E&P | NGI All News Access | NGI The Weekly Gas Market Report

Texas Adds Rigs Amid Broad U.S. Gas-Directed Decline

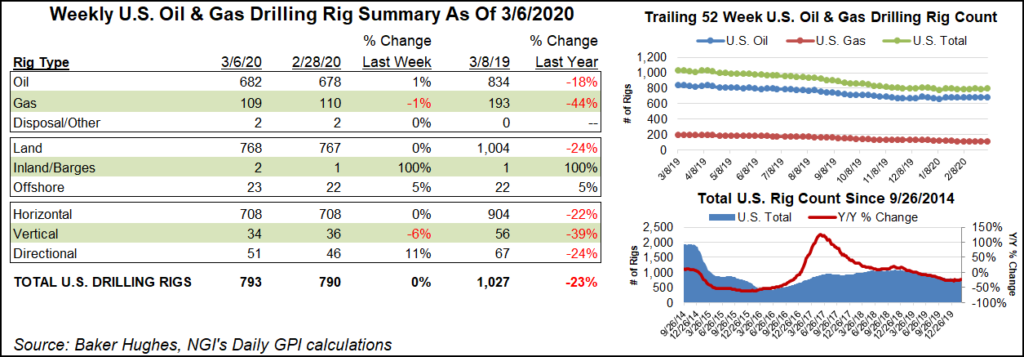

Drillers active in the United States dropped nine natural gas-directed rigs and added one oil rig, according to the latest Baker Hughes Inc. rig count for the week ending Aug. 28.

Societe Generale analyst Breanne Dougherty said in a note last Thursday that price-driven declines in oil-focused drilling will have an effect on associated gas production. But don’t look for accelerated investment in dry gas drilling to make up the difference, given weak economics, she said. “Accordingly, our base case outlook is for negligible (1%) year-on-year gas production growth in 2016,” she wrote.

The North American active rig count dropped by 20 in the latest Baker Hughes tally, with Canada letting go of a dozen rigs and the United States giving up a net of eight. The decline is in step with the “lower for longer” talk on commodity prices that pervades the industry.

Canada gave up nine oil rigs but only lost three gas rigs. Of the U.S. rigs idled, four left land drilling and two each left the inland waters and offshore.

One year ago the U.S. rig count was 1,914. When will it get to that level again? Wait for it…

“…[W]e expect an uptick in activity beginning in 2016, with the domestic rig count reaching almost 1,400 by the end of the decade,” Morningstar analysts said in a recent note.

Analysts at Raymond James said in a note last Monday that the end of this year will see 891 rigs running in the United States, compared with 877 in the latest count (see Shale Daily, Aug. 24). “We expect the rig count to continue to climb through 2016, but at a slow pace, adding only 38 rigs in absolute terms by June and another 151 rigs in 2H16,” Raymond James said.

“In total, we expect the total U.S. rig count to average 956 rigs in 2016, or down 6% from 2015. Looking beyond 2016, we think the U.S. rig count will surge to an average of 1,391 rigs in 2017 (or up 45%) and up another 252 rigs (or 18%) in 2018.”

The latest Baker rig census saw only modest changes across most of the unconventional plays. However, according to NGI data, the emerging Tuscaloosa Marine Shale (TMS) in Louisiana and Mississippi saw the exit of four rigs, a decline of 100%. Earlier in August, Sanchez Energy Corp. said it was dialing back TMS activity (see Shale Daily, Aug. 11). In late July the TMS lost three rigs (see Shale Daily, July 31). One year ago, eight rigs were running in the play. Louisiana was down by six rigs in the latest count.

Texas added three rigs in the latest count, making it the only gainer among the states.

However, in the Lone Star State, permitting for new wells has been down sharply and remains so. In July the Railroad Commission of Texas (RRC) issued 979 original drilling permits compared to 2,419 in July 2014. The latest total included 798 permits to drill new oil and gas wells, 18 to re-enter existing well bores and 163 for re-completions. Permits issued in July included 240 oil, 81 gas, 589 oil and gas, 61 injection, two service and six other permits.

In July, Texas operators reported 1,510 oil, 235 gas, 37 injection and nine other completions compared to 1,958 oil, 234 gas, 73 injection and eight other completions in July 2014, RRC said Thursday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |