny to $1.78, was also the home of the greatest individual point gains and losses. Algonquin Citygate posted the strongest performance adding 64 cents to average $2.65, followed closely by Tenn Zone 6 200L with a rise of 50 cents to $2.53. Transco-Leidy Line suffered the largest U.S. decline in losing 31 cents to average 89 cents.

South Texas overall shed 23 cents to average $2.59 and East Texas and California were close behind with drops of 22 cents to $2.59 and $2.78, respectively.

Bidweek quotes in the Midcontinent fell 20 cents to $2.52, the Rocky Mountains saw prices fall 15 cents to $2.48, and bidweek gas in the Midwest changed hands 11 cents lower to average $2.82.

At $2.43, the September bidweek National Avg. marks a 31% discount from the September 2014 average of $3.50.

Stout supply, a quiet Atlantic hurricane season to-date and the lack of sustained summer heat waves pushed September natural gas futures to settle at $2.638, down 24.8 cents from the August contract settlement and $1.319 below the September 2014 expiration.

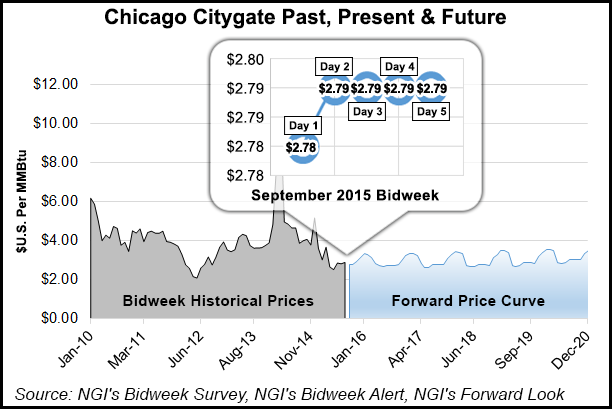

Since the Aug. 1 inauguration of flow capability from east to west on Rockies Express, pricing at the Chicago Citygate has been under the microscope as the most prominent market point to receive the expanded volumes. Data from NGI show Chicago Citygate quotes held steady over the five days ended Monday. At the beginning of bidweek on Aug. 25, Chicago Citygate was at $2.78 and rose to $2.79 for the remainder of bidweek. What NGI data also show is that during four of the last five years Chicago Citygate October bidweek increased relative to September bidweek, thus raising the possibility of lowering gas purchase costs by doubling up on September bidweek buys.

Some things are easier said than done. “Assuming you had storage, you could possibly do that,” an industry veteran told NGI. “In theory your storage gets pretty full this time of year and your ability to deliver gas in October is less than in June because you will have fewer injection rights. The storage field typically limits you since it gets harder to inject. They would have to use more compression.”

In commenting on the trend of September and October bidweek pricing he said, “I imagine in the last five years it has gotten colder between September and October. The demand is up and you are not pulling from storage yet. This September and October could look a lot different since you have some newer pipeline projects coming on with REX [Zone 3] and more gas coming from the Utica and Marcellus areas and getting over to Chicago.” You can follow the pricing and flow dynamics of REX deliveries on a daily basis using NGI‘s Rockies Express Zone 3 Tracker.

“A lot of the storage in Chicago is stuck behind the LDCs such as Nicor, Nipsco, and Peoples and is allocated out to the customers,” he added. “The price is the price and you have to go with whatever you are physically able to do. It would be good to take advantage of the spread, but maybe the way to do it is to use Nymex and take advantage of the spread between September and October when the months are trading close in anticipation that the spread will widen out.”

Other traders were already pretty well set for September bidweek. “I think we did pretty well,” said a Great Lakes marketer. “We had some basis we purchased earlier on, but for September we had some we paid 27 cents on Consumers and another purchase at 29 cents. On Michigan Consolidated we were able to purchase it at 22 3/4 cents.”

At the end of bidweek Monday gas for Tuesday delivery romped higher as traders had to deal with late summer heat expected to bake key Midwest and eastern populations centers. Gains were widespread, with only a small roster of points failing to show gains.

Natural gas injections into storage are not showing much sign of slowing, leaving market bulls on the defensive. Last Thursday’s 10:30 a.m. EDT release of storage data by the Energy Information Administration gave traders an opportunity to hone their estimates of winter supply. Earlier estimates of bin-busting storage over 4 Tcf have now been moderated closer to 3.9 Tcf, but injections going forward look to be robust. Estimates for the week ended Aug. 21, however, looked to be no greater than the five-year average.

Last year, 77 Bcf was injected, and the five-year average stands at 61 Bcf. Analysts at IAF Advisors calculated a 61 Bcf injection, as did the folks at ICAP Energy. A Reuters poll of 20 market observers revealed an average 59 Bcf with a range of 47 to 64 Bcf.

They all missed. For the week ended Aug. 21 EIA reported an injection of 69 Bcf and the expiring September futures contract fell to a low of $2.630 after the number was released. By 10:45 a.m. September was trading at $2.678, down 1.5 cents from Wednesday’s settlement.

Early price action after the number came out had traders scratching their heads. “I don’t get it why it would rally back after a bearish number,” said a New York floor trader. “The high side of expectations was 64 Bcf, With 69 Bcf, what is going on here? Perhaps people were looking to get in this market at lower levels and saw the low $2.60s as an opportunity.”

Analysts see an inconsistency in reports that makes an accurate assessment difficult. Tim Evans of Citi Futures Perspective called the report “a clear bearish surprise. In terms of the larger pattern here, we note there has been considerable volatility in recent reports, with some alternation between bullish and bearish surprises that makes it difficult to forecast and difficult to assess the background supply-demand balance.”

Inventories now stand at 3,099 Bcf and are 480 Bcf greater than last year and 88 Bcf more than the five-year average. In the East Region 53 Bcf was injected and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 12 Bcf.

Teri Viswanath, director of natural gas strategy at BNP Paribas, said the “higher-than-anticipated report caught the market off guard and sent prices lower following its release. At the close, the expiring September 2015 contract settled at $2.638/MMBtu or a loss of $0.055 on the day.

“We expect that domestic production will begin to increase once again in October, when heating demand will mask some of the supply gains. In fact, without strong heating demand, inventories might continue to build into the start of the heating season. Thereafter, we expect relatively light seasonal withdrawals, with end of storage approaching 1.8 Tcf by end March. Consequently, with inventories likely to remain high through the upcoming winter, the opportunities for an extended seasonal rally appear to be limited.”

On Monday, NGI‘s National Spot Gas Average for Tuesday delivery surged 7 cents to $2.53 as forecasters called for temperatures from Chicago to New York to range from 5 degrees to 15 degrees above normal. Futures found no such inspiration, and the October contract dropped 2.6 cents to $2.689 and November fell 3.1 cents to $2.761. All eyes appeared to be on crude oil, with the October contract vaulting $3.98 to $49.20/bbl.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |