LNG Tanker Owners Launch Pooling Effort

A trio of liquefied natural gas (LNG) carrier owners has formed a pool through which their vessels operating in the spot market will be contracted for charters of up to 12 months. The idea is to lower costs and improve contracting efficiencies, a representative of one of the participating companies told NGI.

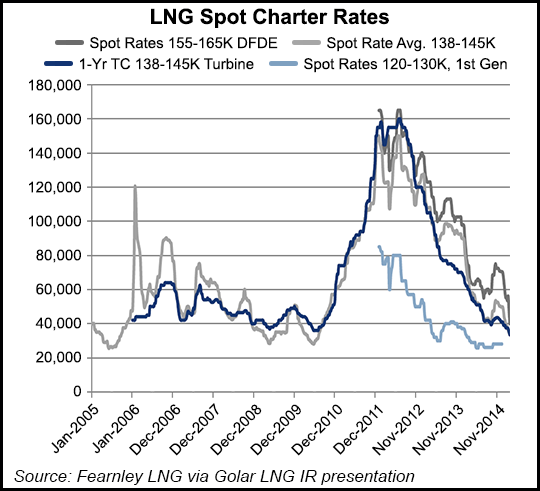

Dynagas Ltd., GasLog Ltd. and Golar LNG Ltd. have formed what they are calling “The Cool Pool.” It is intended to optimize the operation of the pool vessels through improved scheduling, cost efficiencies and common marketing, the companies said. The move comes as there is glut of recently added carrier capacity and as LNG cargoes are increasingly traded on the spot market.

The pool initially will consist of 14 “modern, high-quality and essentially equivalent” diesel electric-powered vessels. Dynagas and GasLog are each making available three vessels, and Golar is providing eight. Each owner will retain responsibility for management of its vessels.

If a pool vessel is scheduled by an owner for a charter that exceeds 12 months, that vessel will cease to form part of the pool. Operation of the pool is expected to begin in September. The pool will allow for contracts of affreightment, which are single-voyage charters, a novelty in the LNG world.

There is no specific geographic focus for where the fleet will operate, GasLog’s Jamie Buckland, head of investor relations, said. “Because they’re all spot market vessels, it really will be where the spot chartering demand is,” he said. Tankers could be operating in the Atlantic or Pacific basins or both. Charterers are expect to be global oil and natural gas majors as well as commodity trading houses.

The LNG spot market has been developing for the last few years, Buckland said, and the pool participants are taking a “wait and see” approach to whether it works as they expect it to, he added. There is a case to be made for the pooling of LNG tankers as done with crude tankers, he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |